Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% per year. At the same time, the ECB cannot hike interest rates, because it wants to provide cheap money to the periphery.

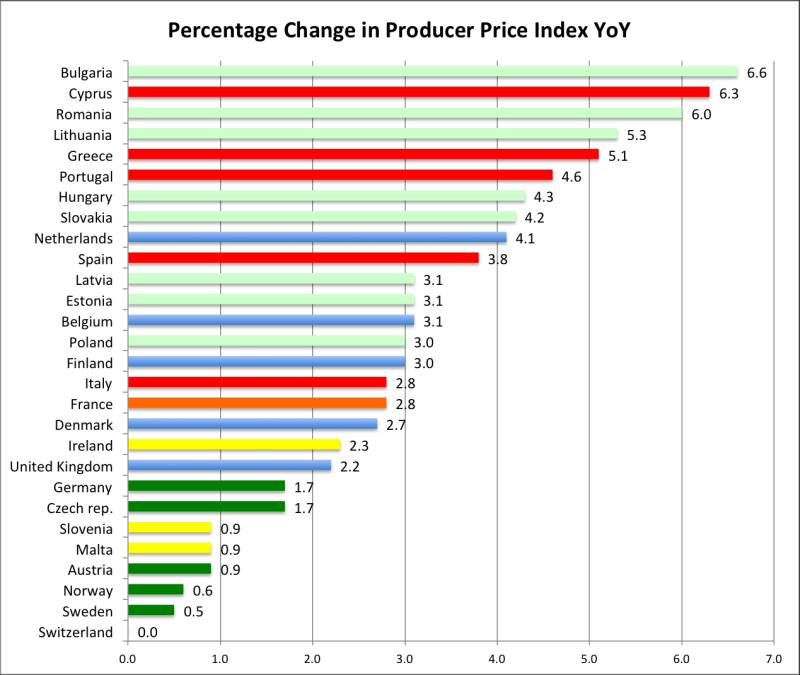

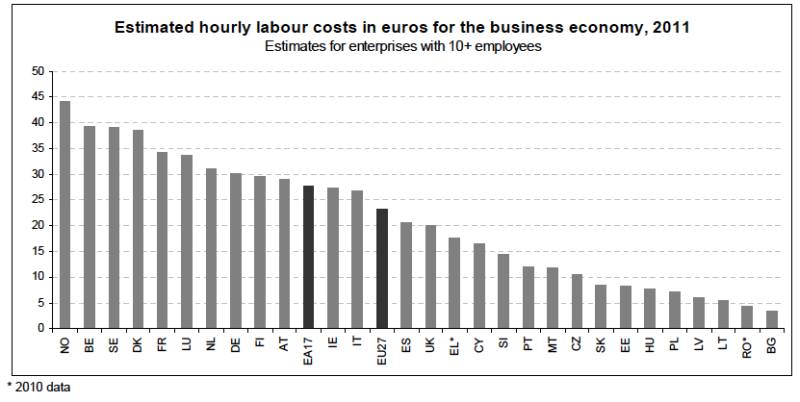

The periphery continues to buy German products, even if they are 1.7% more expensive than last year. The difference between 2.6% higher salaries and the rise of 1.7% in production prices/costs is an indicator of German competitiveness. Production costs in the periphery, however, are rising far more quickly. Eurostat reports that the Greek Producer Price Index is up 5.1% on a yearly basis, the Spanish one 3.8% and the Italian one 2.8%.

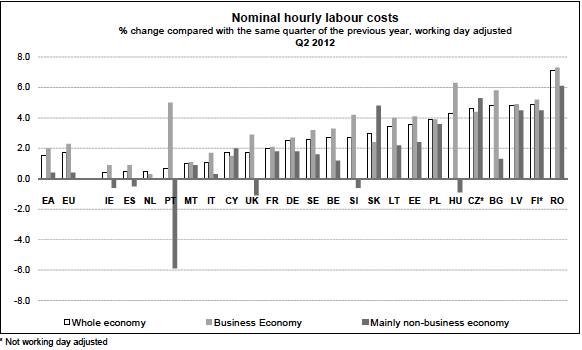

According to Eurostat hourly labour costs are up in most peripheral countries. This is against what the ECB reported last year (as for unit labour costs),

The comeback of stagflation

It seems that there are more things that count to obtain high productivity apart from reducing salaries and firing workers. Firms desperately also need some capital to increase productivity, but capital is simply crunched away.

In the meantime holiday prices in Greece have risen by 12% since last year.

So far the wonderful measures to increase the Southern European competitiveness. The eurocrats have successfully managed to avoid a Greek, Portuguese or Spanish euro exit, a rapidly depreciating drachma, escudo and peseta and the following hyperinflation.

Higher production prices will certainly influence the consumer price index and have created stagflation. Spain sees 3.5% CPI inflation and a contracting economy at a pace of 1.6%, Italy 2.6% CPI inflation and a falling GDP of 2.7%. Greek GDP is down 7.2%, inflation up 1.6%.

At the same time disposal income in Greece is radically slowing:

The drop in #Greece household disposable income accelerated to 13.6% (€34.1bn) in Q2'12 from 5.5% (€35.2bn) in Q1'12.

— Manos Giakoumis (@ManosGiakoumis) November 22, 2012

Rising salaries in the Northern part, low interest rates and a weak euro might potentially trigger even higher inflation on imported products. The PIIGS except Ireland (that profits on its low-tax regime and more flexible labour laws) are and will remain in stagflation for months and maybe years.

Post Scriptum:

The author speaks Italian, Spanish, Portuguese and some Modern Greek, likes the mentalities and lived all these countries at least a couple of months. The critique is nothing against the peoples as such, but against the way the European politicians and economists, the euro morons, try to solve the crisis.

Are you the author? Previous post See more for Next postTags: competitiveness,ECB,European central bank,Greece,hyperinflation,Labor costs,labour costs,stagflation