Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) .

Weekly Overview

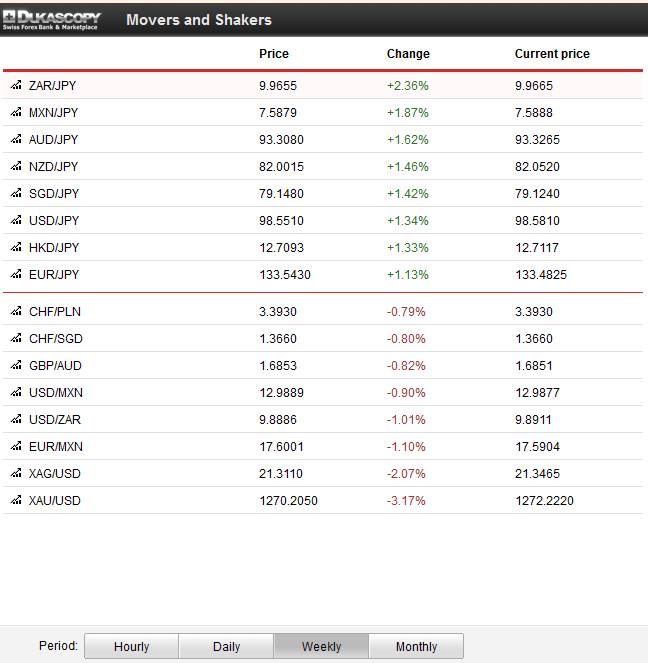

Hopes on a compromise between Obama and republicans on the U.S. debt ceiling and high U.S. initial unemployment claims sustained risk-on currencies that depend on foreign/U.S. funding like MXN, AUD, ZAR and (the not listed) BRL. The safe-havens gold, silver, the yen and to a certain extend also the dollar depreciated.

Saturday, October 12

This weekend’s Chinese trade data for September is one of the most important pieces of fundamental data. Imports often give a hint of upcoming industrial production. We judge that the increase in imports (+7.4% y/y vs. 7.0% in August) could be positive for oil, silver and partially gold. The slowing exports (-0.3% y/y vs 6.0% in August), however, are rather a negative sign. They are expression of the austerity and the continuing balance sheet recession for customers in Europe and the U.S., of some over-invoicing last year and reduced Chinese competitiveness due to higher wages.

Friday, October 11

The Michigan Consumer Sentiment fell to the weakest level since April, while the one-year inflation expectation of 2.9% was the lowest reading since October 2010 (with one exception in July 2012). No increases for industrial production in India (+0.6%) and in Mexico (-0.7% y/y) confirmed the IMF’s opinion about low growth in emerging markets. On hopes of a deal between Obama and republicans stocks were up once again despite poor fundamentals. The funding currency JPY was logically down and risk-on currencies inched up against USD in the following order: MXN, NOK, NZD, SEK and AUD. Gold continued the down-trend after the broken 1300$ support, triggering many stop-loss futures and fell nearly 2% to 1272$. EUR/CHF moved up 0.21% to 1.2350, while USD/CHF nearly unchanged at 0.9120.

Thursday, October 10

Republicans offered to President Obama, to raise the debt limit until November 22. However, they want to disallow him from using extraordinary measures when the ceiling is reached. With this news the dollar strongly improved, but soon traders realized the impact of the government shutdown: Initial jobless claims surged to 374K from 308K. One big part of this increase was caused by a computer-related backlog of claims in California. Strangely, this delay in computerization helped to reduce previous claim reports but it was not mentioned when mainstream media spoke of the record-low number of claims in recent weeks.

French industrial production in August was up 0.2% m/m but down -1.6% y/y, the Italian one -0.3% m/m, minus 4.6% y/y, and the Greek one by minus 7.2% y/y. “Tail-risks” and thanks to the U.S. recovery – “tail-fear” have vanished, but fundamentals show that the disappearance of fear was bought with lower demand and slower GDP growth in the European periphery that might last for years. On the other side, lower wages and costs have increased company margins and helped to strengthen peripheral PMIs and stocks.

The potential elimination of a U.S. default let stocks strongly rise and the safe-havens JPY and gold strongly depreciated. The yellow metal was down 1.5% to 1287$. On the other side, weak US unemployment data was positive for risk-on currencies like MXN, AUD and BRL that depend on cheap U.S. funding. BRL took additionally profit from high real returns after Banco de Brazil’s rate increase. Finally, Norwegian y/y inflation is falling again, Norges Bank’s financial repression might end: But NOK fell nonetheless. The high number of unemployment claims helped to limit CHF losses against EUR and USD by around 0.1% for both.

