1. In the Commitment of Traders reporting week ending November 10 covers the few days before the US employment data and a few days after. Speculative participants made five significant (10k contracts or more) adjustments to gross positions in the currency futures. The prior reporting period saw only three significant adjustments, and in growing gross short euro, yen, and Swiss franc positions. This week, four currencies, euro (+14 .7k contracts), yen (+16.7k contracts), Canadian dollar (+12.2k contracts), and Australian dollar (+10.2k contracts) saw significant increases in gross short positions. The bulls also increased their gross long Canadian dollar position by 13.8k contracts.

2. There was a clear pattern that stands out. All the eight currency futures we track saw an increase in the gross short position. The previous week, the gross shorts also increased except in the Canadian and New Zealand dollars. No such pattern was evident in the gross long positioning.

3. The liquidation of gross long sterling contracts (6.4k) and the accumulation of gross shorts (9.6k) drove the net position back to the short side (-15.8k contracts). It is the first net short position since the middle of October.

4. The gross short euro position has jumped 83k contracts in the past three weeks to 221.9k contracts. This is easily the largest gross short currency position. And, at 79k contracts, the gross long euro position is the largest among the currency futures It has risen by 13.5k contacts since the end of September. The net short position of almost 143k contract is the largest since June.

5. The net short yen position increased by a little more than 50% to 66.9k contracts. This is the largest net short position since August.

6. Both bulls and bears felt confident toward the Canadian dollar during the reporting period. The prospects for a Fed hike and the decline in oil prices punished the bulls. Over the course of the reporting period the US dollar rose from CAD1.3060 to CAD.$1.3275. The US dollar has continued to appreciate since the end of November 10. It is approaching the multi-year highs set in late-September.

7. The big jump in short US 10-year Treasury futures in the previous period (87.3k contracts) were unwound plus some in the latest period. The bears covered 122.2k previously sold Treasury contracts, leavings 448,7. The bulls were hardly tempted to bottom pick. The gross long position increased by 5.1k contracts to 411.7k. The net short position fell a little below 37k contracts from 164.3k. After selling off since mid-October, the December 10-year futures appears to have put in a near-term bottom on November 9. However, before the weekend, the bonds staged a bit of a reversal.

8. The price of light sweet oil has been trending lower. Some bulls tried picking a bottom, and the gross long position increased by 5.6k contracts to 498.9k. The bears are pressing their case, and accumulated another 13.4k short contracts, raising their position to 260.6k. This generated a nearly 8k contract reduction in the net long position, which stands at 238.2k contracts.

| 10-Nov | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -142.9 | -134.3 | 79 | 6.1 | 221.9 | 14.7 |

