The German Constitutional Court ruling, allowing the European Stability Mechanism to go forward, which in turn bolsters the ECB’s Outright Monetary Transaction program, has reduced the extreme tail risk that had been rising after the impact of the Long Term Repo Operations had worn off. It not only reduced peripheral yields, but has also re-opened the bank and corporate bond markets in Europe. The Dutch election results favored pro-European parties. The latest signals suggest that the risks of Greece being ejected from the monetary union has diminished and the odds of a country leaving EMU this year, according to the policy market at www.Intrade.com have fallen to about 15%, near its lowest level in two years.

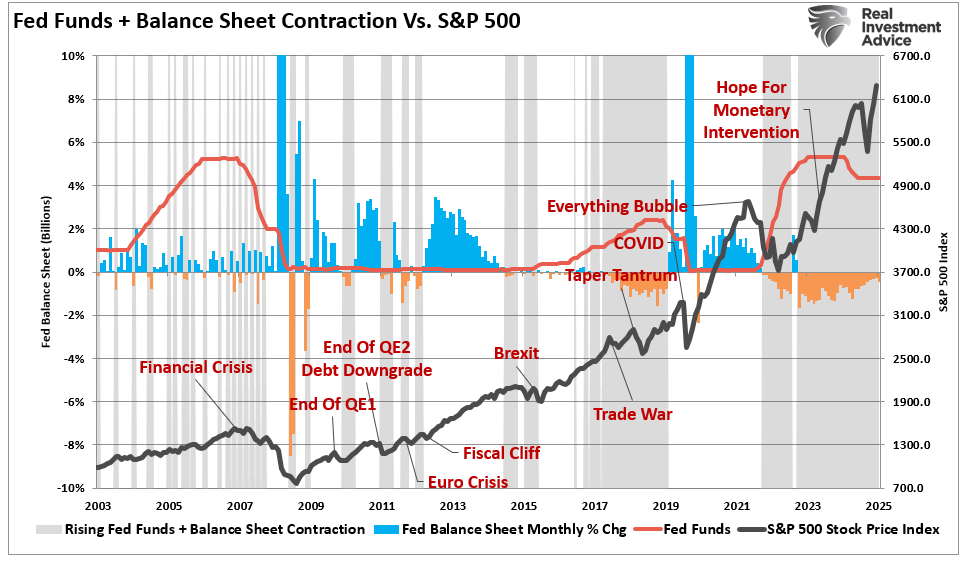

In the US, following two disappointing monthly jobs reports, the Federal Reserve took bolder action than many, including ourselves, had expected. The open-ended nature of its newly announced purchases, which will focus on newly created mortgage-backed securities, is both quantitative easing and a way to encourage new mortgage lending. It also suggested that the bar to additional long-term asset purchases was low in the sense that the only thing that would prevent it would be a significant and substantial improvement in the labor market. Given the uncertainties surrounding the fiscal cliff and the dampening effect this has on investment and hiring decisions, the kind of improvement does not look particularly likely.

The actions by European officials and the Federal Reserve reduce the significance of next week’s economic data. The euro zone’s flash PMI readings will not change perceptions that the regional economy is likely contracting here Q3. The German ZEW is also expected to stabilize low levels. That said, the real sector data has generally been firmer than anticipated from the surveys. US economic, including the Empire and Philly Fed surveys for September, housing starts and existing home sales may see brief market responses, but investors’ focus like the Fed’s, will be the employment market.

The UK’s data, which includes CPI and retail sales, may be more important. The recent data has surprised on the upside, even though an economic rebound is widely expected after some downside distortions in Q2. The BOE minutes will be scrutinized for insight into how close it is to expanding its gilt purchases. The risk of a rate cut may diminish, but an extension of its QE is still likely in Q4.

The Japanese government downgraded its assessment of the economy for the second consecutive months and next week it will likely report that exports are still falling, which curbs domestic output. In addition, deflationary pressures still evident. The BOJ’s two-day meeting concludes on September 19 and there are both political and economic pressures for it to step up its own QE. While we see the yen as largely driven by external factors, failure to extend QE, could strengthen the yen. There is some speculation that the BOJ could buy foreign bonds, but we suspect it and the legal framework, are not ready for such a step.

We recognize that both Draghi’s and Bernanke’s plans were more aggressive then we anticipated. Yet, we do not think that the euro zone debt crisis is over and indeed expect it to flare back up. Some of the weakness in US data, including jobs and the largest fall in industrial output in 3 years, has been a function of distortions from the auto sector. Moreover, leaving aside theory, we have seen in practice that countries that pursue QE do not always experience a weakening currency. In fact, as we have pointed out, the dollar may have been sold off in anticipation of QE2, it rallied after it was announced in November 2010.

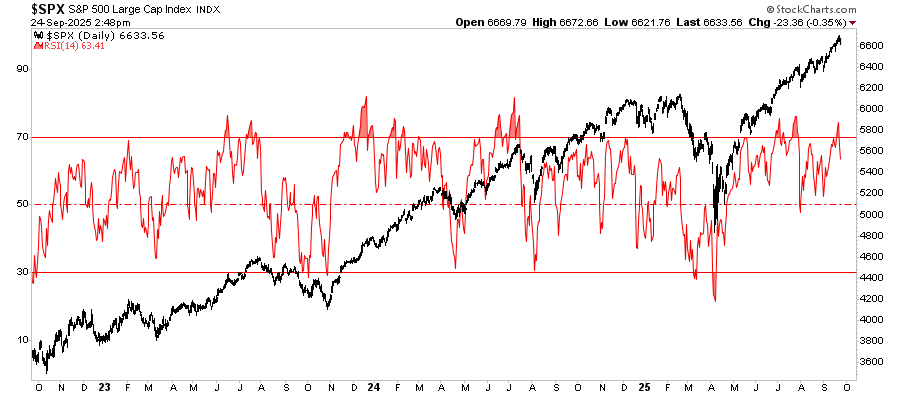

Still, as our review of the positioning in the futures market and technical analysis suggests, there is no evidence that dollar has bottomed. We find that the Canadian dollar and, to a lesser extent, the Australian dollar, may be the most vulnerable. We also note that the pace of the recent moves has left the dollar stretched from a quantitative point of view. This warns against chasing the other major foreign currencies higher immediately without a pullback first.

Euro:

The net speculative short position continued to be reduced during the reporting period that ended September11. The little more than 9k reduction to 93.7k contracts is probably a bit less than many would have anticipated given the price action. However, it is the smallest net (and gross) short position since April. Some of the longs sold into the gains and 3.4k were liquidated, leaving a gross long position of 43.2k. The gross shorts fell 12.1k to a still substantial 136.9k. The euro’s rally in the days since the reporting period ended would seem to suggests more short covering and the establishment of new longs. This in turn would imply a more dramatic reduction in the net short position in next week’s report.

Technically, the euro looks strong. The 200-day moving average and the $1.30 level

cited last week as objective were overcome. While some of the technical indicators look stretched, there are no bearish divergences. That said, a note of caution against chasing the euro immediately is that it is beyond the top of the Bollinger Band (two standard deviations above the 20-day moving average). This is a rare occurrence even if not as rare as a normal distribution would imply. On the upside, the next objectives come in front of $1.32 and then $1.33. We suspect that at this juncture, a pullback toward $1.30 would still be seen as a new buying opportunity. The euro has not closed below its 5-day moving average since August 30. It comes in now near $1.2920.

Yen:

The net long speculative position rose by a third to 32.8k contracts, which is largest since February. This was a function the establishment of new longs (5.7k to 60.9k contracts) and the covering of shorts (-3k to 28.1k contracts).