Wednesday, October 9

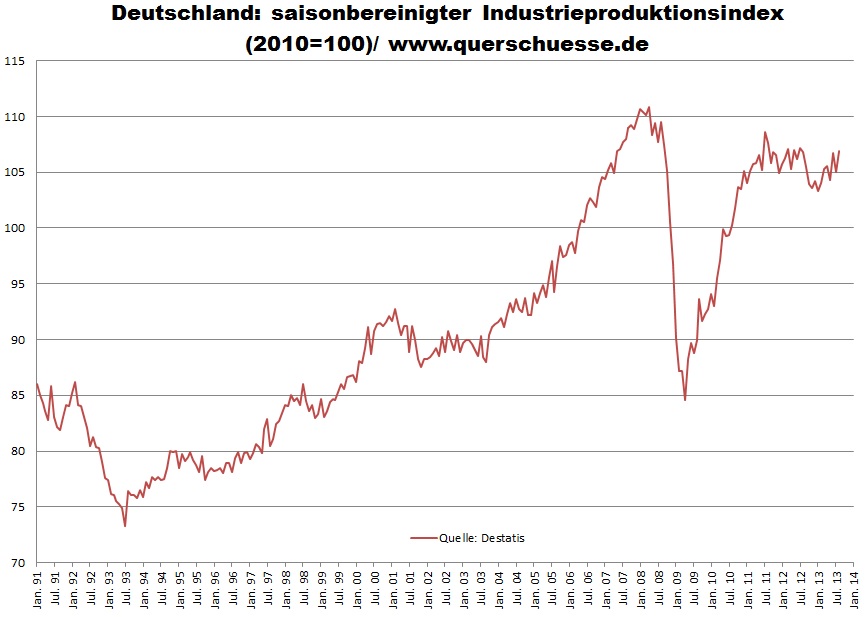

The minutes of the Fed September meeting showed that most members expected tapering to continue this year. Still, the Fed fears a loss of the good labor market momentum, a negative repercussion of rising interest rates and the U.S. budget discussion. German industrial production rose by 1.4% m/m or 0.3% y/y, in particular capital goods improved by 4.4%. Industrial production is just 4% away from the record-high in July 2007.

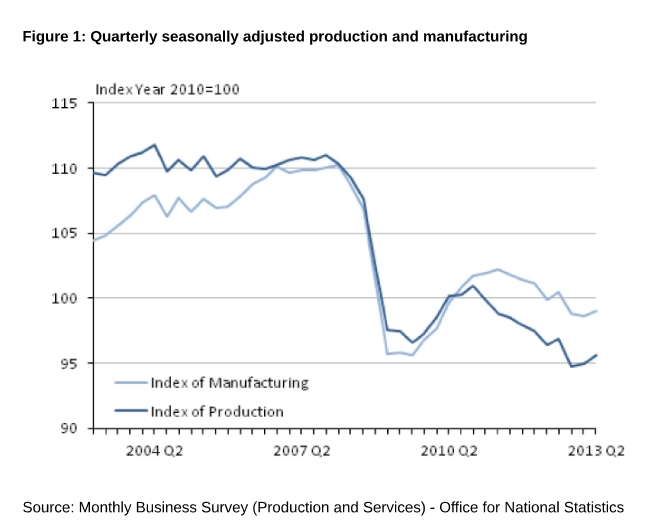

British industrial production, however, was down 1.1% m/m or minus 1.5 y/y, more than 15% weaker than in 2007.

In absence of American and Chinese fundamental news, traders could concentrate on Fed’s tapering expectations and hopes on an end of the debt ceiling debate. The dollar was the clear winner of the day. USD appreciated especially against GBP, the safe-havens CHF and JPY and the European euro, SEK and NOK. The dollar was up 0.96% to 0.9107 against the franc. As usual, since the perceived “end of the euro crisis”, the EUR/CHF followed the rising dollar and inched up 0.36% to 1.2311. Yesterday’s bad news for Emerging Markets and the stronger dollar continued to depress gold: it fell by 1.3% to 1303$.

In absence of American and Chinese fundamental news, traders could concentrate on Fed’s tapering expectations and hopes on an end of the debt ceiling debate. The dollar was the clear winner of the day. USD appreciated especially against GBP, the safe-havens CHF and JPY and the European euro, SEK and NOK. The dollar was up 0.96% to 0.9107 against the franc. As usual, since the perceived “end of the euro crisis”, the EUR/CHF followed the rising dollar and inched up 0.36% to 1.2311. Yesterday’s bad news for Emerging Markets and the stronger dollar continued to depress gold: it fell by 1.3% to 1303$.

