Tag Archive: Uncategorized

The Pros and Cons of Investing in Gold and Other Precious Metals

Understanding Gold and Precious Metal Investments Exploring the Appeal of Precious Metals Investing in gold and other precious metals has long been regarded to preserve wealth and hedge against economic uncertainties. Discover the potential benefits and drawbacks of including these commodities in your investment strategy. The Role of Precious Metals in Diversification Adding precious metals …

Read More »

Read More »

Understanding Different Types of Investment Vehicles: Stocks, Bonds, and Mutual Funds

Exploring Investment Vehicles: An Overview Navigating the Investment Landscape Investing wisely requires a thorough understanding of various investment vehicles. Delve into the essentials of stocks, bonds, and mutual funds to make informed choices that align with your financial goals. The Role of Investment Vehicles Investment vehicles serve as the channels through which individuals can invest …

Read More »

Read More »

The Pros and Cons of High-Yield Bonds

Understanding High-Yield Bonds: An Overview Defining High-Yield Bonds High-yield bonds, also known as junk bonds, are debt securities issued by companies with lower credit ratings. These bonds offer higher interest rates compared to investment-grade bonds, but they come with their own set of benefits and risks. The Role of High-Yield Bonds High-yield bonds can play …

Read More »

Read More »

How to Avoid Common Bond Investing Mistakes

Navigating the World of Bond Investing: A Comprehensive Guide The Importance of Informed Bond Investing Bond investing can be lucrative, but avoiding mistakes is crucial for maximizing returns and minimizing risks. Learn about the common pitfalls and how to steer clear of them. The Role of Bonds in Investment Portfolios Bonds offer stability and income, …

Read More »

Read More »

How to Buy Commodity ETFs: A Guide for Investors

Understanding Commodity ETFs: What You Need to Know Exploring the World of Commodity ETFs Commodity Exchange-Traded Funds (ETFs) offer investors exposure to a diverse range of commodities, such as precious metals, energy resources, agricultural products, and more. Learn how to navigate this investment option and incorporate it into your portfolio. Benefits of Investing in Commodity …

Read More »

Read More »

The Different Types of Commodity Investments and Their Characteristics

An Introduction to Commodity Investments Understanding Commodity Investments Commodity investments involve putting money into raw materials or primary agricultural products that are typically traded on commodity markets. These investments offer exposure to the fluctuations in commodity prices, making them a unique and potentially rewarding addition to investment portfolios. Why Invest in Commodities? Commodities serve as …

Read More »

Read More »

Martin Armstrong: Empires always fail

Part of the upcoming “World War III” documentary

Martin Armstrong has long been known for his very influential work on global capital flow analysis and cyclical economic trends. The forecasting models he designed have anticipated sovereign debt crises and times of geopolitical instability, with his most widely recognized forecasting framework being the Economic Confidence Model (ECM). He has successfully predicted a number of major events,...

Read More »

Read More »

General Kujat: War, Diplomacy, and the Risks of Escalation

Part of the upcoming “World War III” documentary

Few voices in the European debate on the war in Ukraine can claim to combine actual military experience with sound arguments for diplomatic pragmatism and persistent calls for an end to the conflict. General Harald Kujat stands out even among those precious few. He is a retired four-star general of the German Air Force, he served as Inspector General of the Bundeswehr from 2000 to 2002, the...

Read More »

Read More »

2026 Economic Summit Recap: Where Investing, AI, and Digital Assets Converged

The 2026 Economic Summit brought together forward-thinking investors, advisors, and industry leaders for two days of timely insights, candid conversations, and actionable takeaways on the future of money, markets, and technology. A Strong Start: VIP Pre-Event Mixer The event kicked off on Friday evening, January 16, with an intimate VIP Pre-Event Mixer. Attendees from all …

Read More »

Read More »

Ron Paul: War Is Bipartisan

First Interview in the “World War III” Series Is Now Live

When it comes to opposing war and to raising objections even when it is extremely unpopular and even when one is the only sole voice speaking out against collective madness, there are very few individuals alive today that have repeatedly demonstrated the courage to do so. Even among these select few, arguable no-one has been as consistent, as tireless and as consistently sidelined and...

Read More »

Read More »

World War III: A film that challenges everything we have been told

Over the past decades, and especially in the last few years, war has been radically reframed in the public mind. It’s not raw and brutal bloodshed, senseless destruction and atrocious human pain and suffering. War is no longer seen as an abomination, as the absolute worst case scenario that we must all do our best to avoid. The mainstream media and political leadership of the western world is enthusiastically calling for war, with ominous...

Read More »

Read More »

Inflation as a moral hazard

As I have argued many times in the past, the corruption of money itself and its purposeful devaluation is by far the most important problem facing not just investors and savers, but virtually every single citizen on the face of the planet. Taxation, especially the extremely predatory and aggressive kind that most governments enforce today, might indeed be theft, but inflation is even worse. This is because taxation might be robbery, but at least it...

