Tag Archive: Uncategorized

“Real innovation and progress happen beyond Big Tech” – Part II

Interview with Bernd Rodler – Part II of II

Claudio Grass (CG): A lot people still consider it safer to go with a huge, established corporation, thinking these solutions would be more reliable and robust, especially for business applications. What is your take on this view?

Bernd Rodler (BR): This is a perfectly understandable view, at least from the standpoint of a manager applying the „cover your a…“ strategy. Who can blame him if the SAP...

Read More »

Read More »

“Real innovation and progress happen beyond Big Tech”

Interview with Bernd Rodler – Part I of II

Those who know me and who have read my writings before will be very well aware of how important the topic of decentralization is to me and to my way of looking at the world, at our societies and our economies. I truly believe that there is no future to be had, at least not one that respects human dignity, should we continue down this same path of top-down control, mindless conformity and blind obedience...

Read More »

Read More »

Gold: A use case for the modern era

Part II of II

The big picture here is clear and it is essential to understand that it represents a very significant paradigm shift. Whether it is online or offline, whether it is through a mobile app, an exchange or even through physical contracts, ownership titles to gold holdings keep changing hands. And thus, no matter the vehicle that is used to facilitate these transactions, the fact of the matter is that it acts as a gold-backed...

Read More »

Read More »

Gold: A use case for the modern era

Part I of II

For decades, physical gold investors have had to contend with superficial, naive and wholly ahistorical “arguments” from the mainstream financial press, from economists and experts of all stripes, claiming that gold is nothing but a barbarous relic. To them, the yellow metal is akin to investment superstition. It has no yield, it serves no practical purpose and the only attraction they could conceive of is merely symbolic, or...

Read More »

Read More »

Is Switzerland still a safe jurisdiction for precious metals investors?

Over the last two years, we’ve all witnessed state abuses of power and extreme overreaches the likes of which many average citizens had never imagined they’d see in their own lifetimes. This caused a great part of the body politic in many Western nations to revisit their previously held beliefs about what is and isn’t possible for their governments to do and to question whether there really is such a thing as going “too far” or whether anyone in...

Read More »

Read More »

Absolute Neutralität: dringlich nötig

Viele im Westen wurden durch die Sonderoperation der Russen in der Ukraine auf dem falschen Fuss erwischt. Der seit 2014 schwellende innerstaatliche Konflikt war und ist vielen nicht bewusst. Die grundlegenden Probleme mit ihrem geschichtlichen Hintergrund, welche die Operation verständlicher erscheinen liessen, sind selbst heute den Entscheidungsträgern unbekannt. Man hat das Gefühl, dass alles, was vor dem Einmarsch passiert ist, inexistent ist.

Read More »

Read More »

Russia’s “gold peg”: Lessons for Western investors

It is undeniable that the ongoing crisis in Ukraine has polarized Western societies to an extent unseen in decades in any other foreign conflict. For over a month, we have been bombarded unceasingly by all mainstream media sources with reports and stories about Russia’s invasion and this conflict has already created deep social rifts in many other nations, and EU members in particular.

Read More »

Read More »

Ukraine conflict: A dispassionate analysis

I realize that I shouldn’t be surprised at the way the crisis in Ukraine has divided our societies or at the blind fanaticism the conversations around it have provoked. After all, virtually every other development of consequence has tuned out exactly the same. From covid to the economy and from freedom of speech to science itself, rational, respectful and productive debates are nowhere to be found.

Read More »

Read More »

Is gold too expensive?

Over the last couple of years we witnessed quite an extraordinary ride in gold prices. An impressive ascent until the last quarter of 2020 was followed by a pullback that scared many speculators away, which in turn transformed into a period of strength and then came another ebb… And recently, once again, we saw the yellow metal shoot up, fueled by inflation fears and the situation in Ukraine. Given that the fundamentals remain unchanged and that...

Read More »

Read More »

The forgotten art of Debate

One quick glance at different news headlines or just 5’ switching between TV networks suffice to convince even the most naive news consumer that there is something seriously wrong with the way public discourse was (d)evolved in our societies over the last years. Of course, journalism was never entirely devoid of bias, not even in its “golden age”.

