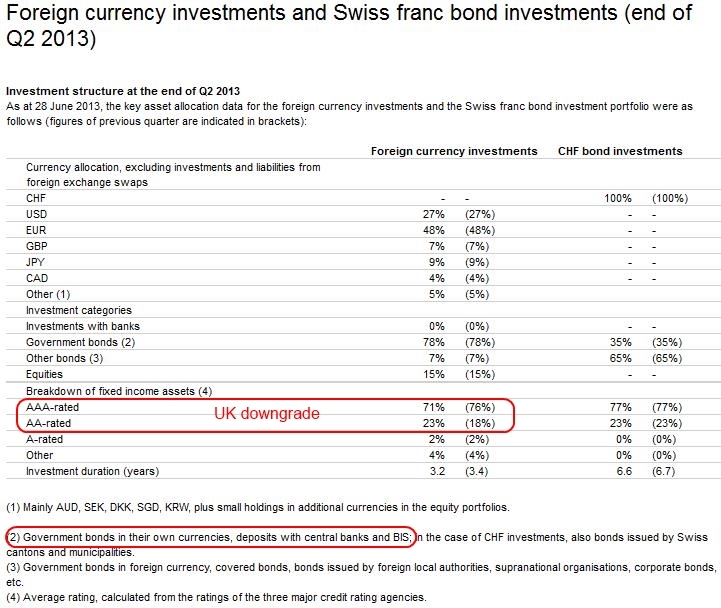

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income and/or rather conservative asset managers.

here the newest data

Total Balance Sheet and Liabilities

The total balance sheet size decreased from 511 bln. francs to 488 bln. Provisions and equity capital decreased from 69 to 49.5 bln. CHF. The bank could reduce sight deposits slightly by 2 bln. francs. However, she increased its liabilities with the Swiss confederation by 7 bln. CHF and another form of debt, namely banknotes by 700 million (see the balance sheet).

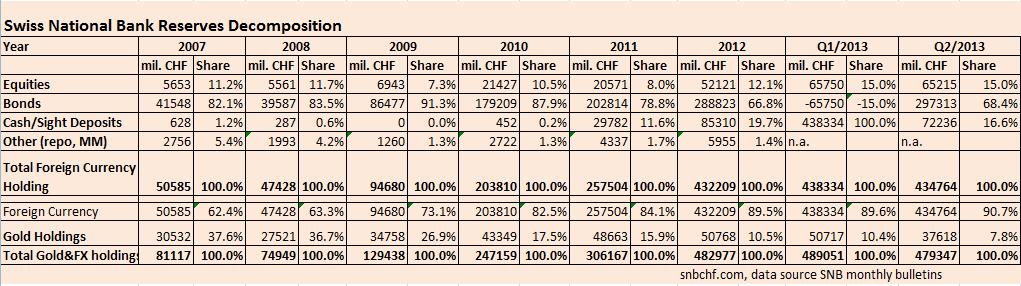

Composition of SNB Reserves (Assets), Q2/2013

Securities positions fell from 365 in Q1 to 362 bln. CHF. The bank continues to hold a lot of cash at other central banks, namely the equivalent of 72 bln. francs or 14.7% of the total portfolio.

These are 16% of the total FX reserves, that do not contain gold, as follows:

Be aware that in the above statistics 16% cash is misleadingly included in the 78% government bonds share (see the footnote 2), the effective government bonds are only 62% of the FX reserves.

The share of AAA bonds, however, fell by 5% because Fitch was the second rating agency (out of 3) to downgrade the UK.

After the hike from 12 to 15% last quarter, the bank (and market valuations) kept the equity share at 15%. Between 2012 and 2013 the bank has massively bought equities, for around 65 billion francs, or 8000 for each inhabitant.

