The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century?

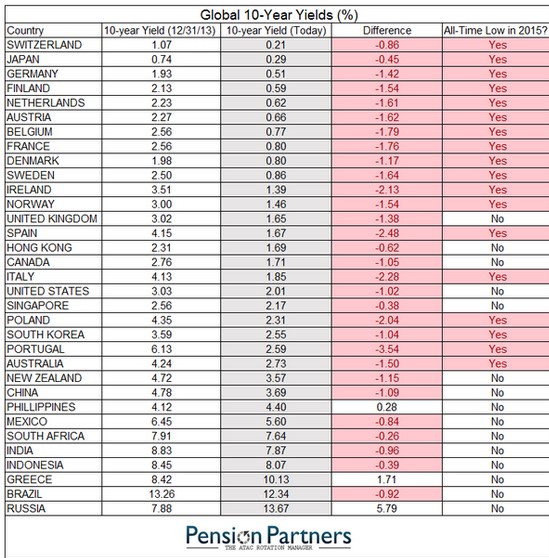

Latest Data

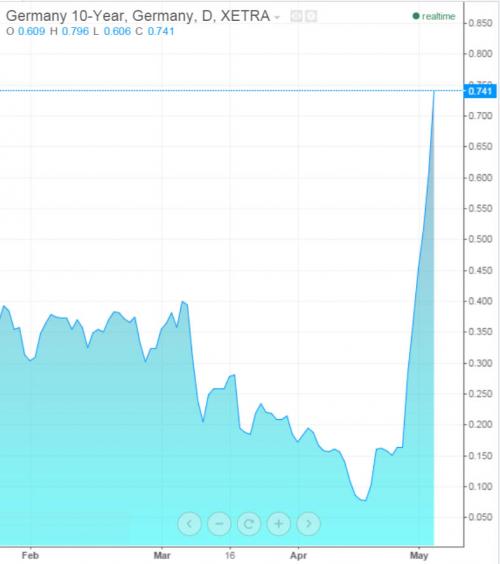

May 2015: A big Bond Sell-Off has started (from JGBs, over German Bunds to US Treasuries).

Via Zerohedge:

Having briefly tested above 3.00% on Thursday, for the first time since December 2nd, 2014, the post-payrolls reaction continues today with 30Y yields up 9bps and back above the 3.00% Maginot Line. We note, additionally, that as Deutsche reports, net short exposure to Treasuries is back at the extremes of its recent range.

Now up 16bps from post-payrolls knee-jerk…

Which spooked stocks…

Update for the year 2014:

bond rates at the end of the year

Update June 28, 2014:

One year later than our previous update: things have not change a lot:

German Bunds 30 yrs. 2.18% (vs. 2.45% in June 2013), UK Gilts 3.4% (vs. 3.4% in June 2013), US Treasuries 3.36% (vs. 3.48%), Japan JGB 1.69% (vs. 1.84%).

On the contrary all wealthy nations are becoming safe-havens: Italy 30 year 3.9% (vs. 5.04% in June 2013), Spain 3.9% (vs. 5.3%)

See on the next page PIMCO starting to sell bonds in August 2013, apparently too early….

Update June 20, 2013:

With the potential “tapering” by the Fed, things start to “normalize” again a bit.

German 30yrs: 2.46%, UK gilts 30 rs: 3.46%, US 30 rs: 3.48%, Japan 1.86%

The Biggest Bubble of Century: Government Bond Yields

Update April 24, 2013: (now with 30 years instead 20 years !!)

German Bunds 30 yrs. 2.19%, UK Gilts 3.04%, US Treasuries 2.90%, Japan JGB 1.60%

20 year bond yields

Update February 23, 2013:

With the exception of Japan, yields of safe-haven countries are up 10-20% (see inflation as one explanation for higher yields) , while Italian ones are stable.

UK gilts 3.04% (despite recent downgrade), German Bunds 2.32%, Japan JGB 1.73% (still no sign of inflation or Japan bears), Switzerland 1.21%, Italy 4.43%

Update December 26, 2012:

UK gilts 2.77%, German Bunds 2.16%, Japan JGB 1.75%, Switzerland 1.00%, Italy 4.41%

Japanese JGB yields rise in line with Swiss ones, in response to potential higher inflation, but no signs of changes of default.

