The Wirtschaftswoche reports about the real reasons of ECB Chief economist Jürgen Stark’s resignation. The reasons are rather political, namely a protest against European governments:

- Even if 90% of “self-appointed or real experts” want it, the indefinite ECB bond buying is clearly “excluded by the fundamental orientation of monetary union”. The measures are only “temporary and limited”. (Comment: The limit might be reached when ECB bonds purchases cannot be sterilized any more. See the FT column: http://on.ft.com/rOTaGr)

- Greece: According to Stark Greece did reforms only until the point it was sure to obtain the next tranche from the IMF and the European partner. After that they reduced the reform efforts again.

- Housing bubble: In 2006/2007 the ECB had to do a common monetary policy so they could not react to the upcoming real estate bubble in single countries like Ireland and Spain, but their governments could have prevented it easily but did not.

- Diverting labor costs: The ECB has warned already in 2005 against diverting labor costs in the Euro-zone, but governments did not act.

The Wirtschaftswoche report is here: http://bit.ly/rRJkZQ

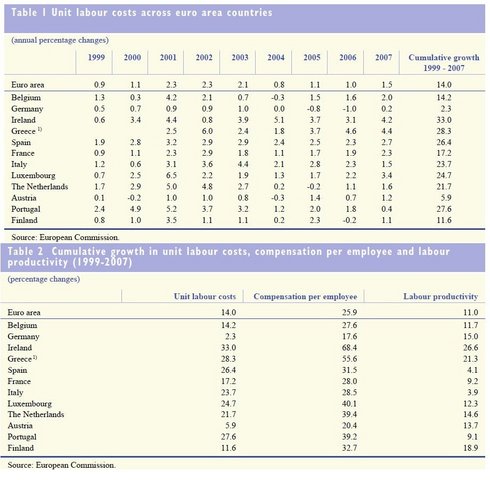

Here an extract of the November 2008 ECB bulletin with some more details on labor costs:

Labor costs rose about 25% in the PIIGS countries from 1999 to 2007 whereas Germany had a modest increase of 2.3%. Labor productivity rose 4% in Spain or Italy but 15% in Germany and other Northern countries. If Ireland’s and Greece’s productivity gains might be partially due to a housing bubble (Ireland) and statistical falsification (Greece).The former German minister of state Flassbeck criticized the German employers and labor unions low salary policy over that period: http://bit.ly/swrHc4

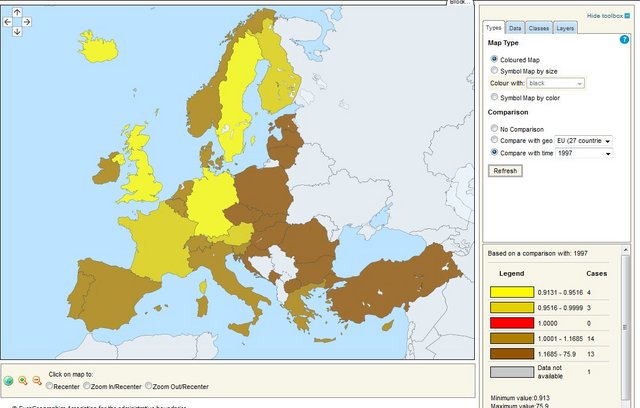

The following comparison with 1997 from Eurostat (http://bit.ly/rDnZHF) shows that the PIIGS have seen an increase of price levels up 16% whereas Germany, France, Sweden, Finland, Austria and Britain saw decreases up to 10%. Eastern & Central European countries have an increase of price levels mostly due to gains of productivity.

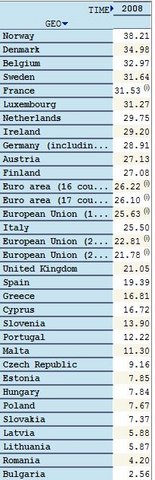

In nominal terms labor costs as of 2008 are the followings (source Eurostat):

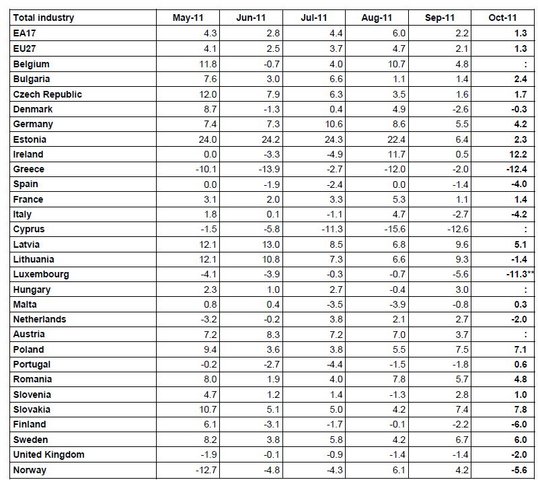

2011 annual industrial production figures show which of these salary levels are sustainable and which are not (source Eurostat):

Stark implies that the only chance to save the Euro-zone is to radically reduce labor costs in Greece, Cyprus, Italy or Spain, may be long-term to similar levels with Estonia or Slovakia, and to increase salaries in Germany. Unfortunately legislation for salary reduction is too rigid for example in Spain, so instead of reducing salaries the unemployment rate jumps up. The way to do this devaluation of wages and salaries is the one Latvia did in 2009/2010 but it was very painful (see the economist http://www.economist.com/node/15581056).

Since radical reforms take time the only quick alternative seem to be the break-up of the Euro-zone and defaults (See the FT column: http://on.ft.com/vjn5e7). Otherwise the Euro-crisis will continue to see Germany’s strength and the PIIGS weakness for years.

Are you the author? Previous post See more for Next postTags: ECB,European central bank,Finland,Government Bonds,Labor costs,PIIGS,Spain,Swiss National Bank