A paradigm is a mental framework. It has a both a positive pressure and a negative filter. It structures one’s thoughts, orients them in a certain direction, and rules out certain ideas. Paradigms can be very useful, for example the scientific method directs one to begin with facts, explain them in a consistent way, and to ignore peyote dreams from the smoke lodge and claims of mental spoon-bending.

Read More »

Tag Archive: yield purchasing power

Introducing Yield Purchasing Power, the Video

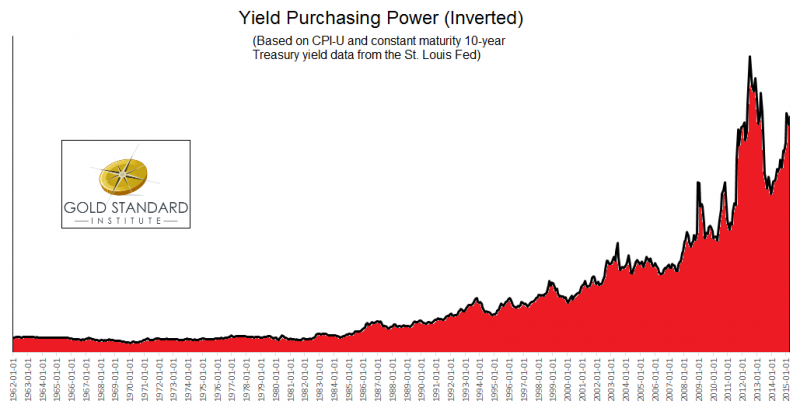

I gave a 45-minute presentation on Yield Purchasing Power at American Institute for Economic Research in Great Barrington, MA on October 14, 2016. I am grateful to the Institute for recording video of my presentation plus extended Q&A.

Read More »

Read More »

How Do People Destroy Capital?

The flip side of falling interest rates is the rising price of bonds. Bonds are in an endless, ferocious bull market. Why do I call it ferocious? Perhaps voracious is a better word, as it is gobbling up capital like the Cookie Monster jamming tollhouses into his maw. There are several mechanisms by which this occurs.

Read More »

Read More »

Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

Our paper currency causes falling productivity, though not in terms of bushels per acre. What falls is productivity per dollar or euro of savings. This is the real meaning of the falling interest rate. When the rate was 10 percent, $1,000 of principal produced $100 of return. When it falls to two percent, then the same capital generates a return of only $20. Now with the Swiss 10-year bond, CHF 1,000 earns only CHF 1.3. Keith Weiner argues that one...

Read More »

Read More »

Yield Purchasing Power: Think Different About Purchasing Power

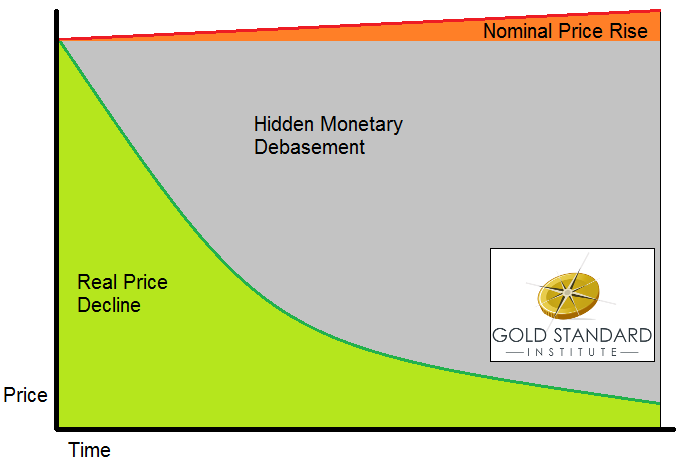

The dollar is always losing value. To measure the decline, people turn to the Consumer Price Index (CPI), or various alternative measures such as Shadow Stats or Billion Prices Project. They measure a basket of goods, and we can see how it changes every year.

However, companies are constantly cutting costs. If we see nominal—i.e. dollar—prices rising, it’s despite this relentless increase in efficiency.

At the same time, the interest rate is...

Read More »

Read More »