Tag Archive: US

FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0.

Read More »

Read More »

FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market's attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa.

Read More »

Read More »

FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing.

Read More »

Read More »

FX Daily, June 19: Still Patient?

Overview: Risk-taking was bolstered by the dramatic shift in Draghi's rhetoric less than two weeks after the ECB meeting and a Trump's tweet announcing that there was going to be an "extended" meeting between him and Xi at the G20 meeting and that the respective staff would begin coordinating. It was later confirmed by the Chinese media.

Read More »

Read More »

FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces--trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies.

Read More »

Read More »

Rare Earths may Provide Leverage

Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading.

Read More »

Read More »

FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China's own willingness to flaunt the international rules are defeating the strategy.

Read More »

Read More »

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession.

Read More »

Read More »

Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market's sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month.

Read More »

Read More »

FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident.

Read More »

Read More »

There at the Beginning

Sometimes it is difficult to gain perspective. That is why it may be difficult to see the forest for the trees. It is as we spend most of our time climbing a mountain: One handhold and foothold at a time. Immediacy and urgency limit our peripheral and forward visions.

Read More »

Read More »

FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive.

Read More »

Read More »

Socialism, Keynesianism, and Fascism

The American political discourse has changed since the 2018 midterm election. Enthusiasm and passion were to be found on the left-wing of the Democratic Party. A new sense of hope and mission replaced the defeatism and cynicism seen in 2016. Some identified with democratic socialism, but in the political rhetoric the broad brush of “socialism” has been used to paint the entire party

Read More »

Read More »

Short Note on Jobs Report

The January employment report was mixed. It is unlikely to have a material impact on expectations for Fed policy. However, it does suggest the downside risks may not materialize. The US economy grew 304k jobs, well above expectation. It is marred by a 70k net downward revision of the past two months, and notably a 90k cut in December's estimate, which brings it to 222k (from 312k).

Read More »

Read More »

Global PMI’s Hang In There And That’s The Bad News

At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

Read More »

Read More »

The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China's rise over the last 40 years has been predicated on Deng Xiaoping's political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States.

Read More »

Read More »

Some Initial Consequences of Trade Tensions

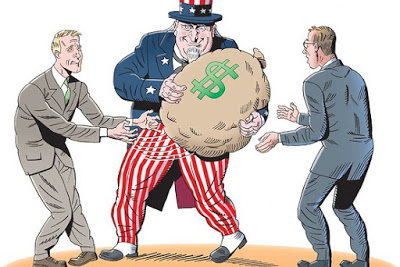

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought.

Read More »

Read More »

Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues.

Read More »

Read More »

FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers.

Read More »

Read More »