I gave a 45-minute presentation on Yield Purchasing Power at American Institute for Economic Research in Great Barrington, MA on October 14, 2016. I am grateful to the Institute for recording video of my presentation plus extended Q&A.

Read More »

Category Archive: 6b.) YPP interest rate

Another Serious Real Interest Rate Fallacy

Modern monetary economics is a siren song, especially alluring in a world of falling, zero, and negative interest rates. I urge you not to dash your wealth against the rocks.

Read More »

Read More »

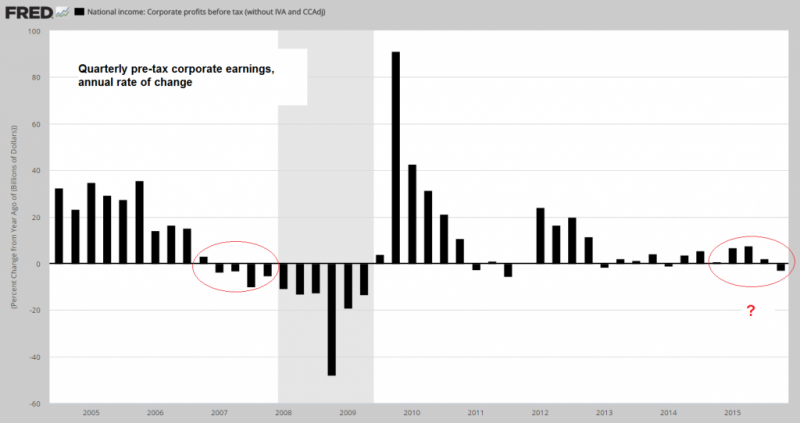

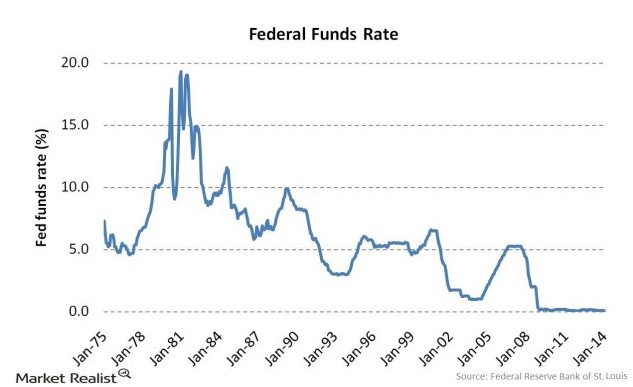

Why Janet Yellen Can Never Normalize Interest Rates

Bill Bonner explains why the Fed will normalize interest rates.

With higher rates, Yellen risks corporate profits and bond defaults.

With higher rates, Yellen risks not only bond defaults, but also bank defaults.

Read More »

Read More »

The Bull Market in Stocks May Be Done

The great stock bull market is, perhaps, done. To most people, a bull market is good, and its end is bad. After all, a rising market signifies a healthy economy. Investors are making money. Share prices are connected to business productivity, aren’t they?

Read More »

Read More »

Open Letter to the Banks

On Friday, I attended a digital money summit at the Consumer Electronics Show. I am writing to you to warn you about the disruption that is about to occur in banking. There are many startups (and larger companies too) that are gunning for you. Perhaps you have watched what Uber has done to the taxi business? Well, these guys are planning the same thing for the banking business.

Read More »

Read More »

Falling Interest Causes Falling Profits

Most people assume that prices move as a result of changes in the money supply. Instead, let’s look at the effect of falling interest. To start, consider a hamburger restaurant. Suppose that the average profit in the burger business is ten percent of invested capital. If MacDowell’s is thinking about expanding, it has to consider the interest rate. Why?

Read More »

Read More »

How Do People Destroy Capital?

The flip side of falling interest rates is the rising price of bonds. Bonds are in an endless, ferocious bull market. Why do I call it ferocious? Perhaps voracious is a better word, as it is gobbling up capital like the Cookie Monster jamming tollhouses into his maw. There are several mechanisms by which this occurs.

Read More »

Read More »

Move Over Entrepreneurs, Make Way for Speculation!

The development of lending was a revolutionary breakthrough. Lending allowed the retiree to do business with the entrepreneur. The retiree has wealth, but no income. The entrepreneur is the opposite, with income but not wealth. The retiree lets the entrepreneur use his wealth, in exchange for an income. The entrepreneur is happy to pay interest, in order to grow his business and increase profits.

At times throughout the centuries, governments...

Read More »

Read More »

Who the Heck Consumes Capital?!

I have been writing about consumption of capital, using the example of a farmer who sells off his farm to buy groceries. It’s a striking story, because people don’t normally act like this. Of course, there are self-destructive people in every society, but, not many. Most people know not to spend themselves into poverty.

To make people hurt themselves, we need to add the essential element: a perverse incentive. Consider a parlor game called...

Read More »

Read More »

The Economy is in Liquidation Mode

If you’re an American over a certain age, you remember roller skating rinks (I have no idea if it caught on in other countries). This industry boomed in the 1970’s disco era. However, by the mid 1980’s, the fad was fading. Imagine running a rink company at the end of the craze. You know it is not going to survive for long. How do you operate your business?