Update December 07, 2012

UK Gilts 2.68%, German Bunds 2.13%, Japan JGB 1.65%, Switzerland 0.87% and even Italy 4.59%.

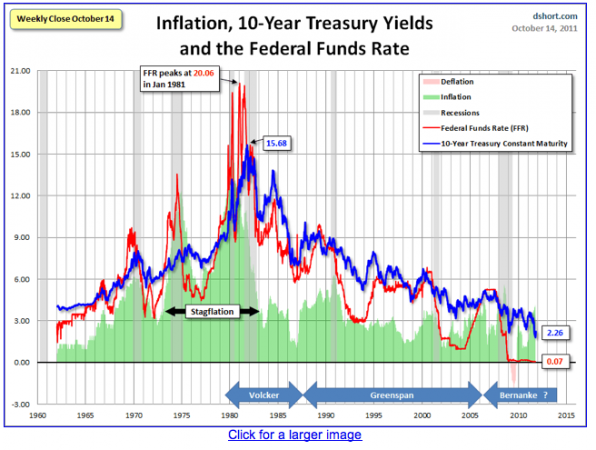

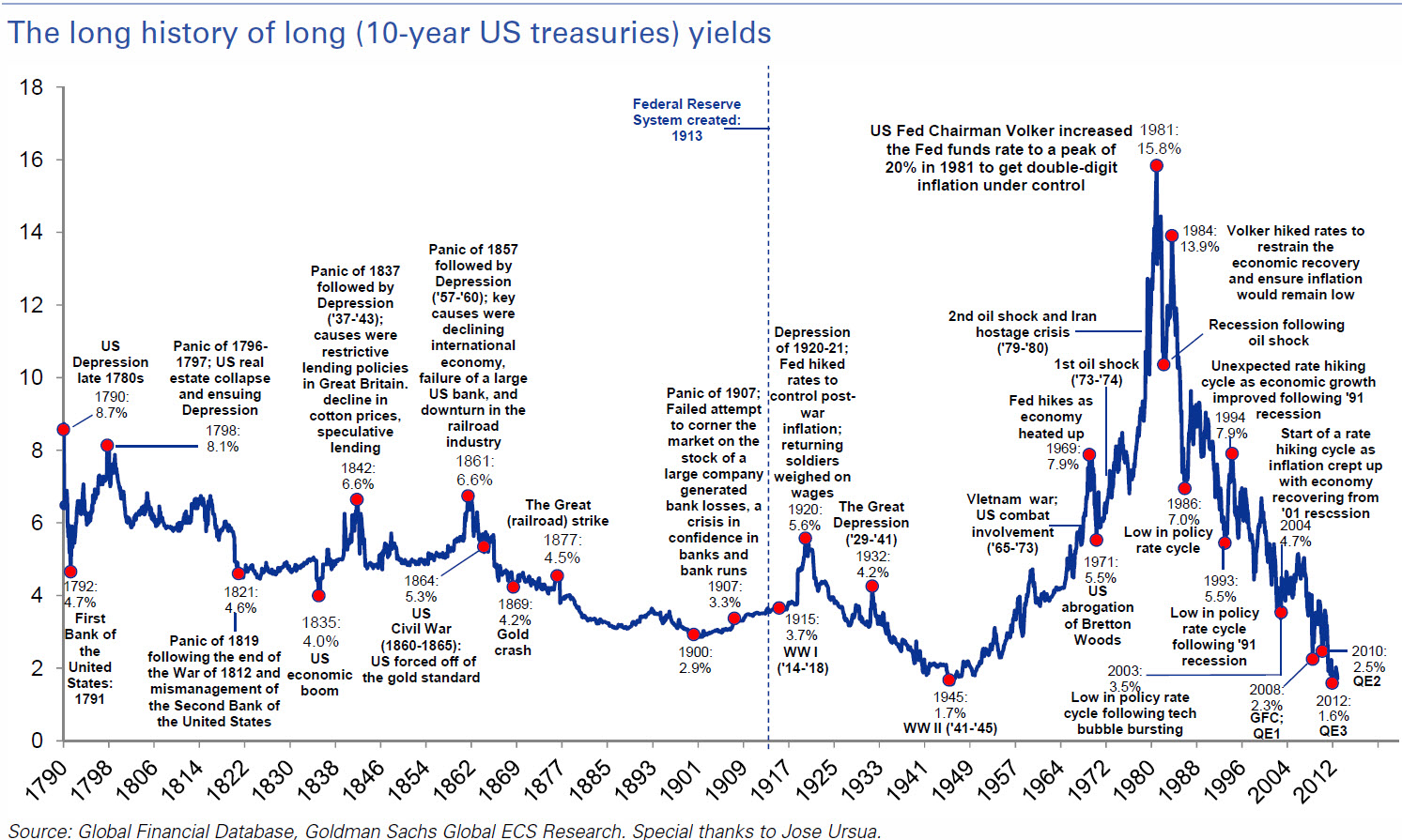

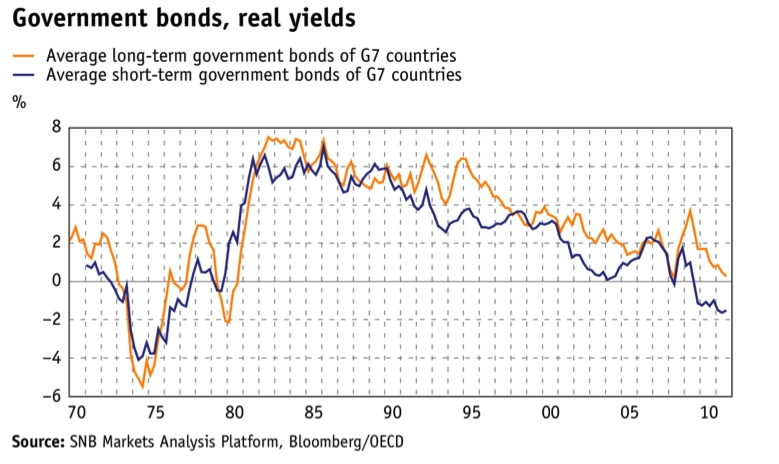

Government bond yields are at record-low levels from an historical perspective.

(click to expand)

How can investors judge today how the global economy is going in 20 years?

There is too much fear around, there is too much money around that goes into unproductive safe-havens like government bonds. See the investor letter of Kyle Bass, CEO of one of the most famous hedge funds, Hayman Capitals.

One day, employees want also a piece of the cake (see PIMCO’s Bill Gross), they will not leave the profits just to the share holders. These employees will not only be Chinese workers, that will start being consumers. They will push up European and American inflation via the back-door of imported goods. Due to aging issues also European and Americans whose wages will rise. Germany is one of the protagonists of this tendency, nominal wages increased by 3% and more in the last two years.

