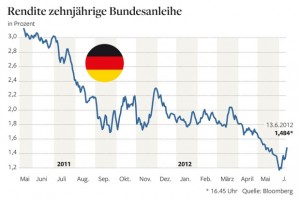

10 yrs. Bunds since May 2011[/caption]

Since the latest Greek elections an other picture has emerged, the new Greek government is likely to renegotiate the austerity package. Furthermore, Germany is pushing Spain to get bailed out by the ESM.

Paulsen bet already in March that Germany is willing to pay all remainders of the debt-financed 2002-2007 consumption run in the struggling European nations, even if Merkel has insisted on the contrary for months. Recently George Osborne and Barack Obama urged Germany to finally pay the bill (certainly without mentioning that the UK and the US could help paying it).

[Adstart] These days many more hedge funds have joined Paulsen and are betting on rising German Bund yields. PIMCO has removed German Bunds from their investments. Since the beginning of June 10-year Bund yields have risen from 1.17% to 1.53%. Some hedge funds expect the euro crisis to last another 20 years (as we expected in an earlier post). This would give German finances a hard life, therefore more than half of the hedge funds expect Bund "yields to double within a year".

10 yrs. Bunds since May 2011[/caption]

Since the latest Greek elections an other picture has emerged, the new Greek government is likely to renegotiate the austerity package. Furthermore, Germany is pushing Spain to get bailed out by the ESM.

Paulsen bet already in March that Germany is willing to pay all remainders of the debt-financed 2002-2007 consumption run in the struggling European nations, even if Merkel has insisted on the contrary for months. Recently George Osborne and Barack Obama urged Germany to finally pay the bill (certainly without mentioning that the UK and the US could help paying it).

[Adstart] These days many more hedge funds have joined Paulsen and are betting on rising German Bund yields. PIMCO has removed German Bunds from their investments. Since the beginning of June 10-year Bund yields have risen from 1.17% to 1.53%. Some hedge funds expect the euro crisis to last another 20 years (as we expected in an earlier post). This would give German finances a hard life, therefore more than half of the hedge funds expect Bund "yields to double within a year".

Bund sell-off puts further pressure on EUR/CHF exchange rate

The first consequence of the Bund sell-off is that the yield spread between 10 yr. Eidgenossen (currently at 0.59%, on June 1 at 0.52%) and 10 yr. Bund (at 1.59%, on June 1 at 1.17%) is getting bigger. Especially when risk averseness against Germany reigns and investors go out of German Bunds, then other secure government bonds like UK Gilts or the Swiss Eidgenossen are in high demand, putting further pressure on the EUR/CHF exchange rate.How much will the SNB lose when German Bund yields double ?

As we explained before, the SNB euro investments essentially consist of German Bunds, even if recent excessive Bund prices triggered some SNB moves into Dutch, Austrian and French short-term notes. The SNB's average bond duration is four years. Since 4 or 5 year Bunds show a similar behavior as the 10 year one, we do the calculation with the 10 year Bund: If 10 year Bund yields really double, this would imply that its price falls from 141 (we use the Bund future equivalent), to 124, to 88% of its value. Given that 52% of the SNB reserves are in Euro and assuming that at least half of them are the more volatile 5-10 years German Bunds, this implies that the SNB would suffer valuation losses of 3% of its 340 bln CHF currency reserves, i.e. around 10 bln. francs.Double-negative effect for the SNB

As result we obtain a double negative effect for the Swiss National Bank: Further pressure on the EUR/CHF exchange rate due to risk-averse investors leaving the German Bunds for the Swiss Eidgenossen and losses on the SNB's Bund Forex positions.Related Blogs

Full story here Are you the author? See more for Next postTags: Austrian economics,Bunds,Duration,Eidgenossen,Euro crisis,Euro exit,franc,German Bund,Government Bonds,Merkel,Swiss National Bank,Switzerland

4 comments

Skip to comment form ↓

Gloeschi

2012-06-20 at 21:40 (UTC 2) Link to this comment

So SNB is in a lose-lose situation; if Euro-zone survives they lose with German bonds (as German yields will have to approach Euro zone average as survival means Eurobonds); if it doesn’t, SNB is stuck with FX losses as the peg breaks.

2012-06-20 at 23:26 (UTC 2) Link to this comment

If the Euro zone breaks, the short-term effect is a break of the peg, at least it should break on the way towards the Euro break-up. Then the opposite will happen: When Germany finally leaves the euro zone or a Northern Euro is created, then the Deutsche Mark/Northern Euro will appreciate strongly against the franc (based on recent high wage increases in Germany, Finland). This will cause Swiss inflation to rise strongly and the housing market could bust. I will add these things to the “Black Swan post”.

Hm

2012-06-22 at 02:35 (UTC 2) Link to this comment

High wage increases = less export = lower currency, or not?

and Germany has still 30% below Eurozone average ULC costs.

2012-06-23 at 01:16 (UTC 2) Link to this comment

Far too simple. Low taxes, high levels of human and physical capital, technology can make high wages sustainable