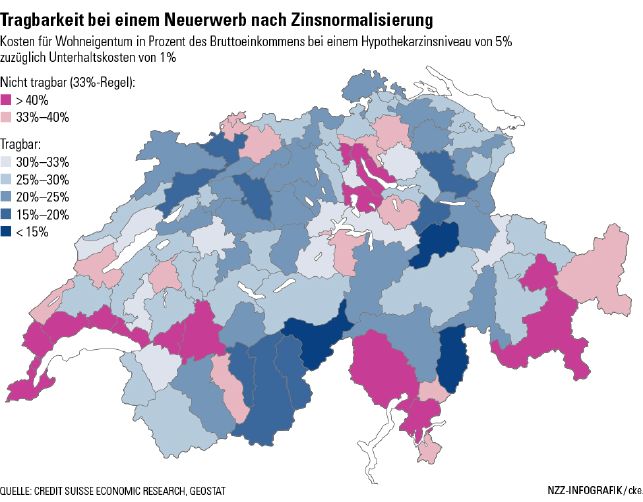

A new study by Credit Suisse claims that the SNB needs to hike interest rates in order to avoid excessive risk taking in real estate markets; in particular around the centers of Geneva and Zurich, but also in the Southern Swiss cantons with lower income, but high real estate prices. Most interestingly these Southern “holiday cantons” – Ticino, Graubünden and Valais – show strong parallels to the “holiday countries” Spain, Portugal and Greece: a high percentage of buyers from abroad who in times of crises quickly sell their property.

Exactly this happens already in one of these regions, St. Moritz. the dark red zone to the bottom right: Prices are said to be in free fall. The reasons:

- Lower growth in emerging markets, which concerns especially Russian property owners,

- the Italian tax authorities who check the Italian rich who cross the border to Switzerland and

- a new law which wants to reserve more homes for locals.

The map of regions shows the ratio of financing costs against income for a potential interest rate of 5%. More than 40% are achieved around Zurich, Geneva and in these holiday regions.

Ratio of financing and other costs of Swiss real estate against income for a potential interest rate of 5%

Are you the author? Previous post See more for Next post

Tags: Housing,Real Estate,Swiss economy,Swiss real estate