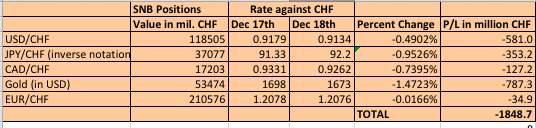

After the disappointing US current account data, traders have realized which countries have strong trade balances, namely Germany and Switzerland (see here for our details on the ever rising Swiss trade surplus), additionally fueled the good German IFO data. Both the euro and the Swissie strongly rose against the dollar. Due to Abe’s pressure on the Bank of Japan the yen lost, too. Additionally gold fell to 1673. The EUR/CHF remained nearly unchanged.

Consequently, the Swiss National Bank (SNB) lost nearly 1.85 billion francs in just one day. This is 231 francs, 250$ for each Swiss national, more than the average daily gross salary for the working population.

December 18th, SNB memorial day: Today we work for the central bank

We could declare December 18th, as the day when the whole of Switzerland needs to work for the central bankers. Unfortunately there might be some more days when the whole country will need to work for its central bank; especially if SNB’s weak inflation expectations are beaten by reality: the producer price index has already risen by more than 1% against last year.

We have already warned that the SNB lost 8.4 billion francs, 1.4% of Swiss GDP, in the months of October and November.

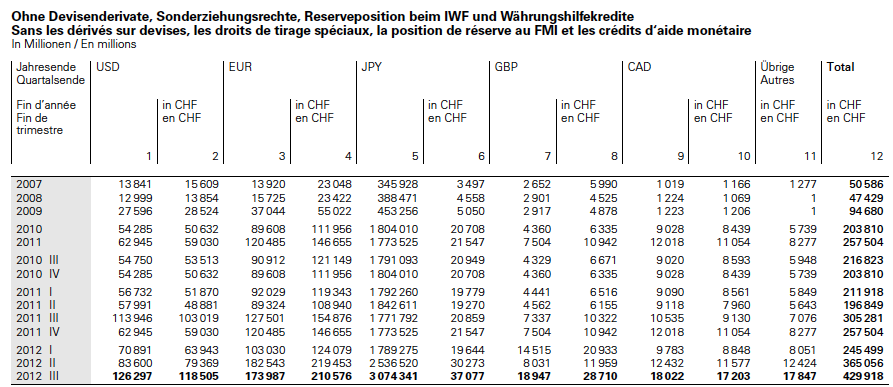

These are the SNB positions as of Q3, 2012:

The following is the currency breakdown per quarter:

Are you the author? Previous post See more for Next post

Tags: currency reserves,current account,FX reserves,gold reserves,Reserves,Swiss National Bank

1 comments

Bob2277

2012-12-19 at 06:20 (UTC 2) Link to this comment

EUR/CHF wouldn’t be where it is if the SNB wasn’t busy buying euros with both hands