Tag Archive: US

How will Yellen Address Fostering a Dynamic Global Economy?

Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues.

Read More »

Read More »

The US and German Relationship

US and German relations may be strained, but this is not unprecedented. It has been fanned by Trump and Merkel's rhetoric. A European sphere of influence seems to have been the force pushing in that direction.

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

Provided Le Pen and Macron or Fillion make to the second round, the market response to the French election results may be short lived. BOJ, Riksbank and ECB meetings. Spending authorization and some announcement from the White House on tax policy are in focus as Trump's 100th day in office approaches.

Read More »

Read More »

Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out.

Read More »

Read More »

Trade Notes: China and Prospects for a New Executive Order

China's trade concessions seem modest, but little discussion of US concessions. Reports suggest Trump is set to sign a new executive order to investigate trade practices in steel, aluminum, and maybe household appliances. Trade imbalances and floating currencies are not mutually exclusive.

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »

China’s NPC Ends with New Initiatives

China will make its mainland bond market more accessible. As China's portfolio of patents grows it will likely become more protective of others' intellectual property rights. PRC President Xi will likely visit US President Trump early next month.

Read More »

Read More »

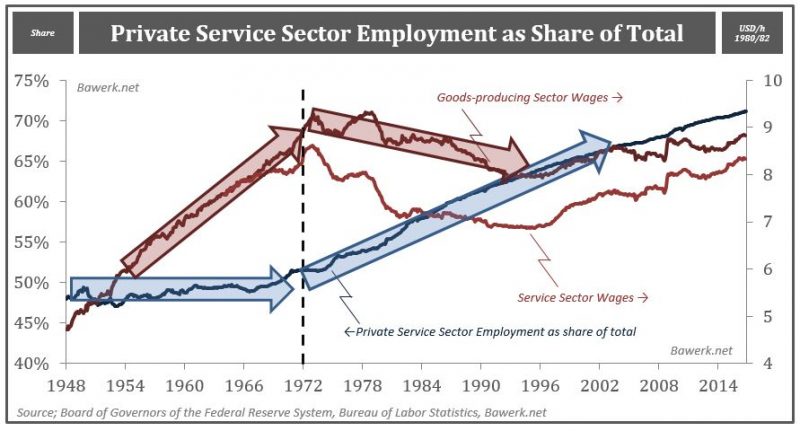

A Few Thoughts about the US Labor Market

The 94 mln people POTUS claims are not working is true but terribly misleading. What happened to agriculture a century ago is happening to manufacturing. New industries are less labor intensive than smokestack industries.

Read More »

Read More »

Great Graphic: US and Japan Five-Year Credit Default Swaps

For the first time since the financial crisis, the 5-year CDS on JGBs is dipping below the 5-year US CDS. It appears to be more a function of a decline in Japan's CDS than a rise in the US CDS. We are reluctant to read too much into the small price changes in the mostly illiquid instruments.

Read More »

Read More »

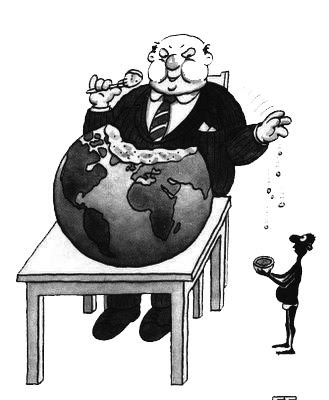

The Future of Globalization

antiglobalizationThe cross-border movement of goods, services, and capital increased markedly for the thirty years up to the Great Financial Crisis. Although the recovery has given way to a new economic expansion in the major economies, global trade and capital flows remain well below pre-crisis levels. It had given rise to a sense globalization is ending.

Read More »

Read More »

FX Weekly Preview: Macro Forces Underpin Dollar, Equities and Yields

Odds of a March Fed hike edged up last week, and Q4 GDP figures were revised higher. Many continue to expect the new US Administration to pursue pro-growth tax reform, deregulation and infrastructure spending. Although many other high income countries are growing, near trend divergence of monetary policy continues.

Read More »

Read More »

FX Outlook 2017: Politics to Eclipse Economics

Investors are familiar with a broad set of macroeconomic variables that often drive asset prices. Many are familiar with corporate balance sheets, price-earning ratios, free cash flow, Q-ratio, and the like.

Read More »

Read More »

Where Do US Companies Hire Abroad?

High-wage economies of Canada, EU, Japan and Australia account for nearly half of US corporate employment abroad. And even in low-wage regions, the high-wage parts tend to draw more US employment. The new US administration may have second thoughts about pivot to Asia, but US companies may not.

Read More »

Read More »

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

Rising Trade Tensions

Obama Administration has taken a hardline against China's trade practices. Other countries are also resisting China's arguments that it is a market economy. Last week, US imposed anti-dumping duties on imported washing machines from China.

Read More »

Read More »

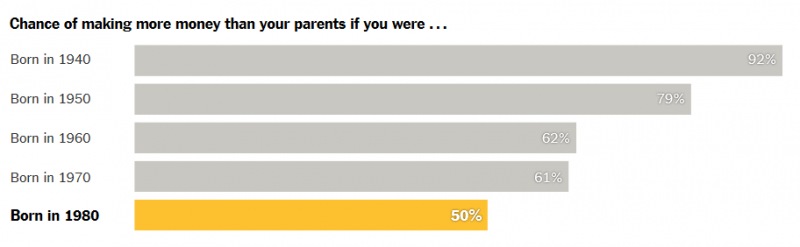

Great Graphic: Another Look at the Reproduction Problem

In order for a society to be sustained social relations have to be reproduced. Yet now neither the middle class nor capital are able to reproduce themselves. This may be the single greatest challenge our society faces.

Read More »

Read More »

Some Thoughts on Q3 US GDP

US Q3 was revised higher mostly due to consumption. Business investment was a drag. Profits rose to snap a five-quarter slide.

Read More »

Read More »

FX Weekly Preview: Shifting Portfolio Preferences Continue to Drive Capital Markets

Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows.

Read More »

Read More »

Toward a New World Order, Part II

One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil.

Read More »

Read More »

Toward a New World Order?

A Brave New World is coming? Perhaps. We had a recent discussion with a group of people in the hopeless business of doing long term forecasting. This made us think about what the world will look like over the next 20 to 40 years. A pretty thankless task, but the bottom line is without a damn good war, Asia will be the way of the future.

Read More »

Read More »