Read More »

Read More »

Korruption & Machtmissbrauch – Die dunkle Seite der Politik!

In dieser Folge im Modelhof begrüßen wir Claudio Grass – Unternehmer, Edelmetall-Experte und überzeugter Verfechter individueller Freiheit und Selbstverantwortung. Seit Jahrzehnten beschäftigt er sich mit dem Geldsystem, der Geschichte des Goldes und den globalen Machtverhältnissen hinter der Finanzwelt.

Im Gespräch analysieren wir, wie korrumpiertes Geld ganze Gesellschaften verändert, warum Zentralbanken mehr Einfluss haben als viele...

Read More »

Read More »

Year-End Financial Planning Checklist: 7 Steps to Maximize Your Wealth Before December 31

The end of the year tends to sneak up on people. One minute it’s late summer; the next, you’re staring at a calendar and wondering how to wrap up your financial goals before the deadline hits. A thoughtful approach can make a measurable difference in what you keep, what you owe, and how prepared you …

Read More »

Read More »

“Sometimes, the only winning move is not to play”

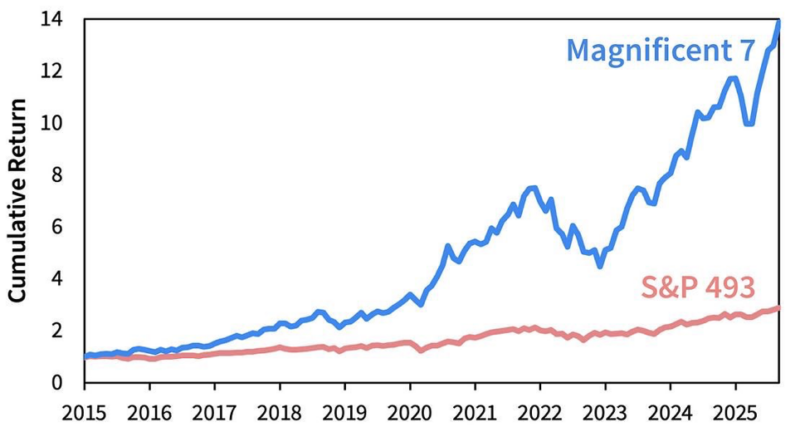

This was the conclusion of the assessment of legendary investor Michael Burry regarding the current market conditions. To be precise, his take as recently posted on X, in full, was “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” The insight behind these words is something that a lot of investors could use at this time. The unrestrained, unjustifiable and unrealistic...

Read More »

Read More »

Gold’s flashing warning: The end is nigh for fiat

Gold’s spectacular performance has drawn a lot of attention and invited endless analyses and commentaries. There are many theories out there as to why the yellow metal is surging like never before in modern memory, however most of them are shortsighted, or tend to miss the forest for the trees. The metal’s meteoric rise is not merely sending message about inflation expectations or rate policy. It’s flashing a clear warning sign about the...

Read More »

Read More »

Bastiat’s enduring legacy

Frédéric Bastiat, the 19th-century French economist and philosopher, is best known for his defense of individual liberty, free markets, and limited government, and his ideas, especially at the time he conceived them were as profound as they were simple and elegant. He recognized the absolute need to protect the smallest minority in the world, the individual, and he clearly saw the numerous dangers of state overreach, of aggressive interventionism...

Read More »

Read More »

A conversation with Catherine Austin Fitts

I recently had the great pleasure of (virtually) sitting down with Catherine Austin Fitts, investment banker, President of Solari, and former US Assistant Secretary of Housing and Urban Development for Housing, and having an extremely interesting conversation about the outlook for gold and silver. It was a fascinating discussion, especially given our current economic, monetary and geopolitical context: there so many risks and challenges ahead, that...

Read More »

Read More »

Investing in times of policy volatility

At the end of last month, a shock announcement came from the US Customs and Border Protection (CBP), declaring that one-kilogram and 100-ounce gold bars imported from Switzerland would be subject to a hefty 39% tariff, under the country’s “reciprocal tariffs” policy, which had already applied broadly to Swiss goods. This CBP decision came in response to a Swiss refiner’s request for clarity and guidance on whether gold would be part of the wider US...

Read More »

Read More »

Storing gold in the right place and in the right way

By now, I’m pretty sure that all of my clients and regular readers fully understand why allocating a part of their wealth to physical precious metals is not just the smart move, but an increasingly essential one. Owing real, tangible gold and silver is the only way to protect yourself from both monetary and fiscal excesses and from government overreach. However, it is equally important to know what to do with it once you bought it. Preparing for...

Read More »

Read More »