The Swiss National Bank (SNB) obtained a profit of around 6 billion francs for the year 2012 (full statement). The profit was reduced from 16.9 billion francs between Q1 and Q3 2012, which means that in Q4/2012 the bank had a loss of around 10.9 billion francs.

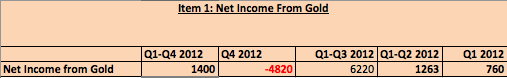

The profit in gold fell from 6.2 billion in the first three quarters to 1.4 billion in the whole year implying a loss of 4.8 billion in Q4. This 4.8 billion loss was equal to our estimate.

We omit the relatively small income from Swiss franc positions that the SNB also did not mention.

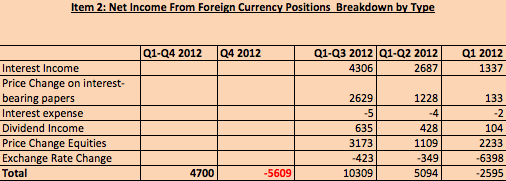

The profit in foreign currency positions fell from 10.3 billion in the first three quarters to 4.7 billion in the whole year implying a loss of 5.6 billion in the last quarter. The loss was 4 billion higher than our estimate (possible reason: the IMF FX reserves data used for our estimate will be revised downwards). Especially the yen and gold depreciated in the last quarter. The latest monetary data showed that the SNB reduced sight deposits and liabilities by only 4 billion francs in Q4/2012 and they even increased by one billion francs last week.

Recently FX traders and some hedge funds pushed the EUR/CHF exchange rate upwards to 1.2450. The question is now if ordinary investors will follow them and remove funds from their Swiss franc bank accounts and reduce their investments in Switzerland or not. Together with the long positions of hedge funds, this move of ordinary investors would affect the SNB balance sheet. FX trading, however, is settled with the margins at the brokers and does not directly affect the SNB, but it affects prices. This is valid at least for a short period.

On the other side, a 3% stronger euro could push Swiss inflation up by 1%, because imports account for nearly 30% of the CPI and the major share of imports comes from the euro zone.

SNB Profit and Loss in Q3/2012

The Swiss National Bank (SNB) reduced the share of euros in the third quarter substantially from 60% in Q2 to 48% in Q3 and increased dollar and pound positions. The SNB bought 80 billion euros or more when the common currency was trading around 1.24$, especially at the end of May, in June and in July.

After the ECB and the Fed promised monetary easing, the SNB used the moment to exchange the cheaply bought euros into US dollars at prices of 1.30 US$ and more.

The central bank might have bought 70 billion dollars between the beginning of August and the end of September.

Nomura even speaks of euros sold with the value of 76 billion CHF.

Based on the 5% difference between EUR/USD 1.24 and 1.30 and 40 billion euros exchanged into dollars and pounds, we judge that the SNB made trading gains of 2 billion €, a big part of the 5.2 billion CHF foreign exchange rate income in Q3/2012.

Are you the author? Previous post See more for Next postTags: FX reserves,Gold,income,profit,SNB results,Swiss National Bank