SNB Spotted In The Cross Today…

Traders say the SNB was seen on the bid in lumpy size on the quick slide toward 1.2120 shortly after the open of US equity cash markets at 13:30. We’ve quickly bounced to 1.2170.

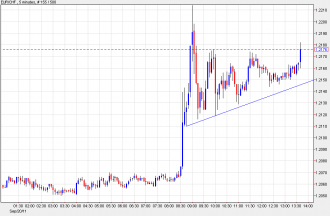

EUR/CHF: Consolidation Expected Between 1.2000/1.2350

The SNB are still expected to support 1.2000 but interbank reports suggest that short-term leveraged players are long, hoping for further SNB action. If this does not eventuate soon, we may see a gradual drift down towards the big pivotal level. Recent daily highs at 1.2350, which is also where the 100-day MA is, should provide solid resistance (barring another SNB black swan event).

Swiss KOF Institute See Growth At 2.3 % In 2011

Sees growth of 1.5% in 2012 and 2.5% in 2013

EUR/CHF steady around 1.2200 with USD around 0.9030

ForexLive Asian Market Open: Smelling More And More Like 2008

AUD and NZD get thrashed and the USD and JPY are much sought after; exactly the same as back in 2008 although the market should be much better prepared this time. Risk-aversion Friday in Asia so this particular trend isn’t likely to undergo a major change but after the AUD/USD fell by over 6% already this week, I’m not expecting any more major collapses. Still lots of rumours flying around in EUR/CHF, and being long looks like a safer bet although we should expect ongoing high volatility levels.

Good luck today and TGIF.

EUR/CHF Can’t Hold Gains

The market has been eager to sell EUR/CHF around 1.23. So far buyers have come in below 1.22.

I’m long but this (strange-looking) chart looks like it wants to go lower.

EUR/CHF Heading Up Towards The 200 Day MA

Been pretty relentless stuff this morning with the EUR/CHF up almost 150 points to 1.2339.

We could get another leg higher up towards 1.2470 if the market can break up and close above the 200 day MA currently around 1.2360…

I Keep Looking At……

Stocks and oil cratering and then I look at EUR/CHF sitting proudly above 1.2200.

And I think to myself; is this telling me something?

EUR/CHF Seeing Choppy Trade

As speculation grows, in some quarters, that the Swiss National Bank may be about to hike the EUR/CHF peg to 1.2500.

We’re up at 1.2240 from a North American close Tuesday down around 1.2155, having been as high as 1.2295 so far.

At 08:00 GMT we’ve the SNB monthly bulletins. Guess some feel we might get an announcement then. Buggered if I know.

EUR/CHF Back To US Highs

EUR/CHF Spike Reaches 1.2215 Before Stall

Color me skeptical of talk of raising the CHF peg. To my mind, raising the peg does nothing but make it more profitable for speculators to test the resolve of the SNB…

If the shite hits the fan in Europe (default, withholding of any aid tranche to any indebted country, discovery of more hidden debts, etc…), the market will buy CHF like there is no tomorrow to force the SNB to capitulate just like the BOE did in 1992. Yes, I realize that the SNB is selling, not buying its own currency, but they have a breaking point. Mr. Market just has to find it…

We’re back down to 1.2125.

Not Sure If This Is Good News Or Bad News…

Fitch: Greece to default but stay in Euro zone... All kidding aside, this is what the market expects…

EUR/USD is well off earlier highs on the talk of a ratcheting up of the Swiss peg. The move coincided with large EUR/CHF buying from a bank with a big P&L hole to fill, so take it with a large grain of salt.

EUR/USD now at 1.3716, EUR/CHF at 1.2145.

Bloomberg reports that the SNB declines comment on CHF movement.

Rumor Doing The Rounds SNB To Hike The Peg Again

Talk of 1.25.

Also making the rounds is talk that the US is set to announce a major trade enforcement action against China.

Stops above 1.3730 have been triggered. We now trade at 1.3720.

What’s Out There ….

Not a massive amount going on or being said in the street regarding orders etc but..

EUR/USD sell stops down through 1.3620, offers above from 1.3720 and up to 1.3750, stops likely above here

GBP/USD support at 1.5680/85 (sovereign bids)

USD/JPY offers 76. 95/00 and 77.10/15, stops 77.40/45. Bids 76.65/70 and 76.50/55, stops under 76.50

EUR/JPY support 104.55 and 103.90, resistance 105.70 and 106.50

AUD/USD bids 1.0200/15, 1.0180. Sell stops down through 1.0170. Offers 1.0265/75 1.0290/00

EUR/CHF bids 1.2050 and 1.2030, offers 1.2090/00

A Trillion Here, A Trillion There

… and soon we’re talking about some real money. That joke never gets old. I’m just reading some research estimating that the SNB will need to spend $500 billion to $1 trillion in order to keep the CHF at 1.20 if the Eurozone crisis continues. You have to question the wisdom of pegging your currency to a something that may be in the early stages of collapse. A peg to the dollar would have made much more sense.

