Monthly Archive: December 2012

FX Theory: The Balance of Payments Model Explained in 400 Words

The balance of payments leads to many confusions because definitions vary. For example, the IMF’s definition is different from the usual or historical definition. Secondly, the relationship between the balance of payments and reserve assets is difficult to grasp, especially in the IMF definition. Thirdly the origin of “errors and omissions” is often unclear. Therefore …

Read More »

Read More »

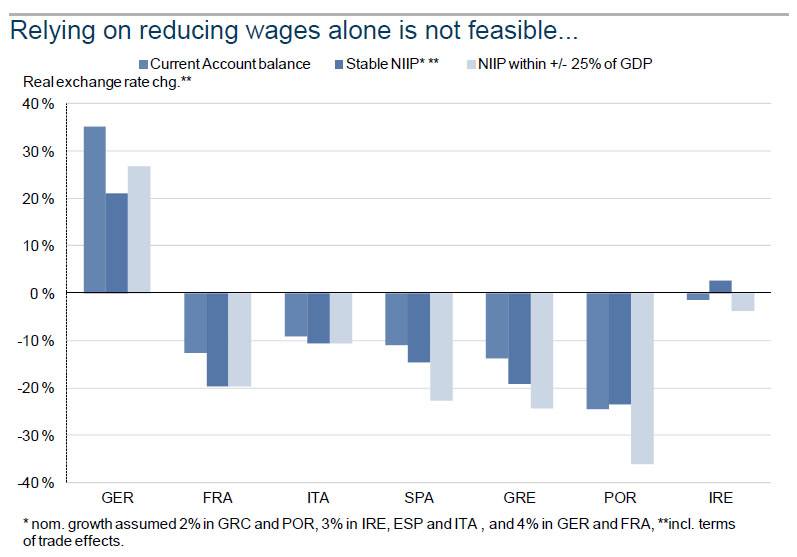

Goldman Sachs: Reducing Wages in Periphery Is Not Enough

The must-read Goldman analysis on Zerohedge: it is not enough to reduce wages in Greece or Spain. These countries will see lost decade(s). Completely in-line with our analysis that

Read More »

Read More »

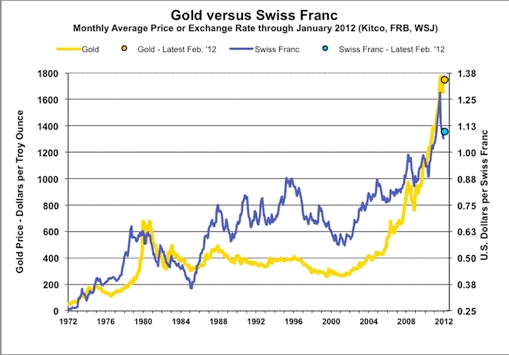

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

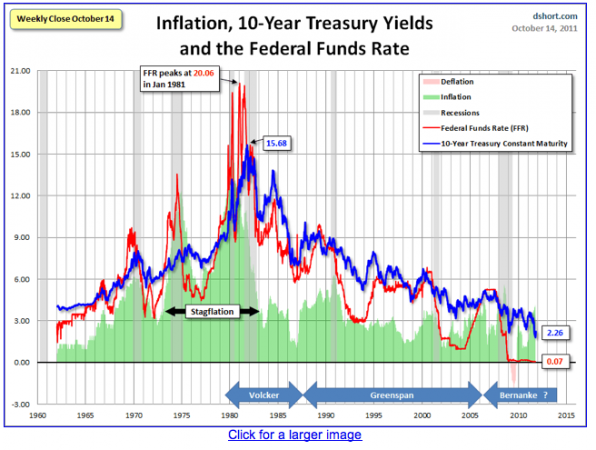

The Rise and Fall of Keynesian Economics

John Cassidy's remarkable interview with the Nobel Prize winner Paul Samuelson maybe best describes the rise and fall of Keynesian economics.

Keynesians led the world to two of its most unfortunate experiences, the 1970s stagflation and to the...