| Yen | -66.9 | -43.8 | 35.1 | -6.4 | 102.0 | 16.7 |

| Sterling | -15.8 | 0.2 | 39.4 | -6.4 | 55.1 | 9.6 |

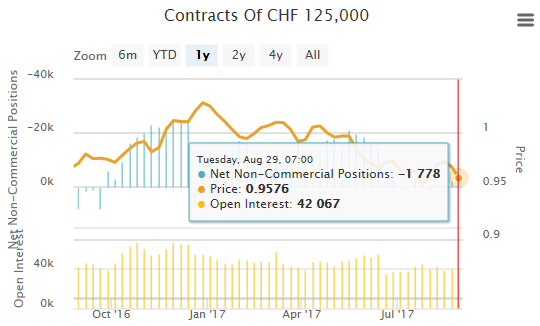

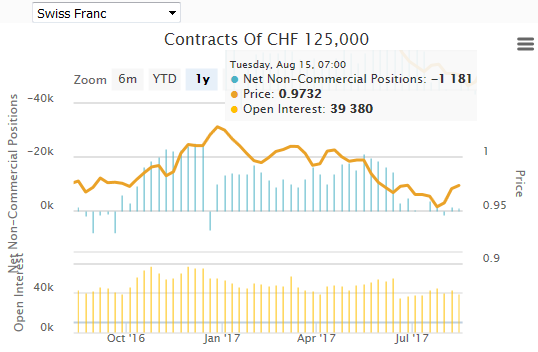

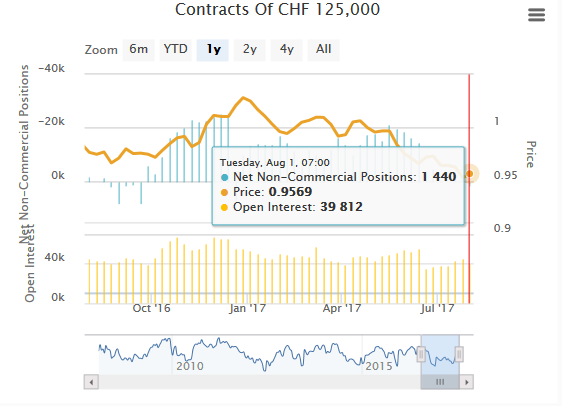

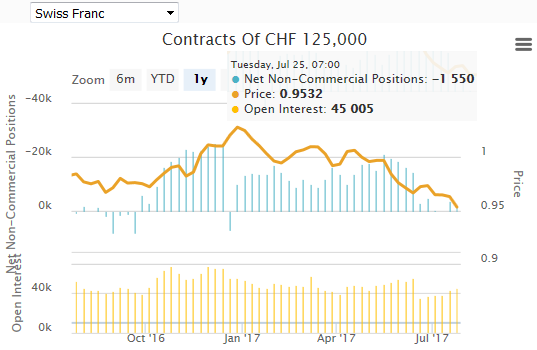

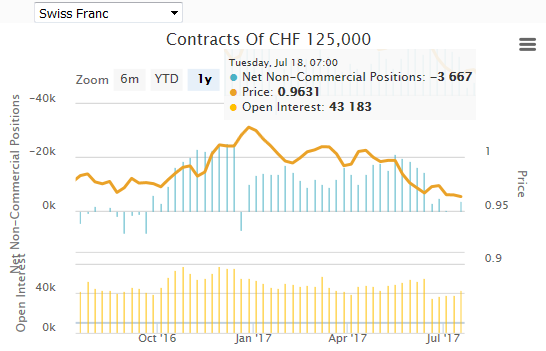

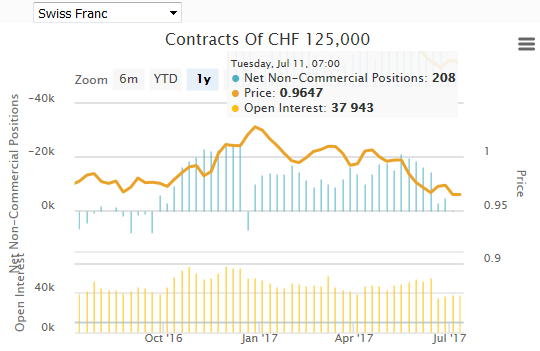

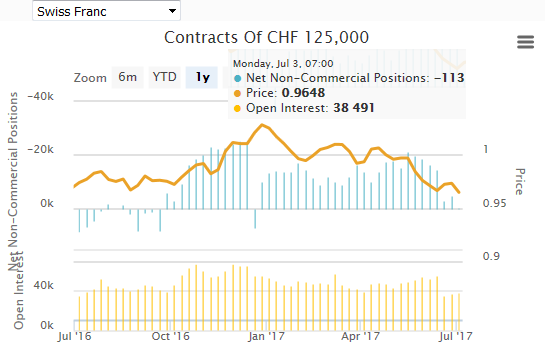

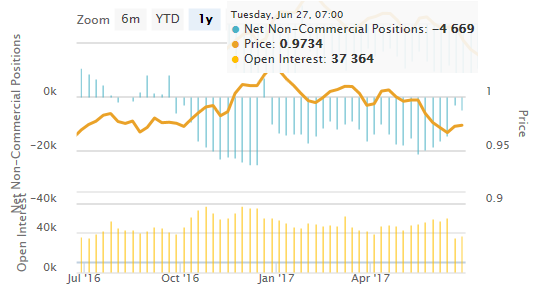

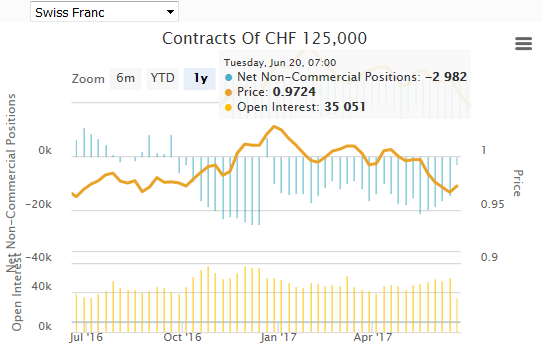