EUR/CHF Chart Tells The Story

Ten handles in EUR/CHF cleared the August highs but at the moment it looks like the market wants to poke around the 1.20 line in the sand. It should be fun over the next few days. The July high was 1.2345.

Dips Buyers Quick To Snap Up A Golden Opportunity

The sharp fall on the back of the Swiss move didn’t take long to attrract dip buying with the Gold quickly recovering towards $1900 after a rapid reversal down to $1859 from early record highs.

Looks like some resistance building around $1900 now in the short term.

Trader’s now looking to see the sustainability of the SNB’s actions

Gold is around $1895

Well…….

Let the SNB’s defence of 1.2000 on EUR/CHF begin……..

Some Scuttlebutt In EUR/CHF

This was doing the rounds yesterday. Talk of decent interest to buy short-dated 1.1400 calls (said to be for wednesday)

The cross continues to rally, the market covering shorts ahead of tomorrow and possible action by the SNB. We’re up at 1.1250 having been as high as 1.1276.

Nikkei Opens -1.1%, Kospi -1.8%

No panic selling so far so we may see an unwinding of some risk aversion plays like EUR/CHF if this steady start is maintained.

Gold is steady at $1903/oz

Euro Bounce Into The London Close..

Not hearing any reason for this, but can only assume some short covering, as no positive news out of the Eurozone or any recovery in equities. EUR/USD back up above 1.4100 around 1.4110

EUR/CHF has staged a strong recovery from 1.1016 to 1.1148, but is now slipping back again to around 1.1080

Political Support Has EUR Bears Feeling A Little More Insecure

One of the comments this morning was complaining how everyone was getting so bearish on the EUR, speculating against it and driving it lower, thus perhaps exacerbating or compounding the EZ problems.

This is an unfortunate side of the FX market, we do tend to all gang up against one currency and our only reason for doing so is to try and make some money. It certainly doesn’t sound like a particularly noble calling when put like that, but the financial markets are a necessary and vital part of the entire global economy and we vultures are part of the eco-system.

That said, vultures do also get caught in traps and the strong statements overnight from Merkel and Sarkozy as well as strong support from the US and China, will have some bears getting worried. The hedge fund and CTA community have been piling into this bear EUR story and of course they’ll talk it down as much as they can. But if everyone’s short already and the bad news stops, then there will inevitably be short-covering rallies.

EUR/CHF Drifting Toward 1.20

One of the first things I check on my Blackberry every morning is EUR/CHF. It is in the danger zone at 1.2033 — the lowest since the day the peg was announced. Nothing in the newsflow today to suggest a run at 1.2000 but it’s early. S&P futures 10.6 above fair value. US retail sales at the bottom of the hour. Core and headline both expected up 0.2%.

Default Chat Escalating In Pro-Trader Community

The noise is getting deafening now with talk that preparations are being made for a Greek default, possibly as early as this week. The noise says that Portugal will follow shortly thereafter and that Ireland may also follow. This would cause a European banking crisis.

Rumours also that SNB will not defend 1.2000 but will say that the game has now changed so why give hedge funds an elevated entry level.

Rumours only but they are getting louder (apologies for butting in Gerry, my positions are getting toasted)

SNB: “We Will Be Testing Their Resolve”

That’s what a NY based hedge fund said to me this morning, meaning that we could be in for another 1992/BOE repeat of the big hedge funds and investment banks taking on a central bank. The SNB would do well to take heed.

If you are buying dips to 1.2000 hoping that the SNB can defend that level, then keep stops tight and book profits on relief rallies as this fight might go on for a few months.

EUR/USD Outlook

- EUR/CHF has vital SNB support at 1.2000 and this should support EUR/USD on dips

- EUR/AUD and EUR/GBP have both seen significant short covering in last 24 hours

- The EUR/USD hourly chart seems to be forming an upward sloping channel with parameters roughly at 1.3600/1.3750

I would look to play the edges of this latter range with a mild bullish bias in short-term, given the action in the crosses

Wait Until All The Trend Chasers Are On Board, Then Jump Off

The nature of the funds management industry means that there are a lot of hedge funds and CTAs who don’t necessarily specialise in the FX market, but who try and jump on trades nonetheless as they start to emerge. Many will be jumping on the EUR bear wagon now. The big question is whether we are seeing the beginning of a major trend or is this just the latest in a long line of false breaks. My personal opinion is that the market doesn’t presently have enough momentum to start a big move in either direction and that an almost 10 big figure drop in EUR/USD is recent weeks is probably enough for now.

Hey, That Joe Brown’s Good!!!

Look at EUR/CHF up at 1.2170 bid.

That’s Joe Brown and his pennant thingey did that I reckon. Could have made an easy peasy 50 odd points profit there

EUR/CHF Ticks Higher

Presently at 1.2105 from around 1.2080 when I parked my bum.

