Tag Archive: U.S. Core PCE Price Index (PCE Deflator)

The Core PCE price Index is the less volatile measure of the PCE price index which excludes the more volatile and seasonal food and energy prices. The impact on the currency may go both ways, a rise in inflation may lead to a rise in interest rates and a rise in local currency, on the other hand, during recession, a rise in inflation may lead to a deepened recession and therefore a fall in local currency.

FX Daily, June 26: Investors Wrestle with Notion that More Covid Cases mean More Stimulus

It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull.

Read More »

Read More »

FX Daily, September 27: Markets Limp into the Weekend with the Euro Languishing at New Lows and Sterling under Pressure

Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to snap a five-week advance.

Read More »

Read More »

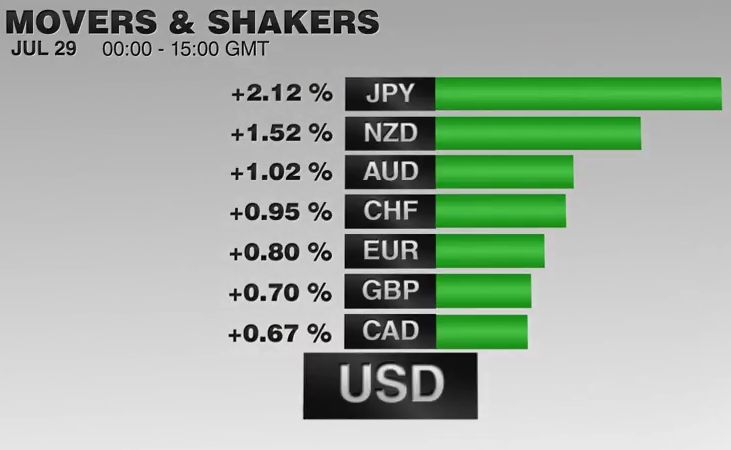

FX Daily, January 29: A Brief Word

The US dollar is modestly firmer, but nothing to suggest a outright correction rather than consolidation. However, have a dramatic drop over the past month, much more than we think is justified by macroeconomic developments and interest rates, we think the dollar may have overshot.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

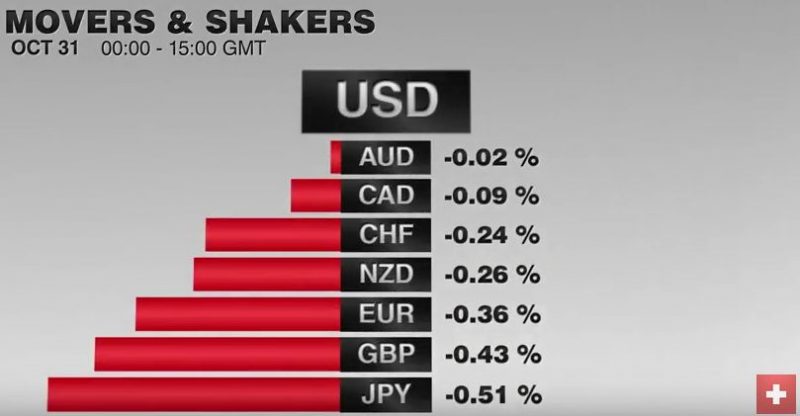

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed's campaign to raise short-term rates was a "conundrum." Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place.

Read More »

Read More »

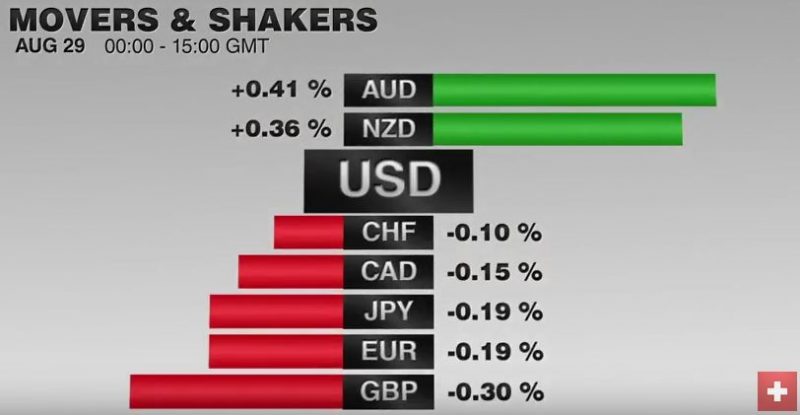

FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed's target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year.