Tuesday, October 8

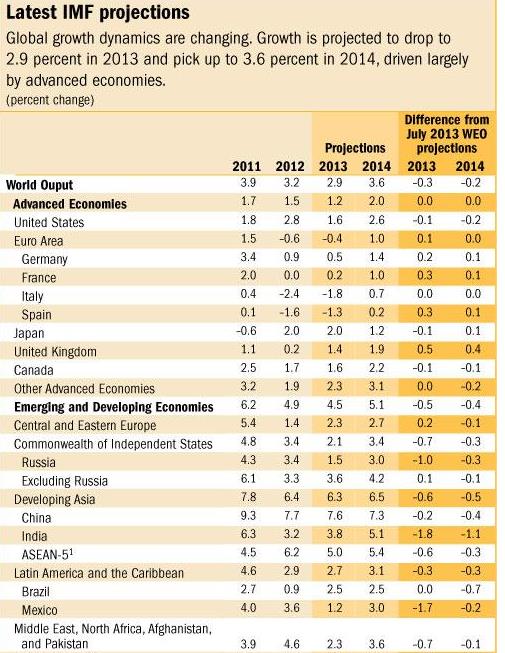

The HSBC services PMI for China came in at 52.4, weaker than the previous reading of 52.8. The American NFIB Small Business Optimism was also weaker at 93.9 (vs. 95.2 expected) and German factory orders were worse than expected. U.S. stocks fell again, in particular after the IMF cut its expectations for global economic growth. According to the IMF, the UK would see some improvements against previous forecasts; while, especially emerging markets should see less growth than the IMF thought previously.

This piece of news helped the pound to appreciate. We wonder that, similar to the wrong Fed forecasts since 2009, the IMF always projects 1% higher U.S. growth for the forthcoming year (this time 2014) than for the current year and – each time they get wrong. The reasoning for the IMF is higher U.S. credit offers and higher spending. Given that many U.S. and British households are still balance-sheet-constrained, we think that the demand for credit will not match the increased credit offer and many will prefer to pay down debt and spend less. This will limit GDP growth. We see Switzerland grow as much as the U.S. in 2014 and more than the U.S. in 2013. Two reasons: the Swiss are not balance-sheet constrained and have higher immigration.

Thanks to income from abroad, the Japanese managed to achieve a small current account surplus, but the high trade deficit weighed on the yen. In late trading the news that Obama had chosen Yellen as the new Fed chair weakened the dollar again and supported risk-on currencies like BRL, AUD and NZD. Weaker growth for emerging markets was negative for gold, the news about Yellen positive. Hence gold fell slightly to 1320$. With mostly negative news and bad equities performance, USD/CHF fell 0.1% to 0.9020. But CHF reacted to the bad news from the correlated German and emerging markets: EUR was slightly up against CHF to 1.2267. With falling energy prices compared to last year, Swiss y/y inflation for September weakened to -0.1%. The HICP remained 0.9% under the provisional reading of the euro zone.

Monday, October 7

In the absence of new major fundamental data, traders could concentrate on the discussion of whether the U.S. will technically default if the debt ceiling is not increased. The first interest payment on Treasuries will be on 31 October, but according to the Congressional Budget Office, between 22 October and the end of the month, the U.S. would need to cease payments. The S&P500 fell by 0.5%, the safe-havens of gold, JPY and CHF inched up. Thanks to their current account surpluses, both the euro and SEK were considered to be safe-havens too, and improved. Risk-on currencies, however, like AUD, NZD, NOK, MXN and BRL, weakened. Gold was up 0.7% to 1323$, the USD/CHF inched down by 0.28% to 0.9029. EUR/CHF was down 0.2% to 1.2262.

Remark:

This post is an extract of daily posts on our CHF and Gold News Bar on our home page or at this address in a post format.

It explains daily gold price and CHF movements based on the most important fundamental indicators in a few sentences.

We continuously observe that in particular U.S. and Chinese fundamental data cause large FX fluctuations, that get reflected in all currencies. So the pound improves with good US data, or AUD with Chinese news, but this rule applies also for many other. Only in the case of political turbulence or expectations on changes in interest rates, data from other countries is able to move their currencies.

The only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – from 1% y/y CPI the SNB should remove the CHF cap. The other data is global macro: mostly US and German data, some European and Chinese/Japanese news publications determine CHF behaviour. CHF is positively correlated to data from Germany and to some extent China and Japan. Good data from the United States lets CHF fall against both USD and EUR; it is hence negatively correlated to good US news. As for EUR/CHF, the Swissie is negatively correlated to good Southern European and French data.

Understand the terms “American bloc” and “Asian bloc” (read here). Remember also that the currency movement over months is a combination of the daily movements explained here.

Are you the author? Previous post See more for Next post

Tags: American bloc,Asian bloc,France Industrial Production,FX news,Germany Factory Orders,Germany Industrial Production,Gold,silver,U.K. Industrial Production,U.S. Consumer Confidence,U.S. Initial Jobless Claims