Read More »

Read More »

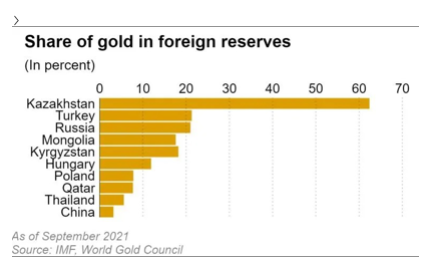

Central Banks’ record gold stockpiling

According to recently released data by the World Gold Council (WGC), as of September 2021, the total amount of gold held in reserves by central banks globally exceeded 36,000 tons for the first time since 1990. This 31-year record was the result of the world’s central banks adding more that 4,500 tons of the precious metal to their holdings over the last decade and it provides ample support for the investment case for gold, in both directly...

Read More »

Read More »

Lessons from 2021: The rational way out

As we are all preparing to bid farewell to 2021, there is a general feeling that this year, much like its predecessor, will not be missed. To my mind, however, it is clear that even though the past 12 months didn’t really teach us anything new, they did help cement the lessons of 2020 and spread important ideas to people who might otherwise have never come to question anything about the status quo.

Read More »

Read More »

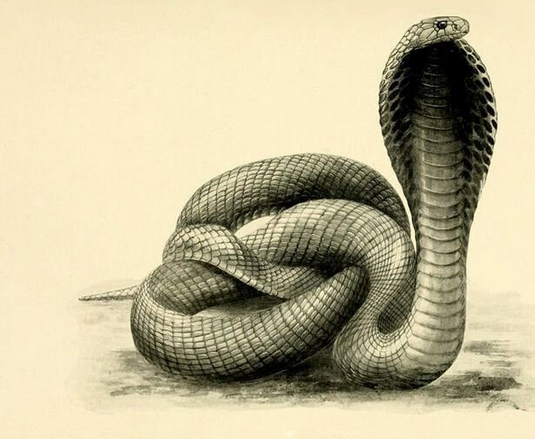

Government interventions and the Cobra effect – Part II

Of course, one of the most important and consequential parts of the incredibly complex organism that is the economy is money itself. It is its lifeblood and as the song goes, “it makes the world go round”. Therefore, manipulating the currency itself is one the most dangerous and hubristic things a central planner can do, which probably explains why it’s their favorite pastime.

Read More »

Read More »

Government interventions and the Cobra effect – Part I

Almost two decades ago, German economist Horst Siebert coined the term the “Cobra effect” to describe the real-world consequences of “well-intentioned” government interventions that go awry and produce the exact opposite results from what they aim for.

Read More »

Read More »

Corruption of the currency and decivilization – Part II

Many rational economists and students of history have written countless analyses on the gold standard and the terrible impact that its end has had on the world economy. However, as the Fall of Rome clearly demonstrates, the implications of the introduction of the fiat money system and of the limitless manipulation of the currency by the State reach much further.

Read More »

Read More »

50 years since the closure of the “gold window”

President Nixon’s unilateral decision to sever the last link between the dollar and gold had wide ranging and long lasting consequences for the global economy and for the entire monetary system. The end of sound money facilitated and accelerated the concentration of power at the top and the ability to manipulate the currency allowed politicians and central planners to further expand the state’s reach and push ahead with populist, reckless and...

Read More »

Read More »

The battle for control over the future of money

It’s no secret that governments and central planners of all stripes have long detested the rise of private money and independent digital currencies. They have tried to stifle the burgeoning crypto industry from the moment it attracted mainstream attention. For years, they have continued to add regulatory hurdles and threaten crypto holders and investors, as well as companies in this space, with unreasonable tax burdens and unrealistic disclosure...

Read More »

Read More »

The far-reaching implications of the amateur trading wave

Part II of II by Claudio Grass, Hünenberg See, Switzerland

Case in point: Silver “apes”

One of the most astounding elements of this shift in retail investing is the proof it offers for what many of us knew along: When people can freely and directly vote with their wallets and put their money where their mouth is, one gets a much clearer picture of what the public, the market or any other large group really thinks and really wants. In...

Read More »

Read More »