Read More »

Read More »

FX Daily, June 30: Greenback Stabilizes

The US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB's annual conference. It is not really clear that Draghi or Carney gave new policy indications.

Read More »

Read More »

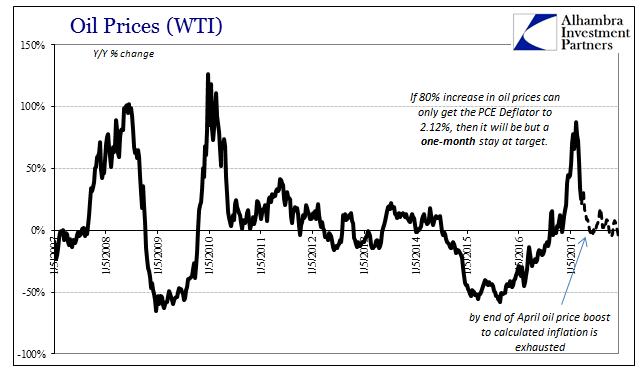

The Power of Oil

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once.

Read More »

Read More »

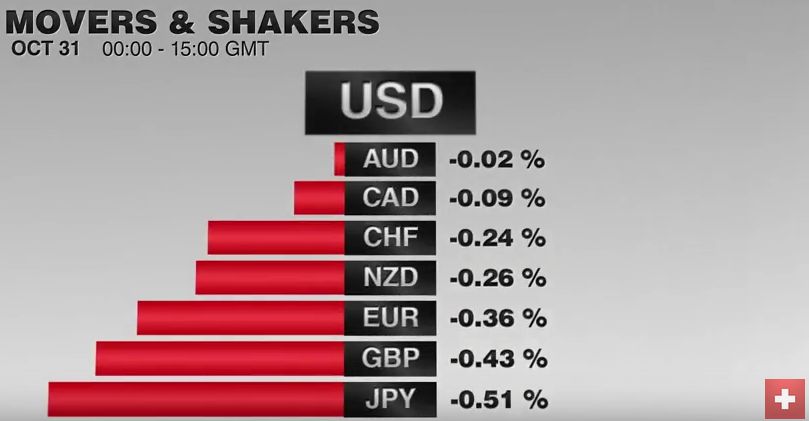

FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

he latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump's fortune in the polls had bottomed prior to the re-opening of the investigation into Clinton's emails and the national polls have narrowed.

Read More »

Read More »

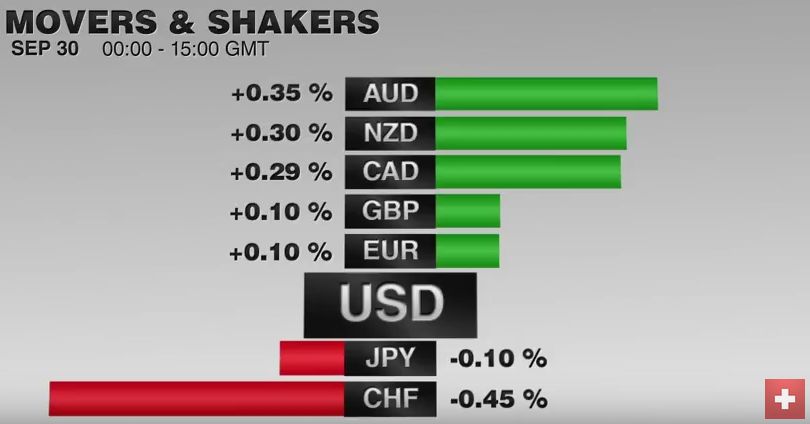

FX Daily, September 30: SNB Intervenes to Polish Q3 Results

True to its recent habit, the US dollar is finishing the week on a firm note. On the month, though, the greenback has fallen against most of the majors, but sterling, the Canadian dollar, and the Swedish krona. Global equities are trading heavily, and investors' angst is lending support to bond markets.