Read More »

Read More »

Former SECO Chief Economist: Switzerland Must Exit Peg in 2-3 Years

Aymo Brunetti, the former chief economist of the SECO, the Swiss national bureau of economy, says that Switzerland must exit the peg against the euro in two or three years time. This is in line with our analysis of upwards and downwards drivers of Swiss inflation. We judged that in 2 or 3 years time, upwards drivers will...

Read More »

Read More »

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

Correlations Between the Swiss Franc, Gold and the German Economy

In yesterday’s post we focused on several economic events that weakened the position of the Swiss National Bank (SNB). In this extended replacement post, we give several reasons for recent movements in the gold price and explain the correlation between German economic data, gold and the Swiss franc. IFO data shows that Germany will not …

Read More »

Read More »

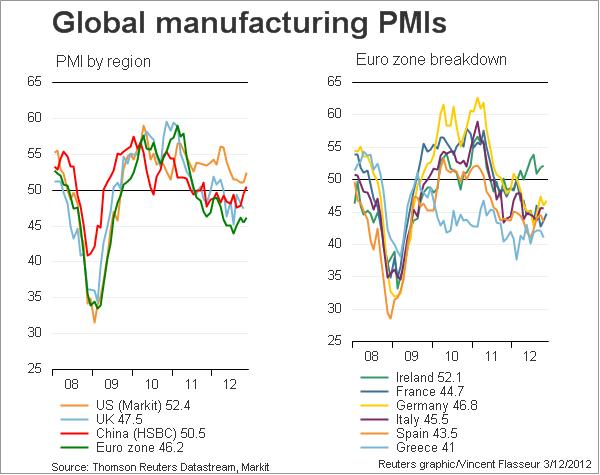

Global Purchasing Manager Indices, Update December 17

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »

The Upcoming Spanish Lost Decade(s)

To us, the big theatre surrounding Greece was just a preview of a much bigger crisis that will happen in the coming years in Spain, the upcoming Spanish lost decade(s). Greece was an absolutely desperate case; therefore, everything was quick. It took just two years till we arrived at the official sector participation and yearly German transfer …

Read More »

Read More »

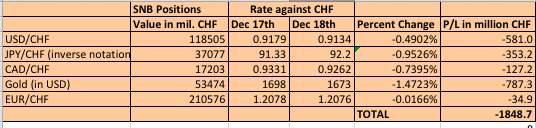

SNB Losses: 1.85 Billion Francs in Just One Day, 231 Francs, 250$ per Inhabitant

After the disappointing US current account data, traders have realized which countries have strong trade balances, namely Germany and Switzerland (see here for our details on the ever rising Swiss trade surplus), additionally fueled the good German IFO data. Both the euro and the Swissie strongly rose against the dollar. Due to Abe’s pressure on the …

Read More »

Read More »

About the Impossibilities of the Common-Currency-Recession-Austerity Cycle

Charles Wyplosz, Professor of International Economics, Graduate Institute, Geneva repeats our arguments in "Who says No to Austerity, Says Yes to the Northern Euro" about the impossibility of getting out of the common currency - recession - austerity - cycle. Similar as we do, he proposes a public...

Read More »

Read More »

