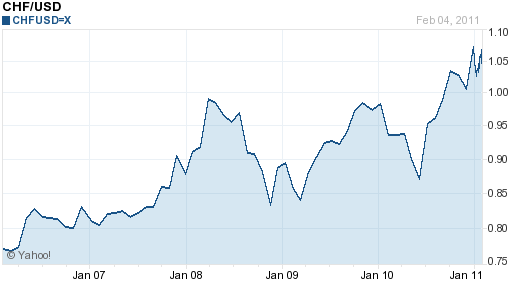

The second half of 2010 witnessed a 20% rise in the Swiss Franc (against the US Dollar), which experienced an upswing more closely associated with equities than with currencies. It has managed to entrench itself well above parity with the Dollar, and has become a favored destination for investors looking for a safer alternative to the Euro. Still, there are reasons to wary, and it could be only a matter of time before the CHF bull market comes to a screeching halt.The forces behind the Franc’s rise are easily identifiable. It basically comes down to risk aversion. While it can’t compete with the Dollar and Yen – its main safe haven rivals – in size and liquidity, it benefits from its perceived economic and fiscal stability, as well as through contradistinction with the surrounding Eurozone. In fact, the Franc’s rise against the Euro has been even steeper than its rise against the Dollar. As the Eurozone crisis radiates further away from Greece, Switzerland has come to seem more like an island in a sea of chaos.Even an abatement in the EU storm has failed to produce a Swiss Franc correction. That could be because the bad news coming out of Europe seems to be never-ending; one country’s rescue is followed by the downgrade of another country’s sovereign credit rating and warning of imminent collapse. In addition, even as investors have embraced risk-taking, they still remain prone to sudden backtracking. Thus, the Franc has been one of the primary targets of risk-averse capital fleeing the Egyptian political turmoil.

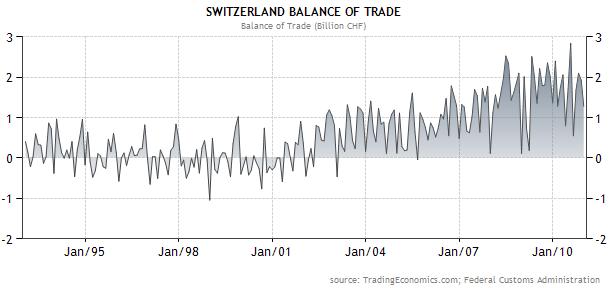

Capital controls and intervention have scared investors away from some currencies, but the Swiss National Bank (SNB) lacks the credibility afforded to other Central Banks. The SNB lost $25 Billion in 2010 in a vain effort to hold down the Franc, and currency investors believe that it has neither the stomach nor the mandate to engage in a similar loss-making campaign in 2011. Besides, the Swiss economy has held up remarkably well, and the trade surplus has actually widened in the face of currency appreciation. The markets might be keen to test the limits of the Swiss export sector, in much the same way that they have challenged Japan by pushing up the Yen.

Still, their are limits to high the Franc can rise, and it appears that I’m no longer the only analyst who thinks it’s undervalued. Don’t forget- the Swiss economy is comparatively minuscule. Its capital markets can absorb only a small fraction of the inflows that the US and Japan can handle, and the Swiss Franc represents a mere 3.5% of all foreign exchange volume, 12 times less than the US Dollar’s share. In other words, it’s only a matter of time before investors run out of Swiss assets to buy, at which point they will have to decide whether to accept short-term returns of 0% in exchange for capital preservation and financial security. My bet is that they’ll walk.

Of course in the short-term, it’s possible that a handful of risk-averse investors will continue to steer capital towards Switzerland, and/or that another mini political or economic crisis will trigger a spike in risk-aversion. When investors once again look at fundamentals, they will be forced to reckon with the Franc’s 40% appreciation over the last five years, and probably conclude that perhaps it was a bit much…

Posted thanks to Forexblog.org.

Tags: Capital Controls,Japanese yen,Swiss National Bank,Switzerland