Wage inflation and important sovereign defaults will come, aging and the smaller and smaller gap between established and developing countries will enforce it. It is a just a question of when. History shows that both wage inflation and the simple fear of sovereign defaults can lead to self-fulfilling prophecies.

Aren’t states allowed to default any more?

Spain defaulted on its debt six times in the eighteenth century, and seven times in the nineteenth century. At the time, a default was a lot easier than pressing out higher and higher taxes. Argentina has issues with its default still today

See more for

1 ping

Το κραχ των εθνικών ομολόγων (από Άρης Οικονόμου) | Mikrometoxos.gr

2016-09-17 at 00:02 (UTC 2) Link to this comment

[…] Αυτό δεν σημαίνει βέβαια πως πρέπει κανείς να πανικοβληθεί, θεωρώντας πως το κραχ θα συμβεί άμεσα, αλλά πως η κατάσταση είναι ανησυχητική –ότι έχει δημιουργηθεί μία καινούργια πυριτιδαποθήκη στο χρηματοπιστωτικό σύστημα, χωρίς να μπορεί να προβλεφθεί πότε θα υπάρξει κάποια σπίθα. Η ιστορία πάντως των επιτοκίων των αμερικανικών ομολόγων φαίνεται στο γράφημα που ακολουθεί (πηγή): […]