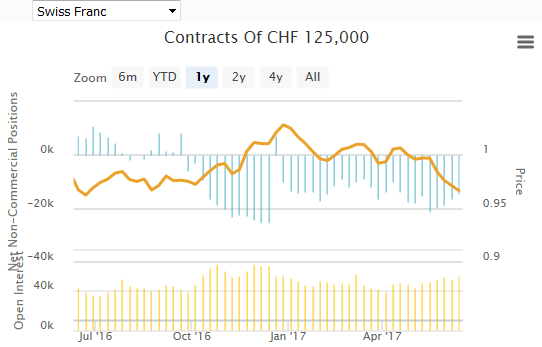

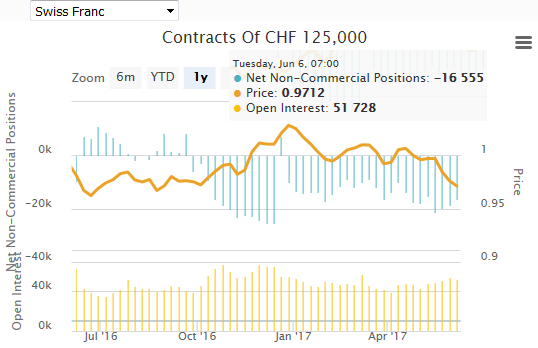

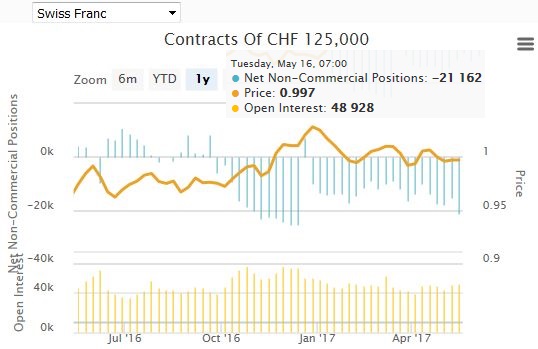

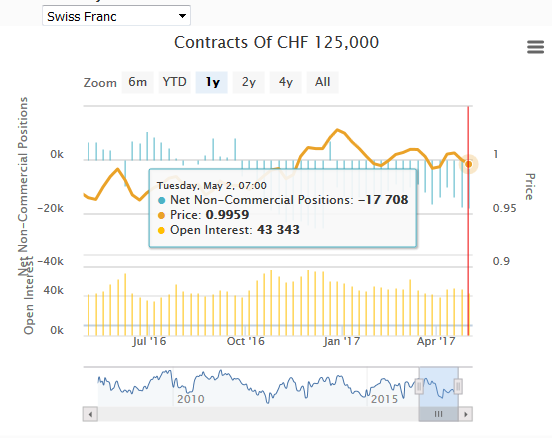

| Swiss Franc | -9.3 | -7 | 18.9 | 1.2 | 28.3 | 3.4 |

| C$ | -17.9 | -19.5 | 45.8 | 13.8 | 63.7 | 12.2 |

| A$ | -52.8 | -38.6 | 45.9 | -4.0 | 98.7 | 10.2 |

| NZ$ | 5.6 | 6.6 | 21.3 | 0 | 15.7 | 1.1 |

| Mexican Peso | -18.7 | -0.7 | 43.9 | -8.2 | 62.7 | 9.9 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions