Rumour Of A Softer KOF Swiss Leading Indicator…

Expected 0.63 vs previous 0.80, but the number now being touted is 0.35

EUR/CHF is getting a leg up on this around 1.2283 now from 1.2260 earlier

Large Corporate Bids In EUR/CHF….

At 1.2250 I’m told it relates to some year end covering.

Beneath here lies the 200 day MA at 1.2229.

NB: Latest CFTC data also points to CHF shorts at 2 year highs

SNB’s Hildebrand: Swiss Franc Is “Highly Valued” , Expects Will Weaken Further..

Comments made by the SNB president to Swiss magazine Schweizer Illustrierte

EUR/CHF Slapped Down With The USD/CHF

Stops went through 1.2325 with a sharp fall to 1.2280, but the move is deemed to be on the back of the USD/CHF more than anything else.

There’s talk of bids now from 1.2270 down to 1.2250 , with likely stops underneath. We’re sitting at 1.2295 now.

USD/CHF tripped those earlier sell stops through 0.9190 to 0.9176

SNB Ready To Act If Franc Strength Worsens Outlook, Jordan Tells Le Matin

“Since Sept 6 we have been saying that we were ready to take further measures if the economic outlook and the risk of deflation require it.”

“No Comment” From SNB

The usual refrain from the Swiss but we’re back over 1.23 again. To me, it doesn’t look like the SNB is at work here. More likely some jittery money fleeing the eurozone or some other flows.

EUR/CHF Stops-Loss Orders Not Far Away

- Below 1.2240 and 1.2200, just as I reported yesterday

EUR/CHF Buyers About…

…out of Lugano i’m told. EUR/CHF’s just bounced sharply from 1.2300 to 1.2337., after model sellers earlier clumped the pair from 1.2320 down to 1.2285.

Points of interest are the 21 and 200 day MA’s at 1.2298 and 1.2245 . The latter should hold some reasonable support

We’re sitting at 1.2325 now

EUR/CHF Orders

- Decent sized stop-loss sell orders reported below 1.2290, 1.2240, and 1.2180

Swiss Govt: We’re Ready To Do More, If Needed

- Finance ministry, SNB and FINMA (mkt regulator) are closely monitoring economic situation and will propose additional steps to boost the economy, if needed

That should get the 1.30 CHF floor talk going again…

EUR/CHF Getting Battered

Talk of a peg rise seems to be history after a report early in the week from UBS suggesting a hike to 1.2500.

Leveraged sell stops have now been tripped in EUR/CHF with the pair drilled down to 1.2342 from 1.2415 highs earlier.

EUR/CHF’s sitting at 1.2354

Scuttlebutt Scuttlebutt: SNB Said To Be Asking……

EUR/CHF and GBP/CHF forward levels.

EUR/CHF up at 1.2430 from around 1.2410 when I parked my bum.

Those who attended the New York gathering last week will know my thoughts on this cross. Those who couldn’t be bothered to attend, tough!!!

EUR/CHF: Noise Getting Louder In Interbank Market

As Jamie reported overnight, CitiTechs took a strategic long position in EUR/CHF and the noise is getting louder in the interbank market that the SNB are preparing another lift in the ‘base’. That would be a very silly thing to do imho but central banks always know best. 1.30 is the popular choice.

Citi Tech Guys Go Long EUR/CHF

Trying to dig up their target and stop…

UBS Suggesting SNB Adopts A 1.2500 EUR/CHF Peg At It’s Next Meeting

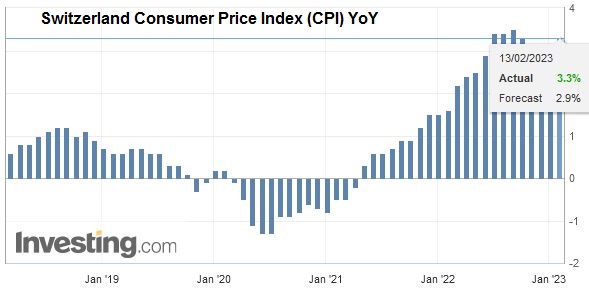

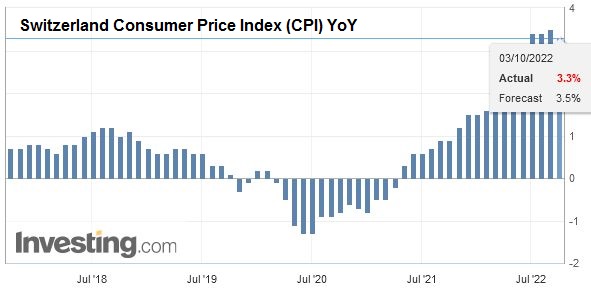

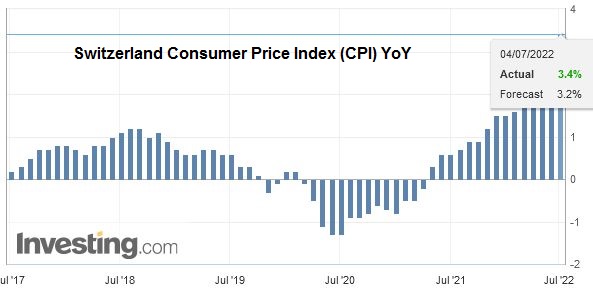

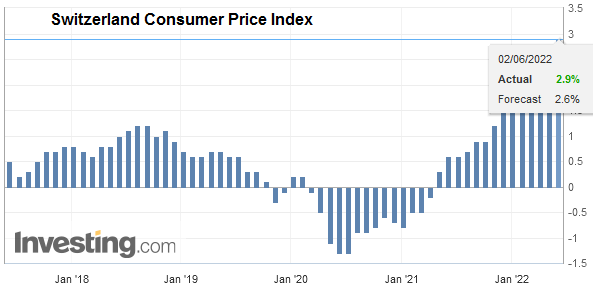

Citing comments from SNB themselves that the Swiss is grossly overvalued, and amid calls from companies and politicians for a peg hike as inflation data deteriorates.

Having said that don’t forget what SNB’s Jordan said earlier which was that he wouldn’t be swayed by pressure and that the decision would lie solely with themselves.

EUR’s around 1.2400

AUD/CHF: Macro Player Accumulating Over Last 6 Weeks

This is an interesting trade and one that I was on for a while and caught a nice updraft. One of the bigger hedge funds has been very active in this cross over the last couple of months. They are a net buyer but have also been off-loading on rallies, thereby improving their average positioning, as any good trader should.

These guys are usually right eventually. I’m guessing that this is a quasi EUR/CHF trade without the inherent dangers of a EUR long position; certainly makes a lot of sense to me.

Is The Floor Rising Or Am I Still Just Queasy…

…from all that drinking I did with Gerry last week?

Dow Jones says UBS sees the floor on the CHF being raised from 1.20 against the euro to 1.25.

Gerry, funnily enough was touting a view at our gathering Thursday that the floor will rise to the 1.25/1.30 area.

Former Bank of England chief dealer Jim Trott sensed that the floor would ultimately fail as the SNB made a strategic error in identifying a specific level that it will be forced to defend. He found himself in a similar position in 1992 and the market won.

Moral of the story: As a central banker, never give the market a clear target to shoot for…

Danthine Hits The Wires, EUR/CHF Jumps

- The SNB’s danthing is saying they are monitoring franc developments constantly

- He sees a risk of deflation in 2012 if there’s an economic downturn

- Ready to take further measures on the franc

- Comments in a Swiss newspaper

EUR/CHF Options May Be In Play

EUR/CHF is trading near a session low at 1.23. There is said to be a good-sized option expiration at 1.23 at the NY cut. There is also talk about buying interest down to 1.2280 but stops below.

SNB’s Hildebrand Speaking In 30 Mins

I mentioned it early today, that he’s speaking in Lucerne at 1330GMT.

EUR/CHF popped the stops down through 1.2320 earlier and we’ve been down to 1.2306 , from 1.2400 Asian highs

There’s talk of some reasonable bids down at 1.2300 now

EUR’s at 1.2320

EUR/CHF Stops Looming…..

Apparently sell stops set on a break down of 1.2320

We’re at 1.2342

SNB’s Jordan: Can’t Move Rates Into Negative Territory

- SNB not weakening the franc to gain export advantage

- Would act to prevent deflationary threats,

- Wrong to engage in competitive devaluation

- Situation for exports remains “very difficult”

- Must consider instruments if domestic credit gets out of control

EUR/CHF smacked lower through 1.2410 to 1.2321 before a bounce to 1.2350

SNB’s Jordan: CHF At 1.2000 Is Still Overvalued Vs The EUR

- Should weaken and SNB is committed to defend the 1.2000 cap to fulfill price stability mandate.

- Deense of the cap may come with high costs.

- Minimum Fx rate for EUR/CHF should be confused with exchange rate target

- SNB’s Monetary policy decision affcected by overseas developments

EUR/CHF sits at 1.2417

SNB’s Hildebrand To Speak In Berlin At 1320GMT

Leveraged traders have been the main drivers of late in this cross rise, and it’s likely Hildebrand will come out with further comments to attempt to bolster the current swiss weakness, following calls from the Swiss advisory panel for a peg hike to 1.3000

Swiss Business Lobby Wants Higher CHF Floor

There’s a shock! EconomieSuisse, the business lobby, says would welcome a Christmas present of a higher floor for the franc, moving it up to 1.30 from 1.20.

I’ve wanted a pony for 45 straight birthday’s now, but you can’t always get what you want.

Strong Bids Sitting In EUR/CHF

I’m told sizeable bids are now in place at 1.2300/10

EUR/CHF Climbing Again In Thin Trade

Hearing from a reliable source that corporate buying is picking up in this pair and we’ve broken up through 1.2345 which i’m told is a 61.8 fibo retracement of the 1.2475-1.2130 sell off.

