Oil prices

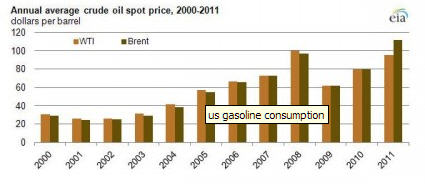

Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already

existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, the supply situation even suggested an oil glut.

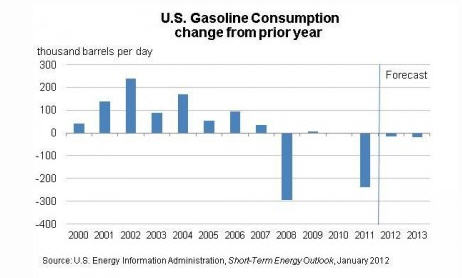

Like always, rising oil prices will hurt the US the most and invert the initial good performance into a rather mediocre growth starting from the moment when gas prices will quickly reach high levels. At that moment US consumers will be similarly shocked as in Summer 2008 (gas from $3 to $4 in 6 months) or April/May 2011 (gas from $2.60 to $3.90 in 8 months). The Fed has promised to keep rates low. Low rates and sufficient growth leads to higher oil prices, no matter what the real demand situation for crude is: Global oil demand rises by 5-10% per year, new resources are discovered, but prices still go up by 20%-25% per year.

The reason is simple: Investors want their return in times when other asset classes like bonds have negative returns, stocks have already high price earnings ratios and the Fed pushes oil prices upwards providing cheap money. Oil traders justify the high prices currently by the Iran issues, later by increasing global demand once China will have picked up growth again.

The experience of the 1980s was different: After the iranian revolution inflation mainly caused by the high oil prices remained low because the Fed’s Volcker decision to make money expensive and supply could be expanded thanks to newly discovered North-sea oil. This resulted into a strong dollar and made US treasuries much more attractive than commodities. Slowing commodity prices reduced the growth and the oil demand of the emerging economies, and pushed some, like Mexico, into bankruptcy.

High oil prices again will result into continued slow US growth and the Fed will continue to depreciate the dollar (see Jim Rogers). When the moment of the mentioned oil price shock will be, is still open. The quicker oil prices rise, the earlier the currently strong US growth will be stopped. A gas price of $4.30 or $4.50 this summer would be sufficient to derail the US economy. US consumers are able to digest slow rises in gas prices, but not a sudden rise. Therefore the similar critical level for summer 2013 will be $4.50 to $5.

Or maybe everything will be different: the Euro crisis stops the US and the world wide growth and there will be a summer glut.

Are you the author? See more for Next post

Tags: China,Emerging Markets,franc,Jim Rogers,Oil & Commodities,Swiss National Bank,Switzerland Money Supply,United States,Volcker