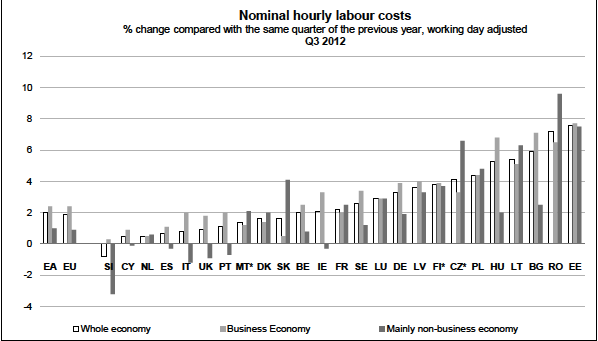

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

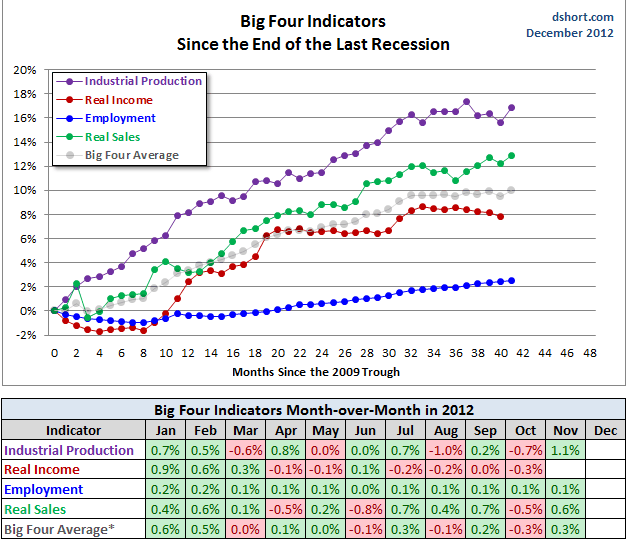

Main US Economic Indicators

The four best “recession” indicators, in form of coincident economic indicators, can be seen at Doug Short/Advisor Perspectives Update September 2013 Update December 21th, 2012 We observe the following: US indicators point upwards, when the rest of the world is slowing. After capital left many emerging markets and Europe, this capital helps the United States …

Read More »

Read More »

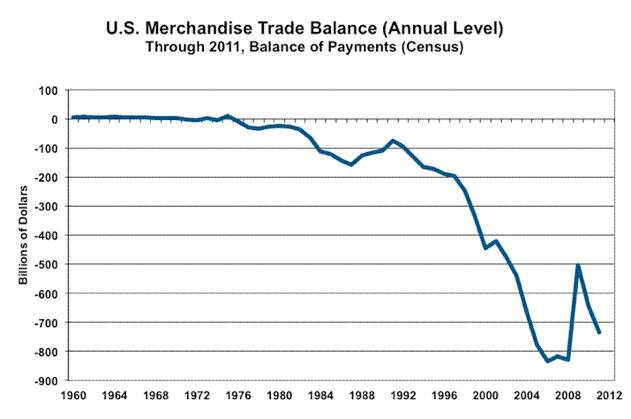

Who is the Biggest Debt Time Bomb: Japan, France, the UK or the United States?

Some must reads: According to the Economist the biggest time bomb in the euro zone crisis is France.

We wonder why the United States and Britain, that have same weak trade balances, the same weak competitiveness and a debt overhang, shouldn't have a problem?

Just because France must do austerity according to the German Fiscal Compact wish, and the US and Britain do not need to do this?

Or like Ray Dalio called it, are the US and Britain...

Read More »

Read More »

Can the United States Be Really More than Just the Global Consumer?

The ISM PMI under 50 shows that the United States are in contraction as for industrial production. The dollar is simply too strong. The Americans consume, but the US trade deficit gets bigger. The Chinese, Japanese, Germans and some global US firms take the profits on it. Today a worth-reading propaganda...

Read More »

Read More »

Five facts you need to know about China’s currency manipulation

Five facts you need to know about China’s currency manipulation Ezra Klein. Washington Post

Read More »

Read More »

4 Different Solutions for the Euro Crisis: Can it Be the Northern Euro? A Discussion

The discussion about the future of the Euro: Among a Post-Keynesian, a European Etatist, an Austrian economist and an advocate of a Northern Euro on the French website www.atlantico.fr. The French paper is asking: “Sommet européen : créer un euro du Nord est-il le seul moyen de sauver l’Europe de l’austérité ?” Is the creation of …

Read More »

Read More »

SNB Monetary Policy Assessment December 2012: (Nearly) Full Text

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% …

Read More »

Read More »

Quantitative Easing: The Fed Wants Americans to Continue Deficit Spending

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This usually pushes down the dollar and inflation hedges like the Swiss franc and …

Read More »

Read More »