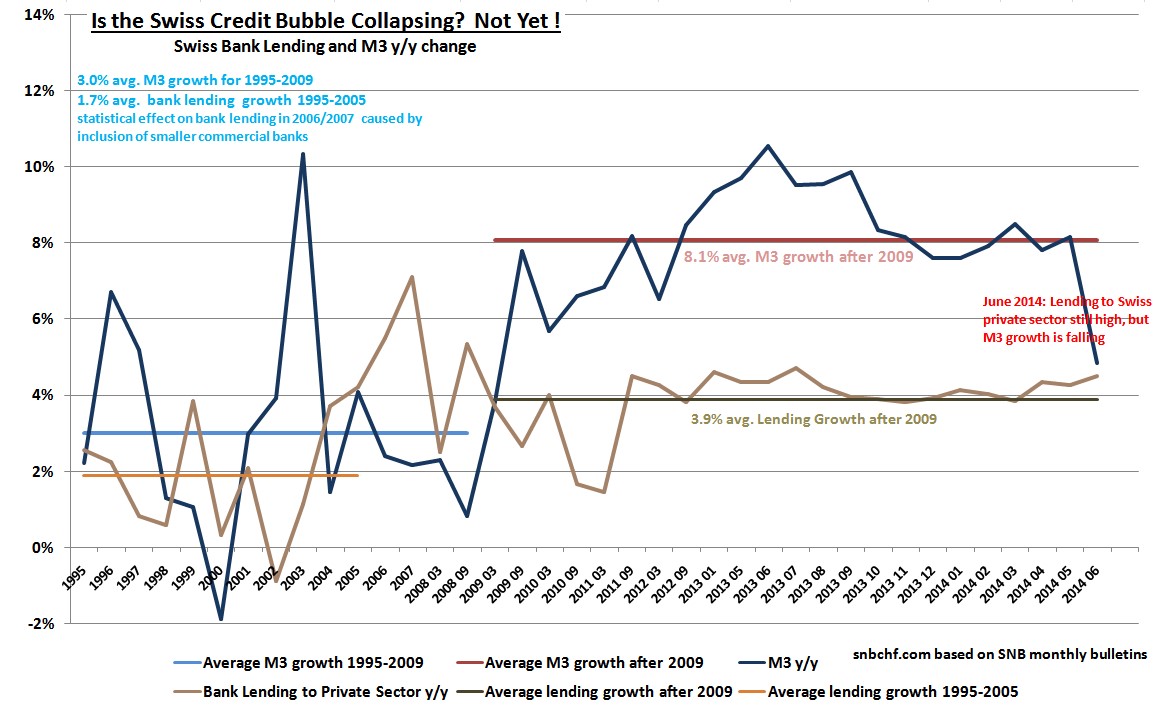

Despite macro-prudential measures like the countercyclical capital buffer, Swiss credit to the private sector is rising more quickly than previously. On the other side, real estate prices are not increasing so rapidly any more. Global risks let M3 money supply growth slow in June 2014.

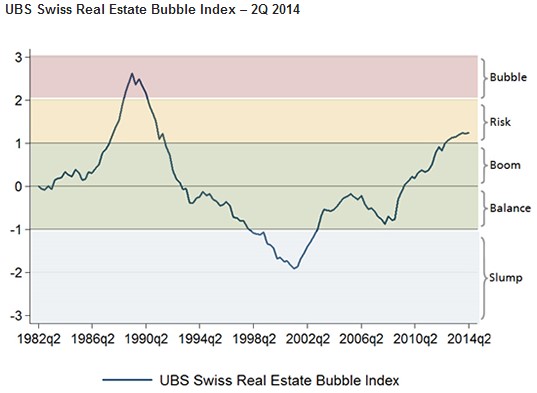

UBS has released the latest UBS Swiss Real Estate Bubble Index. According to the bank, prices in Swiss real estate are rising only slowly. Risks are moving from the centres to other regions.

For us, this phenomenon can be explained by slower demand from foreigners for Swiss real estate. In particular, the need of Asian investors to safeguard their wealth has switched to New York and London. They would rather avoid the safe Chinese and Emerging Market proxy called “Switzerland” currently. Prices in Singapore and Hong Kong are even falling. As opposed to those foreign investors, people living in Switzerland are more sensitive to prices. They realize the big price differences between regions and act accordingly. Moreover, thanks to European deflation, the need for buying real estate as an inflation hedger is low.

Despite the slower increase in property prices, the Swiss credit bubble continues to expand, while in the euro zone both money supply and credit growth are close to contraction.

Since 2009, the Swiss broad money indicator M3 has been rising with an average of 7.7% per year, while between 1995 and 2008 it was only 3% per year.

Banking lending to the Swiss private sector is increasing by 3.9% per year while it was 1.7% between 1995 and 2005. One reason for more borrowing is certainly the population increase: after the financial crisis at 1.1% per year. But immigration cannot explain the increase in loans of over 2%. The gap is caused by monetary policy.

Fortunately, more credit has not translated into higher wages and higher inflation yet.

But Swiss unions recently urged 2% higher salaries. In Germany, the origin of many products imported to Switzerland, even the Bundesbank president cheered 3% higher wages.

With global tensions in Iraq and Ukraine in June 2014, the M3 growth has slowed to 5%. But the Swiss private sector is borrowing even more.

The lending and borrowing growth has risen to 4.5% y/y.

The recent increase in lending, however, shows that the countercyclical capital buffer is a tooth-less concept. The Swiss economy needs higher rates.

We are unable to explain the overly big gap in M3 and credit growth. According to balance of payment data there is no big Swiss lending to foreign countries, maybe a reader can help.

More details on the risks of high lending and money supply:

The Risks on the Rising SNB Money Supply

SNB’s Danthine: Credit – is the sky the limit?

Swiss Housing Bubble: Twelve Reasons Why It Will Continue for another Decade

Pros and Cons of the Swiss Countercyclical Capital Buffer

Read Also:

CHF Is No Safe-Haven, but a Safe Proxy for Global Economic Growth

See more for