An oft cited reason given for the need for the state is that it is the only means through which the poor can access sufficient welfare to relieve them from the harsh realities that can accompany their circumstances. Yet despite the promises made over many decades and the huge sums spent on state welfare programs, it is hardly clear that the needs of the poor have been sufficiently met, especially given the constant outcry for more resources and better programs. If it can be shown that in the absence of a state, purely voluntary or libertarian welfare options are just as good if not better in dealing with the problem of poverty, then this staple reason for people to assume the necessity of the state can fall away.

We already know that a large portion of the population is generally supportive of welfare. In our current state-dominated societies, large numbers of people show this when they vote for policies that redistribute wealth from some to others via state aggression. Also, in spite of the existence of such state redistribution, people even more convincingly show their belief in the need for welfare when they voluntarily donate their own wealth to the poor via private charity.

Using our current state-dominated societies as a starting point, let us see what we could expect to occur if the state and its redistributionist policies were removed from the scene and only personal freedom, voluntary association and exchange, and private charity were left as means with which to legitimately create and transfer wealth.

First, with the end of all taxation and other forms of wealth confiscation by the state, people would have more resources left at their disposal. It would then be possible for aggregate spending on charity to increase without taking away people’s ability to continue with their other spending habits just as before.

Once the state’s explicit or implicit claims to be the ultimate backstop for the poor are removed, people will likely be more motivated to give to charity as private charitable contributions would be seen as critical for those in need getting anything at all. A higher propensity to give to charity combined with a higher disposable income, due to the absence of taxation as pointed out above, supports the conclusion that the quantum of voluntary charity will be much greater as society transitions away from the state and toward a libertarian alternative.

As with anything that is subsidized by the state, we expect there to be more of it than would otherwise be the case. Therefore, without the state’s subsidies for the poor we should expect to find fewer people reliant on welfare in the first place. Unlike a state’s redistribution policies, private charity is not a guarantee or a right, and to the extent it exists it often comes with terms attached that aspiring recipients may not like, such as demonstrating a change in behavior. From this we can conclude that the level of demand for welfare will most likely be less than what would have been the case if the state’s welfare policies had persisted.

With the state’s various economic interventions being unwound, free-market prices and exchange would be able to predominate. As Ludwig von Mises and many other economists in the Austrian tradition have pointed out, state intervention either stops or alters free-market pricing, leading to islands of economic chaos and resources being unwittingly wasted. With unfettered free-market prices, economic calculation can take place, allowing production to be continuously optimized across the whole economy so as to achieve greater output values. This equates to more wealth being generated throughout society versus what would have been the case had the state continued its interventions. With more wealth there is more chance for the poorest to be less poor and not need as much welfare, and there is more chance for those that are not poor to have greater resources with which to give to the poor.

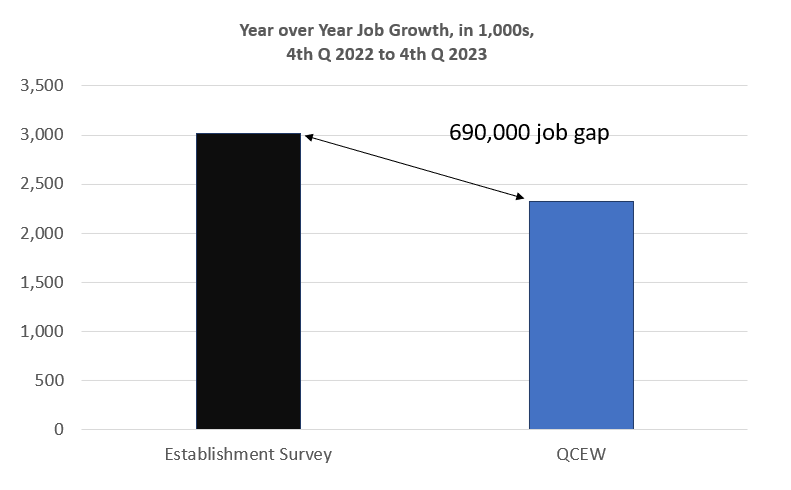

Once state interventions are removed, so too would the various state-imposed labor market rigidities such as minimum wages, mandated terms and conditions, unfair dismissal laws, antidiscrimination laws, and unions backed by state legislation. Without such encroachments on the free transacting of people’s labor there would be no reason to expect that labor markets do not clear in the same way every other market clears: by prices (wages) adjusting until there is no unused capacity or involuntary unemployment among people who can offer labor that is economically valuable to others. The absence of unemployment caused by state-imposed labor market rigidities would result in less demand for welfare. Also, with the output from more employed people being greater than it would otherwise have been, the wealth of society will increase, with a portion of that increase being specifically among that section of the population that would otherwise have been unemployed and claiming welfare.

As the constant threat of state confiscation of wealth (particularly through taxation) is removed, the opportunity cost of deferring consumption for the purposes of saving will decline. A higher incentive to save will likely lead to a greater pool of funds being made available for investment, driving the accumulation of capital goods and further expanding the economy’s productive capacity, enabling greater wealth generation. Also, with a higher saving rate people will accumulate more wealth across their lives and across generations, leaving them in a better position to look after themselves when they fall on hard times and enabling them to support others in their family and their community who need help. This will further reduce the number of people that need welfare versus what would have been the case had state wealth confiscation continued.

Under a state there is typically a category of people who end up as welfare recipients that need not have been had they not had a portion of their wealth confiscated by the state in the first place. This situation often afflicts middle class households in high tax jurisdictions who find themselves reliant on state handouts of one form or another in order to compensate for their loss of spending power due to the high taxation. Needless to say, this category of people would now be left alone and not end up needing welfare to the same extent, thus reducing the total demand for welfare once the state is removed.

While corruption and misallocation of funds can occur in private charity, the voluntary nature of its funding sources means that typically once such abuses are found they are either addressed or the charity’s access to funding rapidly diminishes. A state redistribution system in contrast is funded by the forced confiscation of wealth, so despite abuses it can continue to exist for as long as the state remains in power. Once the state’s redistribution system has been shut down, we could therefore expect the remaining private welfare spending to be more efficient at distributing resources to those in need.

Finally, consideration should be given to the quality of the welfare under redistribution versus private charity. Given that charity comes ultimately at the discretion of individual’s allocations of their own private resources and gets to those in need via decentralized charitable organizations, donors are able to direct their funds to organizations that they perceive to best serve those most in need versus state redistribution spending, which is typically more guided by political considerations and less accountable for substandard outcomes. This makes it more likely that funds directed through private charity are more effective in helping the poor.

The above exploration of the changes we could expect as the state is removed from the scene gives us reasons to expect that more wealth will be generated, some of this increased wealth will end up in the hands of people who otherwise would have been welfare recipients, a greater propensity to give to private charity will exist, a greater incentive to avoid being in need of welfare will exist, welfare via private charity will involve less corruption and misallocation of funds, and welfare via private charity will likely be qualitatively superior to state redistribution as a means for helping the poor.

While we cannot conclude that all people in poverty in a libertarian society will be perfectly taken care of all the time, we note that this is certainly not delivered under our current state-backed redistribution systems. What we can conclude is that whether it is taking care of the young, the old, the sick, the hungry, the homeless, the uneducated, the criminally convicted, those with mental and physical disabilities, those who are unprotected from aggressors be they local or foreign invaders, and anything else that may cause people to be in need, there would be private charitable institutions firmly embedded, effective, and funded in a libertarian society to drive toward ever better outcomes for the poor. The need for welfare should not be seen as a reason to support the existence of the state.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter