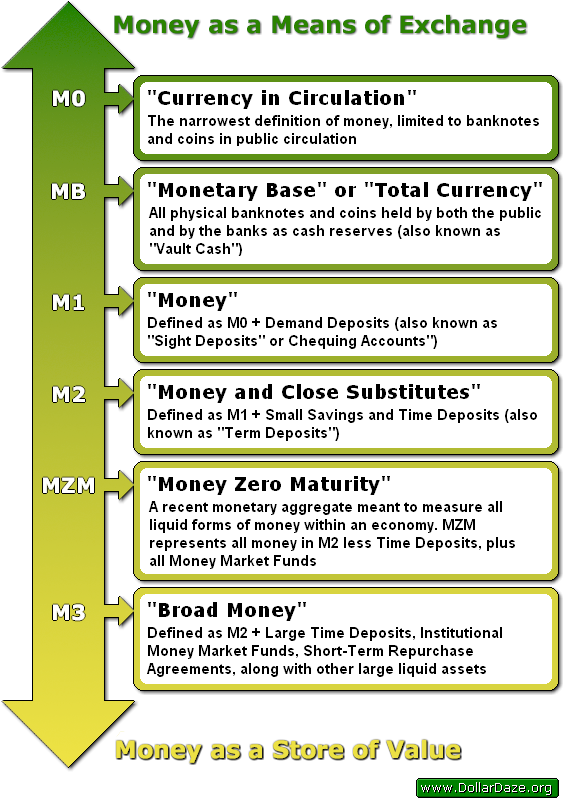

There are several different monetary aggregates used to measure a nation’s money supply. These monetary aggregates can be thought of as forming a continuum from most liquid (money as a means of exchange) to least liquid (money as a store of value). The “liquidity” of an asset is its readiness to be used as an accepted means of exchange to meet immediate and short-term obligations.

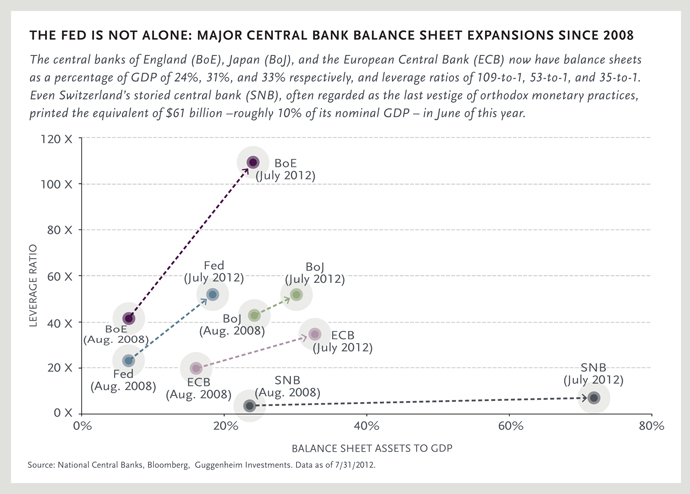

Balance sheets of central banks

Similar as any other bank or company, central banks have balance sheets, i.e. assets and liabilities. On the assets side there are mostly local government bonds. Money in the form of the monetary base (MB) is on the liabilities side.

Since the financial crisis the balance sheets of central banks and implicitly the liabilities.

US-American vs. European definitions of Money Supply

The types of money supply according to the Fed (and also the english Wikipedia) are visible in the graph.

The types of money supply according to the Fed (and also the english Wikipedia) are visible in the graph.The Swiss National Bank (SNB) follows a rather European standard. It regularly publishes their monetary aggregates in the monthly bulletin and in the “IMF Special Data Dissemination Standard” data. They are mostly identical to the ones of the Bundesbank and the IMF standard.

In the following we will discuss:

- The monetary base M0 or MB, the money a central bank owes to commercial banks.

- Broad money M1 to M4, measurements of money that is “publicly available”.

- The role of money printing and currency interventions in Switzerland.

- The development of broad money in Switzerland.

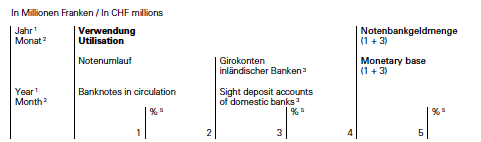

1) Monetary base (M0 or MB) and related

M0 or monetary base (MB) is currency in circulation and sight deposits of domestic banks (of Swiss and Liechtenstein banks) at the central bank. In October 2012 the monetary base was around 350 billion francs.

From the position of the commercial banks, the increase of the monetary base, are the so-called excess reserves, reserves that are higher than the reserves needed to cover the legal minimum amount of reserves.

Other deposits in sight

There are some other components of a central bank’s liability, that are often neglected. They are not part of the monetary base, but are not concerned by the money multiplier (see below).

The “other deposits on sight in Swiss francs”, which the Swiss National Bank (SNB) publishes in its weekly Important monetary policy data consists of all the three following categories:

- Liabilities towards the Swiss Confederation (more detailed explanation). These are listed separately in the SNB balance sheet. In October 2012 they were at 9.6 billion francs.

- Sight deposits of foreign banks and institutions, e.g. foreign central banks (more detailed explanation). In October 2012 they amounted to 9.6 billion francs according to the SNB balance sheet.

- Other sight liabilities: The main components in the other sight liabilities item are sight deposit accounts of non-banks, accounts of active and retired staff members and of the SNB’s pension funds. In October 2012 they amounted to 63 billion francs, about 10% of Swiss yearly GDP.

Further explanation about all four categories of sight deposits you find in the annual report 2011, p. 135 and p. 143 (http://www.snb.ch/en/mmr/reference/annrep_2011_komplett/source). In addition, in the monthly publication SNB balance sheet items, you find the most current numbers for the sight deposit categories (http://www.snb.ch/ext/stats/balsnb/pdf/deen/A1_Ausweise_der_SNB.pdf). Please note, that these numbers as well as those in the annual report are end of the month/year numbers, whereas the numbers in the Important monetary policy data are weekly averages. (source SNB)

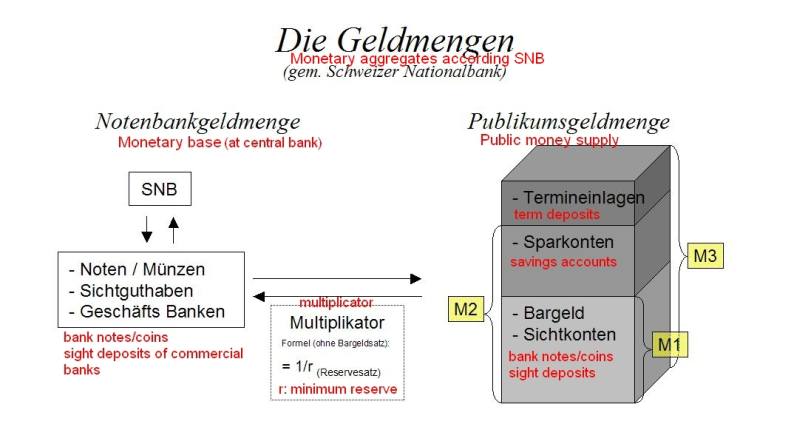

2) Broad or Public Money Supply

As opposed to the monetary base and other sight deposits (which represent together the money at central banks), the higher-level monetary aggregates describe the relationship between commercial banks and their clients, the “public money supply”.

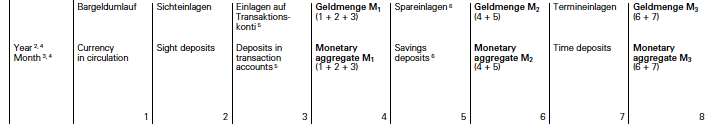

M1: Defined as currency in circulation (bank notes/coins), sight deposits at banks, postal accounts and transaction accounts of non-banks.

M2: Defined as M1 plus saving deposits.

M3: Defined as M2 plus time deposits

Some central banks like the Bank of England does not publish official numbers for M2 or M3.

The definition according to the ECB is the following:

source ECB

There are two other monetary measures worth mentioning:

M4: A less commonly used monetary aggregate, also known as “extended broad money”. Depending on the country, it includes M3 + other types of deposits (such as those held by expatriate citizens or by various governmental agencies). This monetary measure is released by only a few countries.

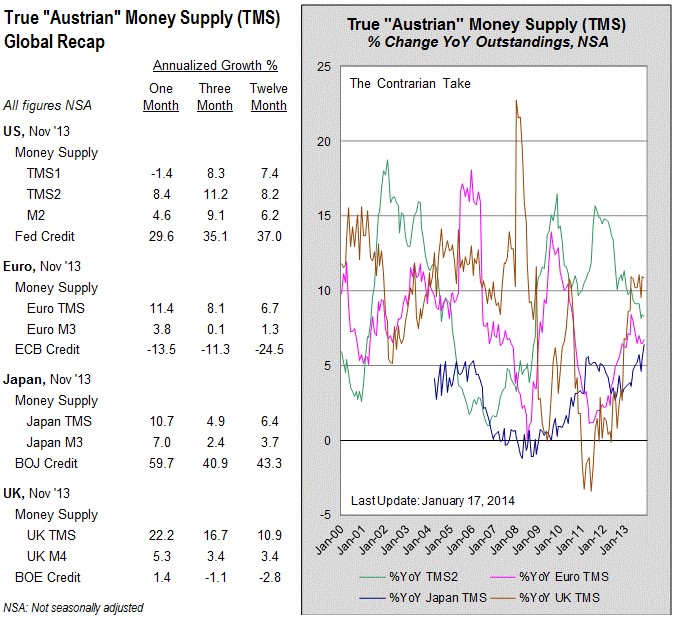

True Money Supply TMS (source Forbes)

TMS: (“True Money Supply”) is a monetary measure developed by Murray Rothbard and Joseph T. Salerno of Austrian School of Economics that defines money as the final means of payment in all transactions. For instance, credit cards are not money, because use of a credit card in the purchase of a good does not finally discharge the debt created in the transaction. Instead, it gives rise to a second credit transaction which is concluded when you pay your monthly credit card bill. Mutual money market funds, while highly liquid and nominally fixed to a set value, are also not money because they first need to be sold in order to be reimbursed.

The TMS consists of the following:

Currency in Circulation,

- Total Demand Deposits,

- Savings Deposits,

- U.S. Government Demand Deposits and Note Balances,

- Demand Deposits Due to Foreign Commercial Banks

- Demand Deposits Due to Foreign Official Institutions.

The monetary aggregates compared in this analysis are the widely used M0, M1, M2 and M3. Global money supply data can be collected from official central bank websites, and the name of each country has been hyperlinked back to the source data for reference purposes.

Not every country publishes all four of the common monetary aggregates. The United States ceased publishing M3 on May 23, 2006. However, various independent sources have continued to publish U.S. M3 figures. One such provider of U.S. M3 money supply data can be found here.

Michael Pollard regularly tracks TMS on Forbes.

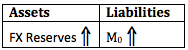

3) Money printing and relationship between monetary base and FX reserves

Money printing has originally a connotation that it helps banks to provide more loans. The thinking that Quantitative Easing (QE) has been rejected by major central banks (see more).

In the case of the SNB, money printing is just a technical accounting process: Minus (or liability) for the SNB, Plus (or asset) for the commercial banks. Therefore it is often called “printing” like adding a zero to a currency exchange rate. The SNB uses this “printed” money to buy more currency reserves.

- The increase of around 2.6 billion francs in SNB sight deposits e.g. during the week of September 14, 2012, should correspond roughly to the same increase of FX reserves, when changes in prices are excluded: 2.6 billion more money (M0) printed to buy 2.6 billion more FX reserves. The SNB did not employ swaps or repos since April 2012. Swaps or repos may distort the picture. In the following we will see that M0 is not sufficient to describe the increase of central bank’s money.

Sight deposits are often called “reserves” from the point of view of commercial banks, they are hence assets for the banks and liabilities for the central bank. In Switzerland these “reserves” are far higher than the SNB reserve requirements, they are hence mostly “excess reserves“. As opposed to the Fed or BoE, the SNB does not pay interest for these excess reserves. Since 2012 even the ECB does not pay interest in its deposit facility.

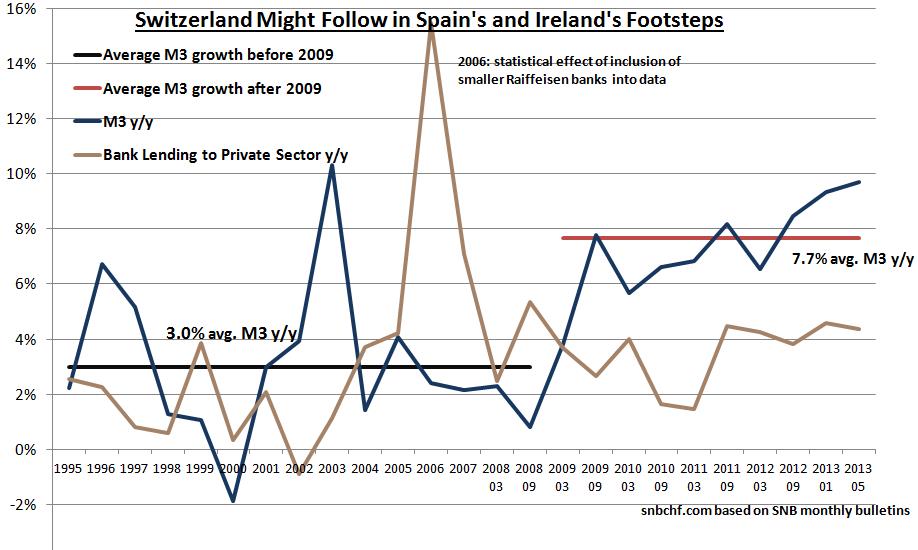

4) The development of Swiss broad money

Since 2008, both Swiss broad money supply M3 and credit has risen far more quickly than in the euro zone.

In order to understand things more deeply please look at the money multipliers in different countries and the secular stagnation confusion.