We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income and/or rather conservative asset managers.

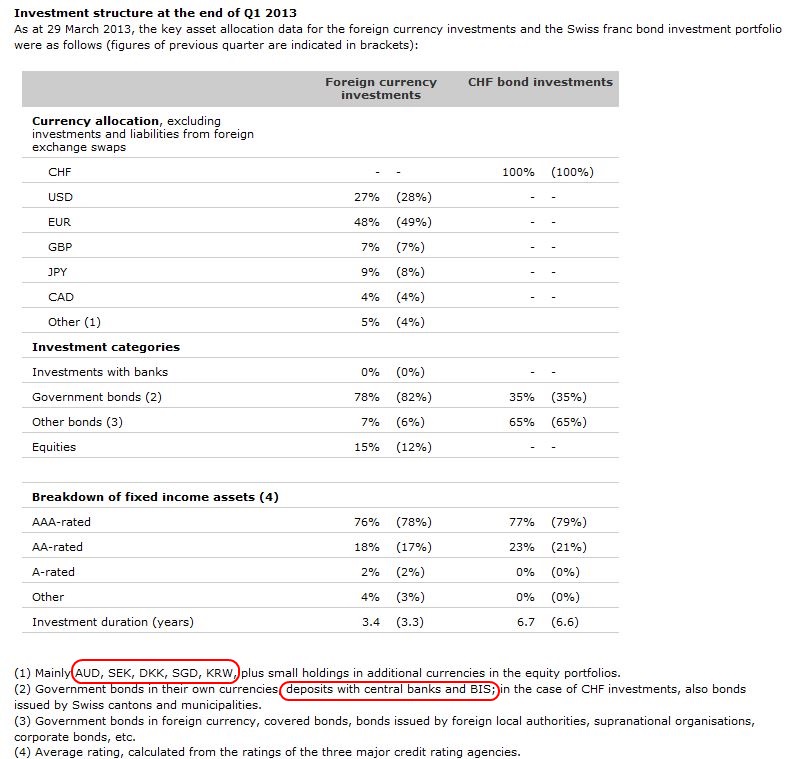

Composition of SNB Forex Reserves, Q1/2013

With the strong results of 11.2 billion francs, the SNB reduced the share of euro and dollar investments by 1% each and increased the one of the yen and other currencies (AUD, SEK, KRW and SGD). Given that the yen has fallen from 94 for one CHF to 99 per CHF in the first quarter, this implies that the quantity of yen-denominated holdings should have risen even more.

SNB reduces government bond share to NET 60%, Cash at 18% of FX Reserves

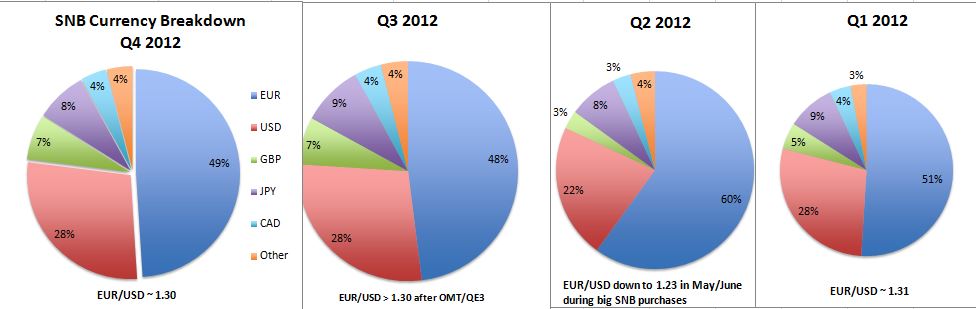

Composition of SNB currency (source SNB)

The total balance sheet size increased from 506 bln. francs to 519 bln, while the securities positions rose from 341 bln. to 365 bln. CHF. The bank continues to hold a lot of cash at other central banks, namely the equivalent of 73 bln. francs or 17% (see the balance sheet).

Be aware that in the above statistics 18% cash is misleadingly included in the 78% government bonds share (see the red marked footnote 2), the effective government bonds are only 62% of all security holdings.