You milk it.

Read More »

Read More »

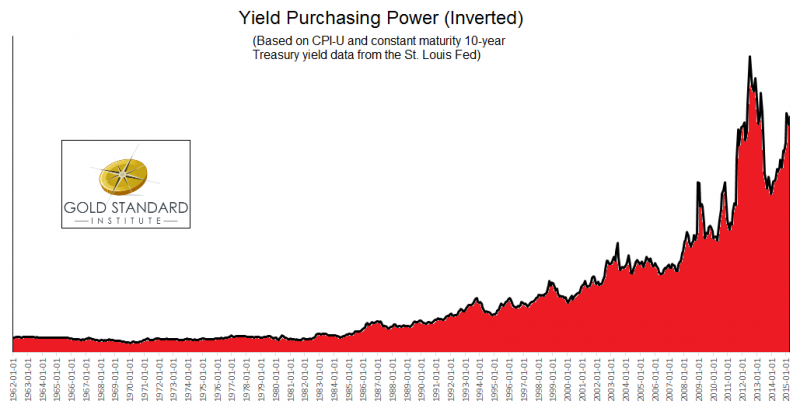

Yield Purchasing Power: $100M Today Matches $100K in 1979

Yield Purchasing Power reveals that with today's zero interest we are living in times of hyperinflation. Larry worked for his savings his whole life. Through the lens of conventional purchasing power defintions, we don’t focus on the liquidation of Larry’s wealth. We ignore—or take it for granted—that he’s trading his life savings for bread. We only ask how many loaves he got.

If you had a farm, would you consider trading it away, to feed your...

Read More »

Read More »

THERE’S Your Hyperinflation!

Hyperinflation is commonly defined as rapidly rising prices which get out of control. Let’s restate this in terms of purchasing power. In hyperinflation, the purchasing power of the currency collapses.

Many critics of the central banks have predicted that this end is coming soon. They have been frustrated as prices are clearly not skyrocketing. For example, the price of crude oil was cut almost in half (so far). There’s little to see if one...

Read More »

Read More »

Interest – Inflation = #REF

Economists say real interest = nominal interest - inflation. They paint a false and misleading picture.

Read More »

Read More »

Who Is Worth More: Some Hedge Funds or All our Kindergartens?

"The top 25 hedge fund managers made more than all the kindergarten teachers in the country," declared President Obama in a discussion of poverty at Georgetown University. Calling them “society’s lottery winners,” he proposed to hike their taxes. Predictably, battle lines have been formed between two polarized sides. One side is unhappy with the pay disparity. The other is quick to defend the status quo. Rather than arguing about whether hedge fund...

Read More »

Read More »

Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

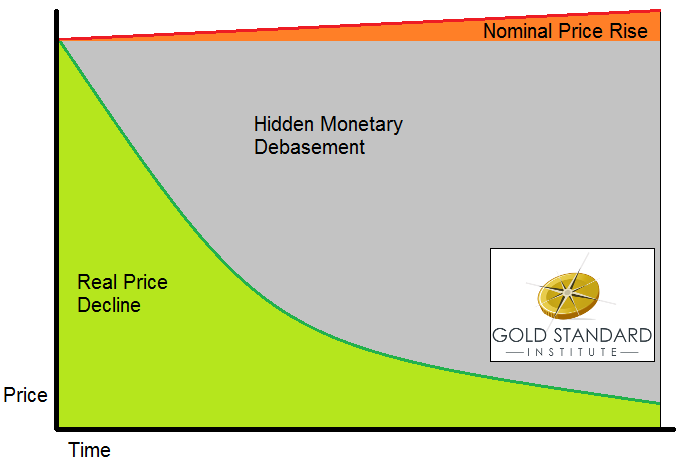

Our paper currency causes falling productivity, though not in terms of bushels per acre. What falls is productivity per dollar or euro of savings. This is the real meaning of the falling interest rate. When the rate was 10 percent, $1,000 of principal produced $100 of return. When it falls to two percent, then the same capital generates a return of only $20. Now with the Swiss 10-year bond, CHF 1,000 earns only CHF 1.3. Keith Weiner argues that one...

Read More »

Read More »

Yield Purchasing Power: Think Different About Purchasing Power

The dollar is always losing value. To measure the decline, people turn to the Consumer Price Index (CPI), or various alternative measures such as Shadow Stats or Billion Prices Project. They measure a basket of goods, and we can see how it changes every year.

However, companies are constantly cutting costs. If we see nominal—i.e. dollar—prices rising, it’s despite this relentless increase in efficiency.

At the same time, the interest rate is...

Read More »

Read More »

What Happens When Credit Is Mispriced?

Keith Weiner explains what happens when credit is mispriced. The rich are privileged because they can profit on the volatility and the bubbles the cheap credit createes.

Read More »

Read More »

Can The Fed Raise Interest Rates?

Keith Weiner argues that the question should be, not when the Fed will raise interest rates, but if. Before our central planners can raise rates, they must deal with a problem of their own making.

Read More »

Read More »