Tag Archive: U.S. Capacity Utilization

"Capacity utilization is the extent to which a nation uses its productive capacity. It is the relationship between industrial production (the actual output) and the potential output which could be produced with it, if capacity was fully used. In 2016, the United States only used of 75% of its capacity, while still in 1967 90% was used."

Broader Slowing in Industrial Production

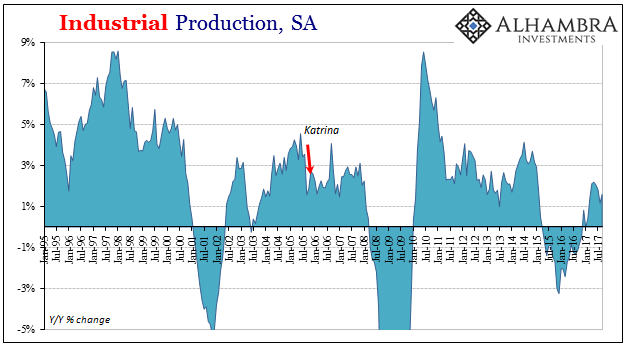

Industrial Production rose 1.6% year-over-year in September 2017. That’s up from 1.2% growth in August, both months perhaps affected to some degree by hurricanes. The lack of growth and momentum, however, clearly predated the storms. The seasonally-adjusted index for IP peaked in April 2017, and has been lower ever since. This pattern, the disappointment this year is one we see replicated nearly everywhere on both sides (supply as well as demand)...

Read More »

Read More »

FX Daily, September 15: Short Note Ahead of the Weekend

Sporadic updates continue as the first of two-week business trip winds down. North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit Guam. However, there was not an immediate response from the US. South Korea said it had simultaneously conducted its own drill which included firing a missile into the Sea of Japan (East Sea).

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »

U.S. Industrial Production: Industrial Drag

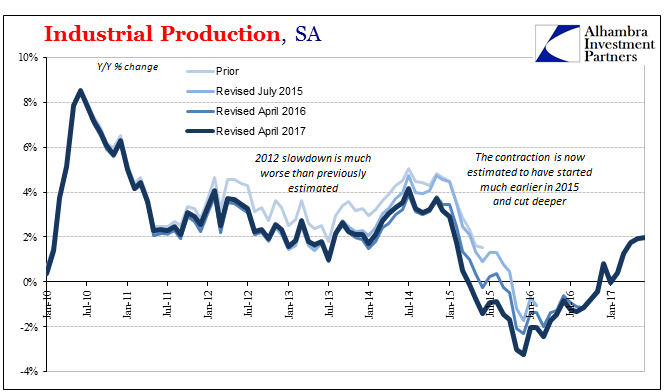

Completing a busy day of US economic data, Industrial Production was, like retail sales and inflation data, highly disappointing. Prior months were revised slightly lower, leaving IP year-over-year up just 2% in June 2017 (estimates for May were initially 2.2%). Revisions included, the annual growth rate has been stuck around 2% now for three months in a row, suggesting like those other accounts a pause or even possible end to the mini-improvement...

Read More »

Read More »

FX Daily, June 15: Dollar Trades Higher in Wake of the FOMC

The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month.

Read More »

Read More »

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

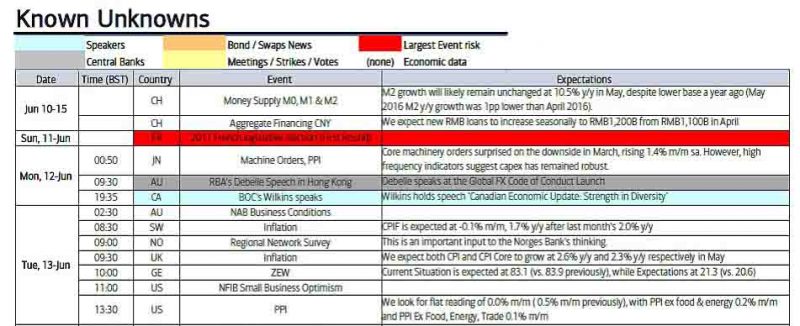

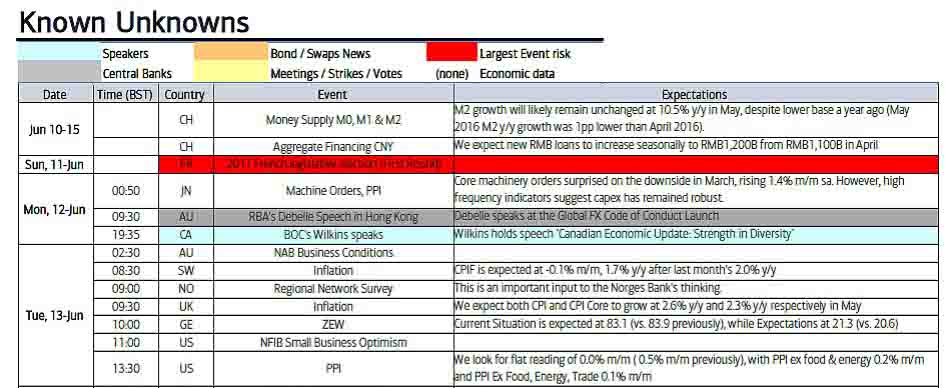

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

FX Daily, March 17: Dollar Remains Heavy

The dollar is softer against most of the major currencies to cap a poor weekly performance. The Dollar Index is posting what may be its biggest weekly loss since last November. The combination of the Federal Reserve not signaling an acceleration of normalization, while the market remains profoundly skeptical of even its current indications, and perceptions that the ECB and BOE can raise earlier than anticipated weighed on the dollar. The PBOC...

Read More »

Read More »

FX Daily Rates, October 17: Dollar Starts Week Narrowly Mixed, while Bonds and Stocks Retreat

The US dollar is consolidating in relatively narrow trading ranges. Participants appear to be waiting for fresh incentives, while the recent rise yields continue and equities have begun the new week on a soft note. Yellen spoke before the weekend, and her explicit willingness to tolerate higher inflation pushed yields higher, while not deterring expectations for a hike in December.

Read More »

Read More »