While the FT says:

Abenomics is succeeding in bringing inflation back to Japan.

The preferred core CPI measure, which excludes volatile food prices, rose a higher-than-anticipated 0.4 per cent in June (year-over-year), the highest reading since November 2008 and the first positive reading since April 2012. (The reading was flat in May).

Overall inflation climbed a higher-than-forecast 0.2 per cent, up from -0.3 per cent in May.

The Japanese yen promptly weakened 0.3 per cent after the data was released, to 99.34 per dollar.

Tokyo‘s key figures, year-to-year in July:

- CPI rose 0.4 per cent, versus predictions of 0.2 per cent and up from a flat reading in June.

- Core CPI rose 0.3 per cent, matching forecasts and up from 0.2 per cent in June. Source Fast FT

we do not agree. The main driver of higher inflation was the volatile 5.7% increase in fuel prices (or 9% in July). What the FT does not mention, is that Core CPI in Japan is not “ex energy and food”, like in the U.S., but just “ex fresh food”.

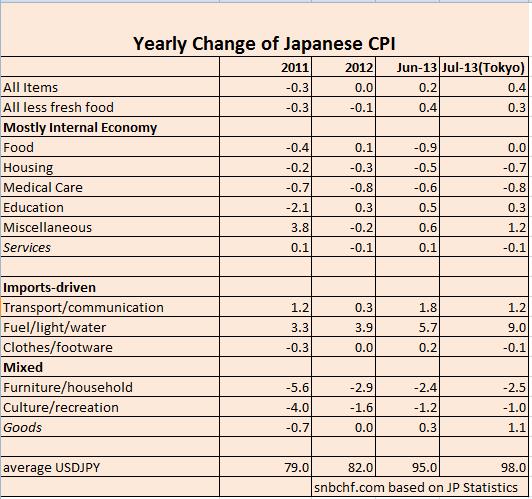

If we separate CPI items that are driven by the internal economy and the ones that are determined by imports and the weaker yen we obtain the following picture:

sources: Latest and 2012 and 2011

sources: Latest and 2012 and 2011

Japan is a rather closed economy, the import share is even lower than for the US. Still imported energy prices have a big influence.

CPI components driven by the internal economy

Services are at minus 0.1% in July 2013. In 2011 they were up 0.1% despite the strong yen. Housing costs are falling more and more. While American medical care costs are up 2.8%, Japanese pay less each year. After the reduction of Japanese education fees in 2011, education costs are slightly rising. Miscellaneous, e.g. insurances, were rising far more in 2011 after the earthquake than now.

In summary, deflation has slightly intensified for CPI components that depend on the internal economy.

CPI components driven more by imports and yen

Abenomics has pushed energy prices up, in July even by 9%. These hefty changes are also due to low oil prices in July 2012. Clothes and footwear, which are often imported from China or elsewhere, are down by 0.1.

Mixed CPI components

Mixed CPI components like “furniture/household” articles that are quite often imported or “culture/recreation” that often vary with package holiday prices are both down between 1 and 3 percent. But thanks to the weaker yen, deflation has slowed against 2011.

It is clear that when you spend more money at the pump you have less for other things, and this might put price pressure on these others. But still, the Japanese are the G7 nation with the strongest increase in consumer spending . Maybe one reason for growth is that prices (except energy) do not rise? The CPI shows a potential cost-push-inflation, but no demand-pull inflation yet.

Effectively Mitsubishi UFJ Morgan Stanley showed that consumer prices excluding food and energy were down 0.2% on the year.

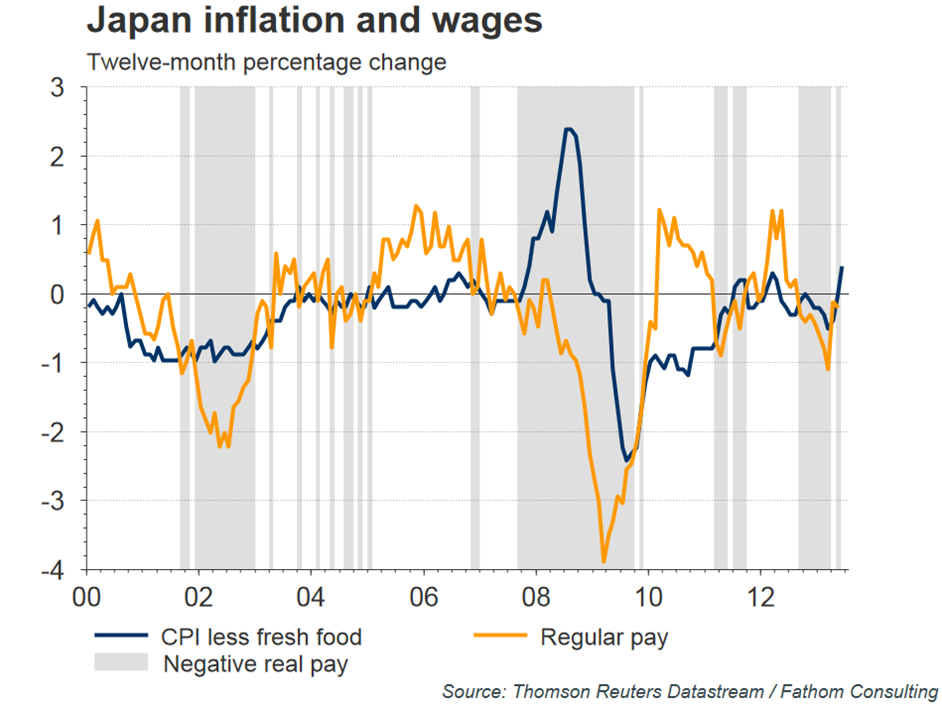

Who wants to create inflation, must increase in particular wages, but those are still contracting.

Tags: Abenomics,inflation,Japan Consumer Price Index / Inflation,Japanese yen