The dollar did spend a few days last week below JPY78, but it recovered sharply at the end of the week. When every thing is said and done, the dollar remains range-bound against the yen. Three factors may have helped the dollar recover. First, and probably least significantly, verbal intervention increased markedly as the dollar approached JPY77. Second, the combination of Draghi’s plan in Europe, the German Constitutional Court ruling, and open-ended nature of the Fed’s QE flows into risk assets and this weighed on the yen, not only against the dollar but on the crosses as well. Third, there has been an unappreciated but dramatic rise in US Treasury yields. The in the past week 10-year Treasury yields have risen 20 bp. They are up 40 bp this month.

Sterling:

The net speculative position remained short for the second consecutive week but was trimmed by about 2.5k contracts to 4.4k. The small net position should not conceal that the gross positions are substantial. New momentum and trend followers jumped aboard, increasing the gross longs by 7.5k to 49.3k contracts. This is the largest gross long position since May. Top pickers increased their gross short by 5k contracts to 53.7k, the largest in six months.

Sterling also still looks strong technically. It broke a trend line drawn off three key highs: April 2011 (~$1.6750), August 2011 ($1.6620), May 2012 ($1.6300). It came in last week near $1.6160. The $1.63-$1.64 is the next objective. Like the euro, sterling has also moved above the top of its Bollinger Band. This would caution against chasing the market out of the gate. A pullback toward $1.6150-80 would likely be seen as a new buying opportunity, with a break of $1.60 suggesting a potential failure.

Swiss Franc:

The net speculative short position was cut to 9k contracts from 131k. There still continued to be minimal interest in the Swiss franc. The gross longs rose 2.6k to 11.6k contracts, while the 1.5k shorts were covered leaving 20.6k contracts.

The dollar is heavy. The break of the CHF0.9360-CHF0.9400 area is technically important and should serve as resistance now. The next objective is CHF0.9200 and then CHF0.9000. The dollar is trading beyond the lower end of its Bollinger Band against the franc.

Canadian dollar:

The net speculative and gross long positions rose to record levels in the latest reporting period. The net long position rose by more than 50% to 102k contracts. New buyers came in lifting the gross long position to 27.2k contract to 116.5k. A little more than 8k shorts capitulated leaving 14.9k gross shorts left.

The Canadian dollar appears technically vulnerable. Not only is market positioning extreme, but there was a potential reversal on before the weekend and there is a minor divergence appearing in the daily RSI. This does not mean a US dollar low is in place. However, short and medium term participants may want to consider tightening stops. A move above the CAD0.9780-CAD0.9800 would strengthen the case of a correction rather than consolidative phase.

Australian dollar:

The net speculative long position grew by about 5.9k contracts to 68.3. However, this was not a function of an increase in the gross longs, which in fact were cut by 4.3k (to 107.5k). Instead it was the covering of 10.2k shorts (leaving 39.3k contracts) that drove the change in the net position.

The Australian dollar’s technical condition is weaker than one might suspect, given the risk-on market flavor. However, the move above the May high was not confirmed by the momentum indicators and it failed to sustain the move before the weekend. A potential short-term reversal pattern may have been recorded with this failure. Initial support now is seen in the $1.0435-50 area, but it may require a break of $1.04 to confirm the failure.

Mexican Peso:

Speculators in the futures market continue pursuit of the Mexican peso. The net speculative position rose by a third to 122k contracts. Gross longs rose 25.7k to 127.2k contracts. Around 5.7k shorts capitulated, leaving 4.k contracts, the least since May 2011. To appreciate the pace of the positioning adjustment, consider that as recently as early June there were over 40k short contracts and less than 12k long contracts.

The dollar fell to 6-month lows against the peso. While it is stretched, there is no technical evidence that a low is in place. As we have seen we some of the other currencies, the pace of the dollar’s sell-off has left it beyond its Bollinger Band, which we interpret as a cautionary warning about chasing the market, not as a compelling reason to look for a reversal. The next area of support for the dollar is seen near the Q1 12 lows in the MXN12.50-60 area. Beyond that, there is a trend line drawn off the August 2008 lows and the May and July 2011 lows. It comes in next week near MXN12.20.

