UPDATE:

July 30th, 2013:

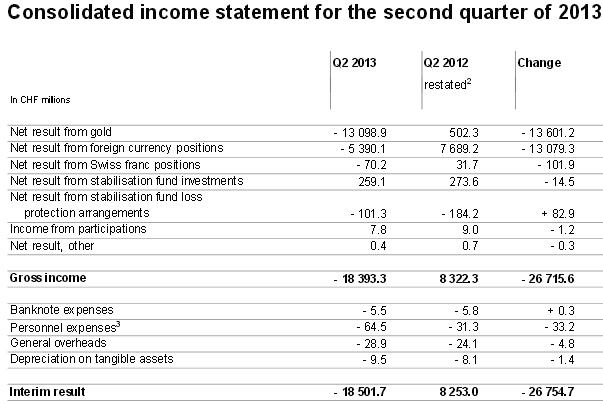

Our estimate for the quarterly loss missed the reality by 1 billion francs. The quarter results: 18.3 billion francs loss. The loss for H1 was 7.3 billion CHF.

July 1st 2013:

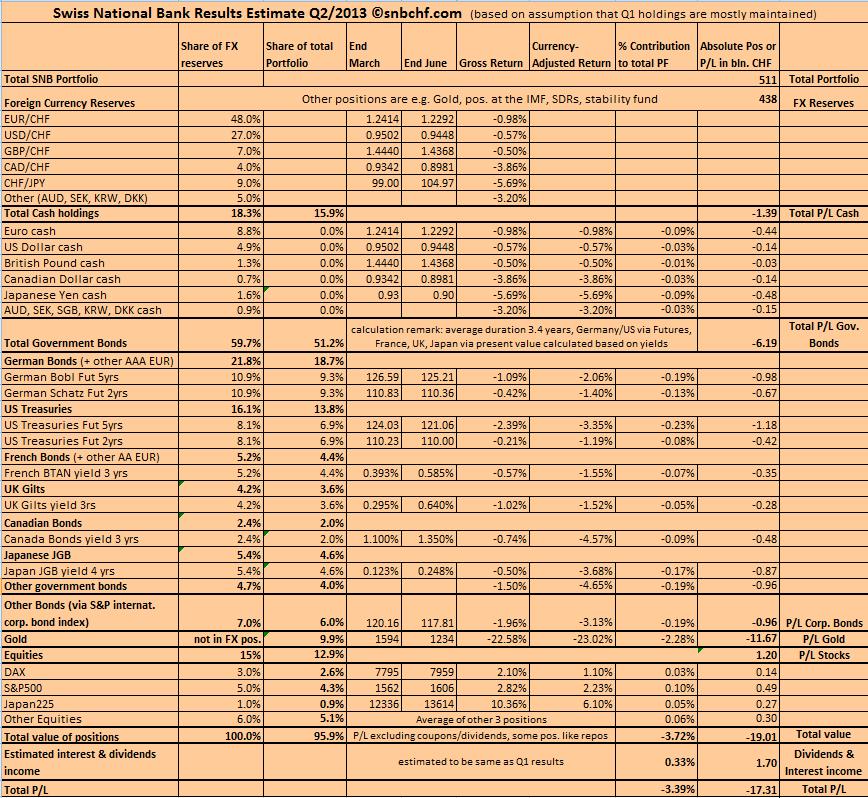

We estimate that the Swiss National Bank (SNB) obtained a loss of 17.3 billion francs in the second quarter 2013. This is the equivalent of a performance on the whole portfolio of minus 3.4%.

We think that gold holdings contributed 11.7 billion, government bonds 6.2 bln. and cash holdings 1.4 bln. to these losses; while, gains of 1.2 bln. francs come from equity investments.

“Other currencies”, e.g. the weak Australian dollar or the Swedish Krona, and corporate bonds may add another 1.5 bln. CHF loss.

The bad result in Q2 needs to be compared with the first quarter when the bank still achieved a gain of 11.2 bln. (a 2.2% positive performance). The numbers are far better than some “conservative” hedge funds achieved. Bridgewater’s All Weather Fund, for example, is down 8% this year.

Reasons for the better Swiss performance is that the SNB still holds the equivalent of 80 bln. CHF (18% of the portfolio) as cash at other central banks, IMF and BIS, and that the bank is far less leveraged than the Bridgewater fund.

We explain in more detail how we obtained the different percentages here.

(click to expand the details table)

On the other side, weak interest and dividends income of 0.33% in Q1 or 1.3% per year, raise doubts on the long-term profitability of the central bank investments.

The former cash cow, gold, does not help the bank any more to achieve good results.

The end of cheap Federal Reserve money shows that asset management has become very difficult. The main task of SNB asset management is to find investments that are able to achieve a similar performance as the Swiss franc: a currency that is assisted by immigration and structural advantages against most countries of the euro zone.

The cap on the franc has possibly helped to reduce Swiss unemployment by 1% to 2% in 2011/2012, a potential output gap of 6 to 12 billion francs, based on the 600 bln CHF GDP. Given that recently the risks in the Swiss real estate sector have become stronger and deflation seems to be only temporary, the cap might become a burden on SNB monetary policy in the coming years.

In March, we were warning of the negative effects on the SNB portfolio when inflation and bond yields start to rise again:

Read also another March paper:

Are you the author? Previous post See more for Next post

Tags: equities,Gold,Government Bonds,results,SNB Gold Holdings,stocks,Swiss National Bank,Swiss real estate