This could now possibly build higher towards 1.2390 or even 1.2475. But stiff resistance is sitting just ahead of 1.2500.

We’re presently up at 1.2353 after a recent high of 1.2359

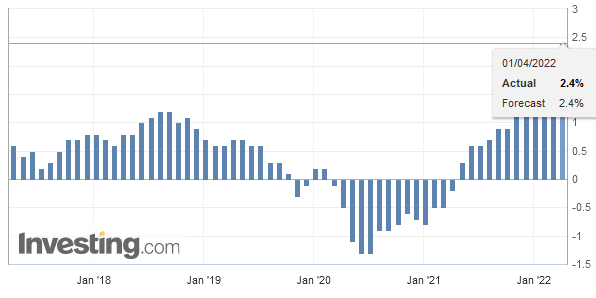

Swiss Oct CPI -0.1% Y/Y, -0.1% M/M

Against market consensus of 0.2% for both

Soft number which could lead SNB’s Hildenbrand to consider raising the peg.

EUR/CHF’s just hit a day’s high of 1.2347

EUR/CHF Gets Another Leg Higher

Just ripped up to 1.2336 ahead of the upcoming Swiss CPI, with market nervous after SNB Hildebrand’s warnings that further intervention may be necessary .

Some strong buying in USD/CHF from the off this morning adding fuel to the move.

Tech resistance seen in the EUR/CHF towards 1.2355. Were presently sitting around 1.2317

EUR/CHF Jumps On SNB Warnings

EUR/CHF rose to 1.2200 from 1.2130 on Friday after a warning from the SNB’s Danthine. The pair opened the week an additional 70 pips higher at 1.2270 after a similar warning from SNB leader Hildebrand.

This humble forex strategist said it was a great time for a EUR/CHF long on Friday at 1.2136 and is comfortable staying long here.

EUR/CHF Rallying Nicely

Well if you’re long. We’re up at 1.2210 from early 1.2150.

That 1.2125 support I mentioned the other day has provided amazingly robust support…….

Great Spot For A EUR/CHF Long

I’ve been long EUR/CHF since the peg was rolled out and I’m thinking about adding here. The SNB’s Danthine warned earlier today that the SNB is prepared to act. The Swiss may have also used the G20 smooth over any problems caused by the intervention.

An inflection point on the chart rests just 20 pips below spot at 1.2116. The SNB may take action soon after this level is broken. If not, look to exit on a bounce back to 1.2137 for a miniscule loss and put a stop at 1.2090.

The downside is 47 pips, the upside is 300+.

SNB’s Danthine: Not Affected By Worries About Losses On Intervention

It’s a damn good thing too. They’ve lost billions and stand to lose billions more if the wheels fall off Europe.

EUR/CHF: Rumour Of ‘Something’ At 1.2125

Unfortunately I don’t know any more than that, but if we hang around these levels for a few sessions, I’m sure we’ll find out if and what. Low so far 1.2126.

I’ve Read In A Few Places This Morning…..

1.2125 is fairly important support for EUR/CHF.

I have absolutely no confirmation of this, but this leads me to deduce that they’ll be sell stops parked very close below said level. I sound a bit like Sherlock Holmes, don’t I?

Don’t say you haven’t been warned. We sit presently at 1.2160.

Techs/Orders

EUR/USD- Bids 1.3650/60, sell stops on a break of 1.3650. Nearby tech resistance towards 1.3730. Real money the recent sellers.

GBP/USD- Bids 1.5890/00. Tech Resistance up at 1.6000 and 1.6020/30

EUR/GBP- Small stops up through 0.8615, Resistance 0.8625/30. Support 0.8550, stronger down at 0.8530/35

AUD/USD- Offers 1.0370/75. Bids 1.0280. tech support below at 55 and 50 day MA’s at 1.0259 and 1.0240

EUR/CHF- Tech resistance 1.2240, tech support 1.2140. Option strikes today at 1.2100 and 1.2200

USD/JPY- Tech res 78.20, offers 78.50, 78.65/70 and layered up to 79.00. Tech support 77.82 (100 day MA) , Bids 77.65/70. Large 78.00 option strike today

EUR/CHF Back Up Towards 1.2200

Some talk doing the rounds earlier that the SNB was possibly in the market, but this doesn’t appear to be the case.

There was some aggressive sovereign buying in USD/CHF earlier from around the 0.8825 level which looks to have caught a few traders on the hop and led a spike to 0.8906.

EUR/CHF has some option strikes today at 1.2100 and 1.2200 . Tech resistance is noted towards 1.2240 with some support down at this week’s lows around 1.2140.

I Have To Say One Thing Is Striking Me At The Moment….

Ain’t EUR/CHF holding up terribly well given the marked risk off backdrop.

Up at 1.2175 from around 1.2145 when I sat down.

Tags: Switzerland Consumer Price Index,Switzerland KOF Economic Barometer,UBS