Read More »

Read More »

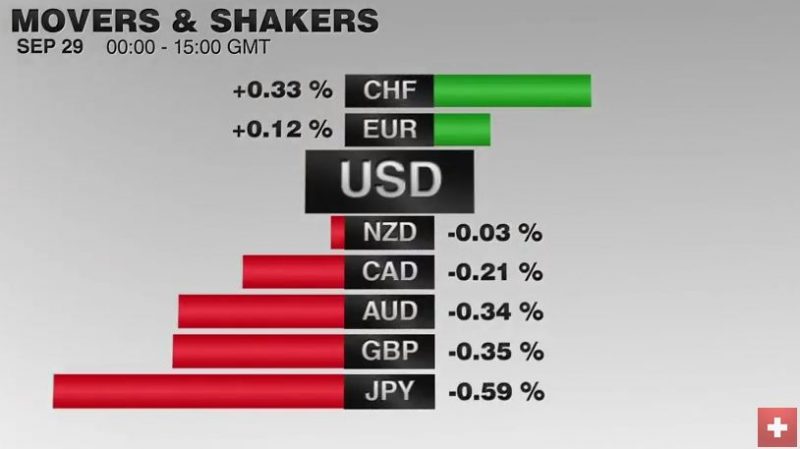

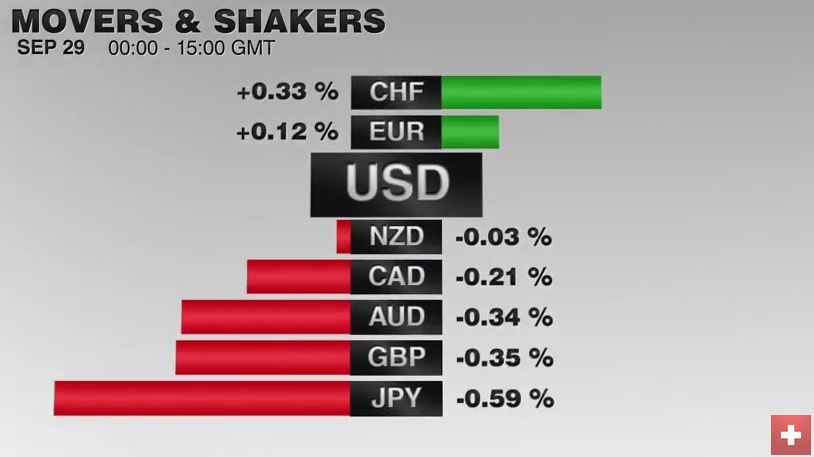

FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen's weakness. While the majors are mostly off marginally and now more than 0.3%, the yen is 0.75% lower. That puts the greenback at a six-day high (~JPY101.75) at its best.

Read More »

Read More »

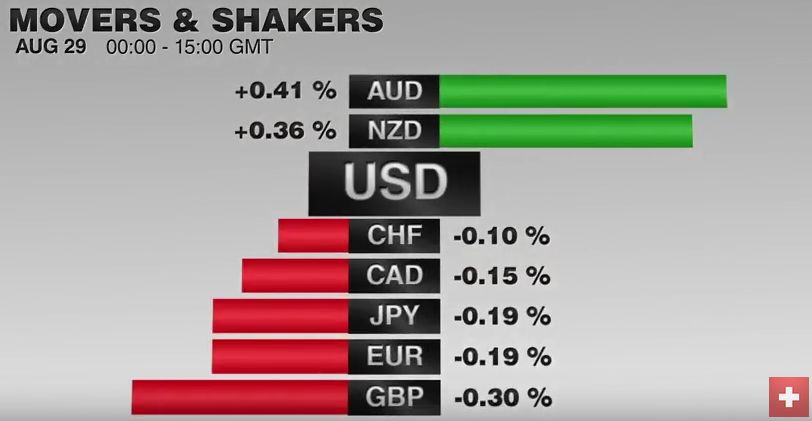

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »

FX Daily, June 29: Fragile Calm Ahead of Quarter-End

Sterling is firmer, but quarter-end considerations seem to be the key driver. Poor Japanese retail sales keep focus on policy response likely next month. New Zealand and Australian dollars are leading today's advance against the US dollar.

Read More »

Read More »