Sources report “two large continental banks buying this morning.”

Guess they figure they might as well give it a go, with the SNB intent on drawing a line in the sand at 1.2000.

A little birdy (well actually Joe) advises me there’s a pennant forming on EUR/CHF with a target of 1.30. Wow!!!!

I used to have a Leeds United pennant once. Really cool it was, all silver and gold…….

Ve Half Vays Of Making Sings Constitutional…

No one breathing easier today than the SNB that the German constitutional court did not rule the bailouts unconstitutional.

EUR/CHF trading very quietly above the 1.20 floor….

How Long Can The SNB Hold Back The Tide?

Once the shock of the SNB move to peg the franc at 1.20 or weaker against the EUR wears off, the burden of maintaining that peg will likely prove insurmountable for the SNB. Over the last 18 months, the SNB has lost approximately CHF 30 bln on its previous interventions at much, much higher levels in EUR/CHF.

Given the disarray in the euro zone, the tacit disapproval of the ECB to the SNB’s unilateral action, that lumpy 1.20 bid from the SNB may prove irresistible.

Just think about it: the SNB may have to buy billions of euros as soon as Wednesday if the German constitutional court scuppers the EU bailouts.

The peg will survive tomorrow, of that you can be sure. But can it stand the test of time? I suspect not.

Should we get several weeks of successful defense of 1.20, options volatility should plunge.

Low volatility means cheap options.

The way to be play may be to buy a deep out-of the-money EUR put/CHF call once markets settle down and await the inevitable failure of the Swiss to weaken their currency in a sustained way. Markets have blown currency pegs to kingdom come many times before (see GBP forced from the ERM in 1992 and the Thai Baht devaluation in 1997 as spectacular examples).

Switzerland will not run out of reserves like the BOE and the Thai central bank nearly did but they will run out of nerve once they acquire hundreds of billions of euros at a generous rate of 1.20…

EUR/CHF Hammered Again, EUR/USD Barrier At 1.4100 Flushed Out.

Risk aversion building again as stocks continue to slump, with EUR/CHF plunging to 1.1024 in thin market conditions.

Support at 1.1000 looks set to be tested as the EUR/USD barrier at 1.4100 is exhausted and flushed to a low of 1.4092.

Some support seen down at 1.4080 and 1.4055 (Aug 4 lows), but a bounce now possible

EUR/USD Lower On Rumours Of An Italian Sovereign Rating Downgrade..

By Moody’s apparently, but as usual treat with caution and a pinch of salt .The markets are very thin and a classic opportunity to spread a rumour .

Italy is on review which ends apparently in a couple of weeks

The barrier looks to be intact at 1.4100 with a low of 1.4101 and the Euro’s back up around 1.4110.

EUR/CHF slipped to 1.1069 day low on the back of the EUR/USD move.

Swiss Bankers Association Head: Setting Temporary Franc/Euro Target Rate Could Be Possibility In Extraordinary Situation

NY Flow Reports

- Liquidity in the CHF pairs after the NFP has been described as appalling, which is a huge change from the days when EUR/CHF hardly moved and had almost limitless liquidity.

- Many of the bigger players were trying to sell the immediate post-NFP rally in EUR/USD

- Despite the big sell off in risk trades, demand on dips for both AUD/USD and NZD/USD was said to be decent

A Major Swiss Bank Behind That Latest Clump In EUR/CHF

Apparently for a fund hitting both the euro and the dollar. Now we have an explanation, which suggests its all done now, might have to watch the topside, with the likes of real money bods probably going to lead the way.

Deep pockets need though and not for the faint hearted…

Lows on the last run down were 1.1060 and 0.7760 i’m told.

EUR/CHF Shredded Again.

Dunno who by as my sources seem to have all taken Trappists vows this morning.

We’re at the lows on the day around 1.1077 and its just filled the gap left on that weekend of the 12-15 August, so the close tonight could be interesting for the next direction

P.S.Support is now seen around 1.1023 which equates to a 50% retracement of the 1.0075-1.1971 move

Spain August Jobless Rises 1.25% M/M

By 51,185 people, hits 4.13 mln – Labour Ministry.

Oh dear ![]()

EUR/USD extends early sell-off, presently at 1.4227.

Elsewhere swissy seeing accelerated gains, EUR/CHF down at 1.1195 from early 1.1310. The currency seems to have got its’ mojo back against the backdrop of accelerated risk aversion, and with the market seemingly convinced the swiss authorities have little in the locker to stymie the process.

Well, As I Didn’t Get Round To Telling Ya…..

There were sell stops through 1.1500 in EUR/CHF, best I tell ya there are apparently sell stops through .7950 in USD/CHF.

We’re at .7978 having been as low as .7962.

Tags: Banking Crisis,Constitutional Court,Fair Value,Gold,Jackson Hole,Monthly Bulletin,Swiss National Bank,Switzerland,Switzerland KOF Economic Barometer