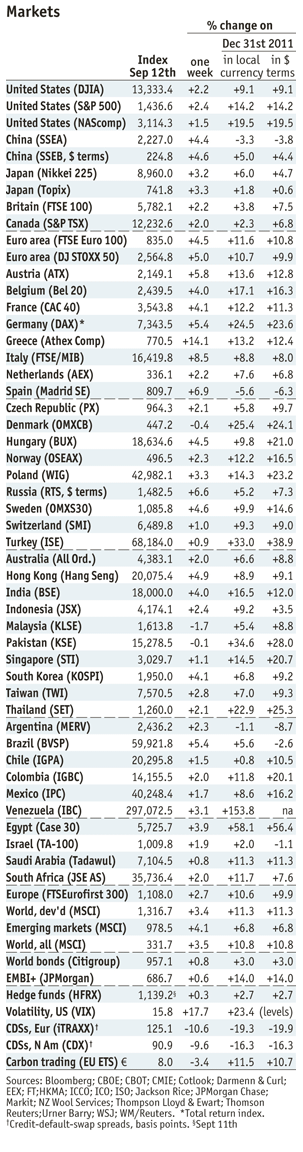

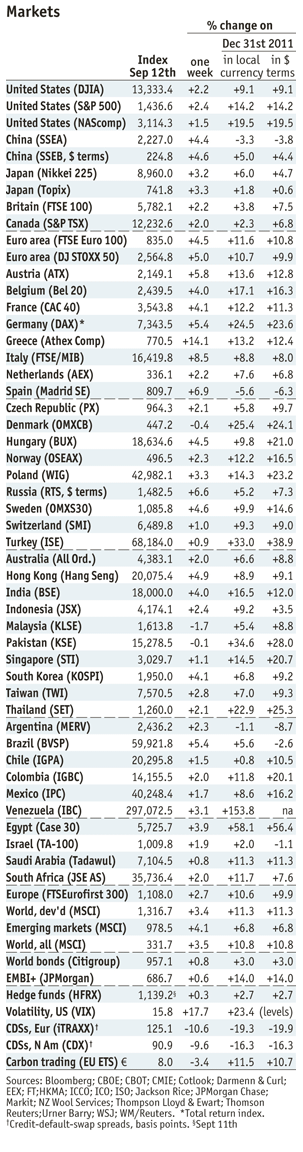

Economist Sep 12 - Click to enlarge

Global Stock Markets (by George Dorgan):

After the strong revaluation of the euro and the limitation of risks in the euro zone, the DAX and the Denmark’s OMX haven overtaken the NASDAQ as leading index in US$ terms. NASDAQ’s weekly gains were far lower, whereas the DAX exploded together with Chinese and Japanese stocks and commodities.

In the euro area Greek, Italian and Spanish stocks saw weekly gains over 7%, but profits in Northern and Eastern Europe markets were limited, Denmark’s OMX even lost.

The Swiss SMI has finally achieved 9% return in both CHF and USD terms.

Gains for Australian stocks were limited to 2% last week, after the strong currency rise prevented higher profits. In the Emerging Markets, Russia and Brazil strongly rose last week, “QE-unlimited” raised hope on a stop of the capital outflows. Both Mexico and Colombia continue this year’s success story. With a smaller local markets and/or thanks to a closer distance to the United States their economies and stock markets are expanding better.

More related posts directly from Marc’s website:, , , , , , , , , , , , , , , ,

Are you the author?

He has been covering the global capital markets in one fashion or another for more than 30 years, working at economic consulting firms and global investment banks. After 14 years as the global head of currency strategy for Brown Brothers Harriman, Chandler joined Bannockburn Global Forex, as a managing partner and chief markets strategist as of October 1, 2018.

Previous post

See more for 4.) Marc to Market

Next post

Tags:

Bank of Japan,

Ben Bernanke,

Canadian Dollar,

Commitments of Traders,

Constitutional Court,

COT,

Credit Suisse,

Currency Positioning,

FX Positioning,

Japanese yen,

Marc Chandler,

MXP,

Net Position,

Peso,

Speculative Positions,

Technical Analysis,

U.S. Existing Home Sales,

U.S. Housing Starts