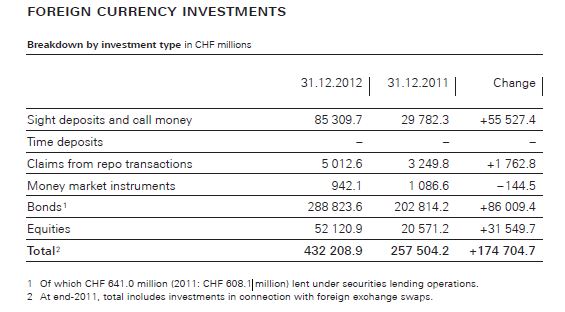

End 2012, equities were still 52 bln CHF, source annual report SNB

SNB Investment Strategy 2007-2013

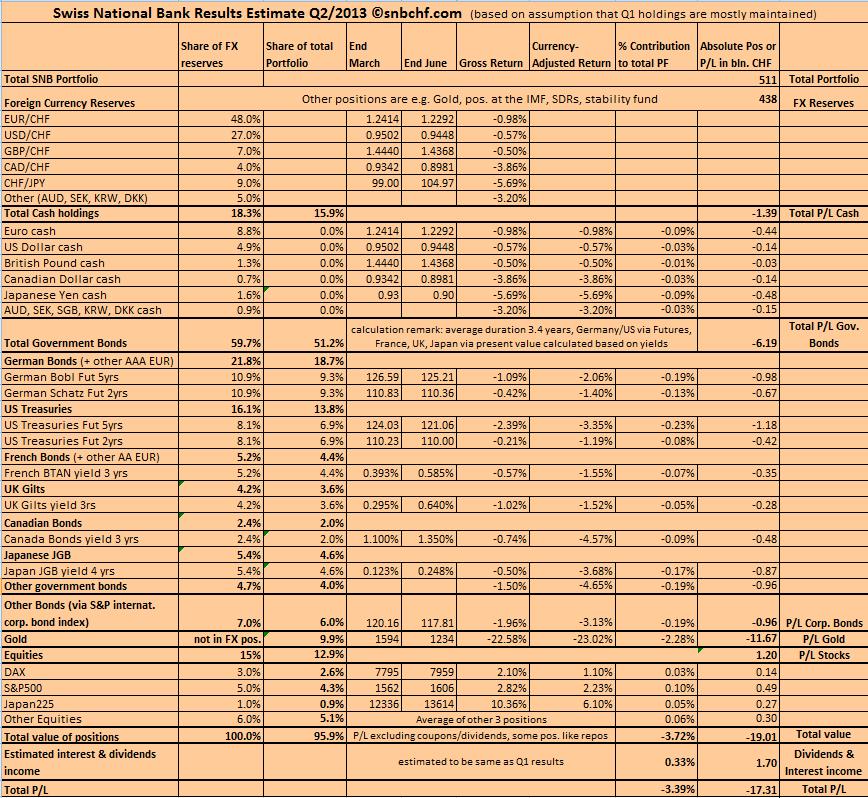

Breakdown by major positions

The following gives a rough estimate of major SNB positions (see the European ratings e.g. here), in comparison to all FX reserves positions (of which gold and the smaller IMF, SDR or repos positions are excluded).

- German and other AAA EUR government bonds make up around 22% of the FX reserves = 48% * 60% * 76%

Explanation: EUR share 48%, Government bonds 60%, German bonds remain the only major euro-denominated AAA bonds, AAA 76%

Other AAA are: Dutch, Austrian, Finnish and Luxemburg bonds, all of them smaller countries. - US treasuries are around 16% of the FX reserves = 27% * 60% * 100%

Explanation: USD share 27%, Government bonds 60%, only U.S. issues USD gov. bonds - French (and Belgium) government bonds make up around 5.2% of the FX reserves = 48% * 60% * 18%

Explanation: 48% EUR, Government bonds 60%, AA share 18%, France (and Belgium) only AA in Europe. - Japanese JGB are around 5.4% = 9% * 60% * 100%

Explanation: JPY share 9%, government bonds 60%, only Japan issues gov. bonds in JPY - UK government bonds are around 4.2% of the FX reserves = 7% * 60% * 100%

Explanation: GBP share 7%, government bonds 60%, only UK issues gov. bonds in GDP - Canada government bonds are around 2.4% of the FX reserves = 4% * 60% * 100%

Explanation: CAD share 4%, government bonds 60%, only Canada issues gov. bonds in GDP

Detailed decomposition

The following table gives a very detailed approximation of SNB position. We calculated a loss of 17.3 bln. in Q2/2013 that was close to the reality of 18.3 billion CHF.

Find here the information about SNB Reserves Composition in Q1/2013 and 2012.

See the historical composition of SNB reserves in this post.

Tags: decomposition,Duration,equities,Forex reserves,FX reserves,Government Bonds,Rating,Reserves,SNB asset allocation,Swiss National Bank