Extracts from the history of the Swiss franc (June 2009)

Back on March 12, the Swiss National Bank issued a stern promise that it would actively seek to hold down the value of the Swiss Franc (CHF) as a means of forestalling deflation. The currency immediately plummeted 5%, as traders made a quick determination that the SNB threats were made in earnest. Over the months that followed, however, investors became complacent and the Franc slowly crept back up.

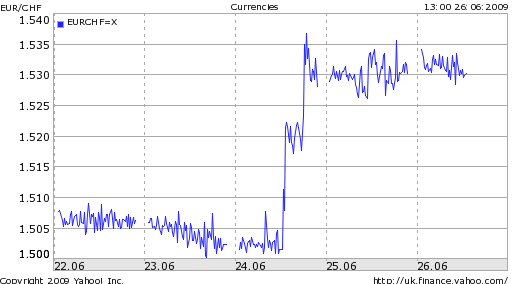

That was until this week, when the SNB sprung into action, buying Euros on the open market. “The franc slid as much as 2.4 percent versus the euro and 3.3 percent against the dollar, the biggest declines since…March 12.” It’s not clear why the SNB suddenly intervened after months of inaction. The Central Bank didn’t hold a press conference to “celebrate” its intervention, and the only indication was a vague declaration last week that “policy makers will act to curb any ‘irrational appreciation’ of the franc.”

Analysts have speculated that the SNB is (arbitrarily) targeting the exchange rate of $1.50 Francs/Euro, which is plausible given that the intervention occurred very close to that level: “They’re trying to put a line in the sand at 1.50. There’s a big debate as to whether they will continue doing this, and for how long they will remain successful.” After all, the idea of intervention is more effective than intervention itself. The SNB can only buying so many Euros; the real value is in the threat to continue buying, which keeps investors from building up speculative positions.

While the SNB has been criticized as “protectionist” for its actions, its premise for intervention is well-grounded. According to the OECD, “Switzerland should keep interest rates close to zero well into 2010 and mull more fiscal stimulus to fight a deep recession and the risk of deflation.” Modest deflation has already set in, facilitated by a collapse in aggregate demand. Varying forecasts are calling for an economic contraction in 2009 equal to -2.5%-3%, and even a modest contraction to follow in 2010. Q1 GDP growth was negative and the consensus is that Q2 will prove to have been more of the same. If this trend continues, 2009 will be the worst year economically in over 30 years. Still, economic indicators suggest the bottom is soon approaching, and the overall picture is consistent with the rest of Europe.

The real concern is that other Central Banks will imitate the Swiss approach. “In the past couple of weeks we have had five or six central banks, including the Bank of Canada and the Bank of England, talking down their currencies. Like Switzerland, they are fearful that currency appreciation could offset the stimulus to the economy,” noted one analyst. Monetary and economic conditions remain abysmal worldwide, and most banks have already exhausted the tools available to them. Interest rates are universally close to zero; fiscal “stimuli” will push the OECD debt/GDP ratio past 100% in 2009; quantitative easing has given rise to wholesale money printing. Currency devaluation may be the only option left.

Posted thanks to Forexblog.org.

Tags: Bank of Canada,Currency Wars,fiscal stimulus,franc,intervention,money printing,Swiss National Bank,Switzerland