Cash was reduced from 85 bln. to 73 bln. (compare securities holdings in the balance sheet, page 8, to the monthly bulletin of February 2013).

The share of fixed income positions with ratings below A increased to 4% thanks to higher valuations of Italian and Spanish bonds (see Q4/2012 data below). The share of AAA bonds, however, fell by 2%. The bank increased the equity share of her portfolio massively from 12 to 15%. Given that at the end of 2012, the bank possessed 52 bln. CHF in equities (see below), the equivalent of 12%, this should have increased to 65 bln. francs to achieve the 15% share.

AAA and even AA government bonds have been at the zero border for 3.4 years. The bond holdings had an interest income of 1.7 bln. CHF, compared with the 306 bln. bonds, this is 0.5% or around 2.2% annualized. However, bond holdings lost a value of 0.9 billion francs.

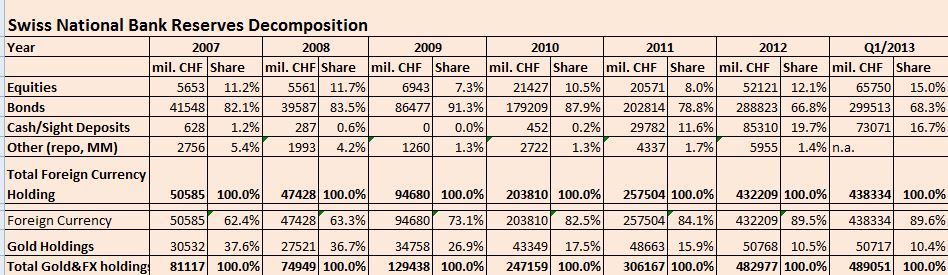

SNB Investment Strategy 2007-2013

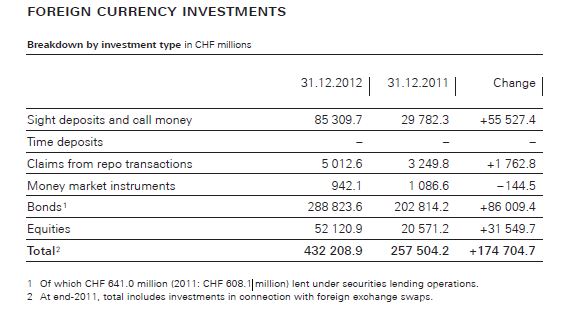

Breakdown by major positions

The following gives a rough estimate of major SNB positions (see the European ratings e.g. here), in comparison to all FX reserves positions (of which gold and the smaller IMF, SDR or repos positions are excluded).

- German and other AAA EUR government bonds make up around 22% of the FX reserves = 48% * 60% * 76%

Explanation: EUR share 48%, Government bonds 60%, German bonds remain the only major euro-denominated AAA bonds, AAA 76%

Other AAA are: Dutch, Austrian, Finnish and Luxemburg bonds, all of them smaller countries. - US treasuries are around 16% of the FX reserves = 27% * 60% * 100%

Explanation: USD share 27%, Government bonds 60%, only U.S. issues USD gov. bonds - French (and Belgium) government bonds make up around 5.2% of the FX reserves = 48% * 60% * 18%

Explanation: 48% EUR, Government bonds 60%, AA share 18%, France (and Belgium) only AA in Europe. - Japanese JGB are around 5.4% = 9% * 60% * 100%

Explanation: JPY share 9%, government bonds 60%, only Japan issues gov. bonds in JPY - UK government bonds are around 4.2% of the FX reserves = 7% * 60% * 100%

Explanation: GBP share 7%, government bonds 60%, only UK issues gov. bonds in GDP

- Canada government bonds are around 2.4% of the FX reserves = 4% * 60% * 100%

Explanation: CAD share 4%, government bonds 60%, only Canada issues gov. bonds in GDP

