According to IMF data for March 2013, the foreign currency reserves of the Swiss National Bank (SNB) rose by 8 bln. CHF from 437 bln. to 445 bln. One reason for us are valuation gains on US dollar, sterling and Canadian dollar. Typically the SNB has good results in first quarter of the year when the dollar and the US economy often improves.

The USD/CHF gained from 0.9371 in February to 0.9502 end of March, the GBP/CHF from 1.4239 to 1.4440, CAD/CHF from 0.9092 to 0.9342, while the euro fell slightly from 1.2239 to 1.2168. Gold was slightly up from 1580 to 1597 $. Since gold is valued in USD. Total valuation gains added up to a sum between 2 to 3 bln. francs.

Some news report that the SNB increased purchases due to the Cyprus events, which we cannot confirm. Sight deposits that represent the major mean of financing, did not change a lot in March.

The difference might be financed by bank notes, for which March data is not available yet. The bank doesn’t use swaps or derivatives any more a lot. It might also have happened because the SNB had a good timing to sell euros and buy dollars. Last but not least, the IMF data is subject of revaluation.

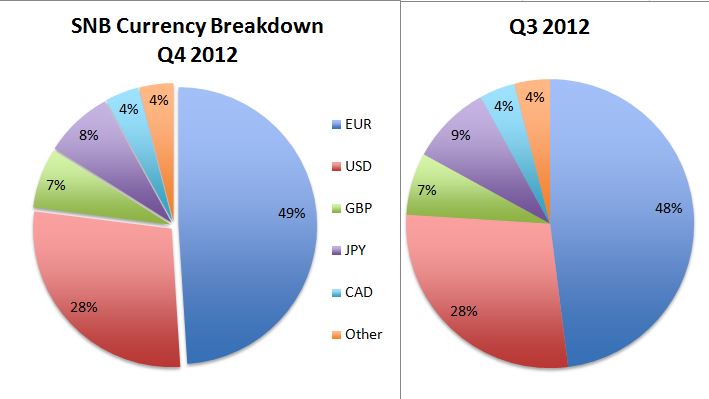

The SNB increased the dollar share in Q3 and Q4/2012 and drastically reduced euros from 60% in Q2/2012.

Are you the author? Previous post See more for Next postTags: Deposits,Monetary Base,Reserves,Swiss National Bank