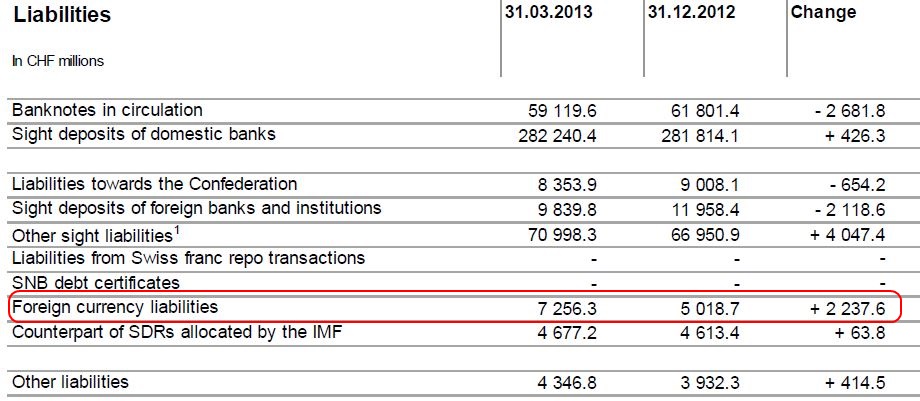

Financing of the increase in equities

Only one third of 13 bln. CHF increase in equities was obtained by valuation gains of 4.9 bln. But two thirds were financed by the decrease in cash and an increase of 2.5 bln. “foreign currency liabilities”, in essence cheap margin debt.

It shows that the central bank possibly went the same way as many hedge funds that borrowed in yen and invested in the Japanese stock market. But, as opposed to “other hedge funds”, the Swiss already reduced margin debt in March from 9 bln. in February.

We judge that the rising prices of Japanese and US stocks certainly helped to achieve the good SNB results, while European stocks remained mostly stable in the first quarter.

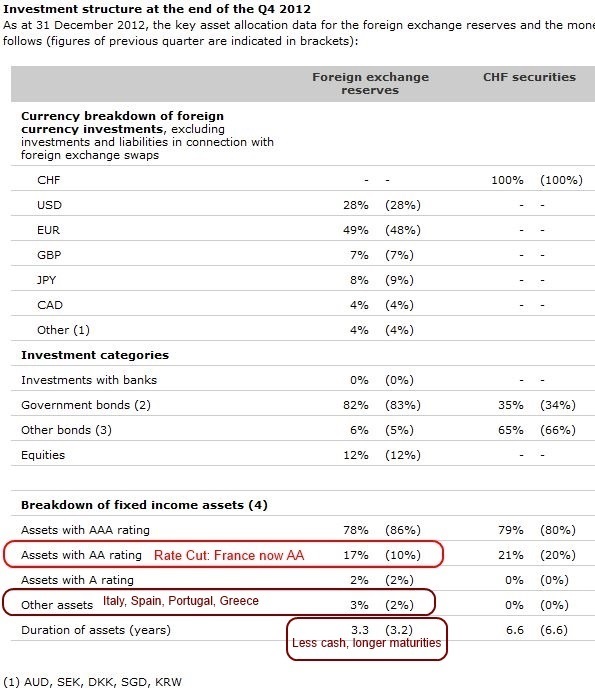

Composition of SNB Forex Reserves, Q4 2012

The Swiss National Bank (SNB) saw a reduction of AAA assets because France was downgraded to AA by two of the major rating agencies.

Since the price of French government bonds relative to others did not fall substantially despite the downgrade, it is obvious that the SNB exposure to France is 7% – the difference between AA assets as of Q3 (10%) and as of Q4 (17%). Other assets, e.g. government bonds of the European periphery rose in price. Therefore they have a higher percentage (3%). The SNB continues to increase duration and replaces redeemed bonds with securities with higher maturities.

This gives an indication that the central bank excludes an inflationary environment and a rise of bond yields. Otherwise it would not make sense to buy bonds with longer maturities at high prices now.

The central bank holds nearly 20% cash at other central banks. They are contained in the official statistics in the 82% government bond share, the net government bond piece is hence only 62%.

Breakdown by Currencies in 2012

For comparison the breakdown in 2012 was.

See the historical composition of SNB reserves in this post.

Tags: decomposition,Duration,equities,Forex reserves,FX reserves,Government Bonds,profit,Rating,Reserves,Seigniorage,SNB asset allocation,Swiss National Bank