Tag Archive: U.K.

RBA Surprises with a 25 bp Hike

Overview: The large bourses in Asia Pacific except Hong Kong eased. Japan and China's mainland markets are closed for the holiday. Europe's Stoxx 600 is up about 0.6%. It gapped lower yesterday and has not entered the gap today. US futures are a little softer.

Read More »

Read More »

The Yen Bounces after 13-Day Slide and BOJ Defends Yield Cap

Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan's sell-off accelerated and slide to its lowest level since last October.

Read More »

Read More »

Yen Blues

Benchmark 10-year bonds yields in the US and Europe are at new highs for the year. The US yield is approaching 2.90%, while European rates are mostly 5-8 bp higher. The 10-year UK Gilt yield is up nine basis points to push near 1.98%. The higher yields are seeing the yen's losing streak extend, and the greenback has jumped 1% to around JPY128.45 The dollar is trading lower against the other major currencies but the Swiss franc.

Read More »

Read More »

Short Covering in the US Treasury Market Extends the Yield Pullback

Overview: What appears to be a powerful short-covering rally in the US debt market has helped steady equities and weighed on the dollar. Singapore and South Korea joined New Zealand and Canada in tightening monetary policy. Attention turns to the ECB now on the eve of a long-holiday weekend for many members. The tech-sector led the US equity recovery yesterday, snapping a three-day decline. Most of the major markets in Asia Pacific advanced but...

Read More »

Read More »

New Day, Same as the Old Day

Overview: It is a new day, but with the continued rise in interest rates and weaker equities, it feels like yesterday. Only China and Hong Kong among the major markets in Asia Pacific resisted the pull lower. Europe's Stoxx 600 is off by more than 0.5% led by health care and real estate. It is the fourth loss in five sessions and brings the benchmark to its lowest level since March 18. US futures are flattish.

Read More »

Read More »

RBA Drops “patience” to Send the Aussie Higher

Overview: The Reserve Bank of Australia hinted that it was getting closer to a rate hike. The Australian dollar was bid to its best level since the middle of last year. Australian stocks advanced in a mixed regional session while China and Hong Kong markets were closed for the local holiday. BOJ Kuroda called the yen's recent moves "rapid." The yen is sidelined today as the dollar weakens against other major currencies, led by the...

Read More »

Read More »

Calmer Markets: Hope Springs Eternal

Overview: Interest rates continue to rise, but equities are looking through it today and the dollar is drawing less succor. Asia Pacific equities were mostly higher. With half of Shanghai in lockdown, Chinese equities were unable to join the regional advance. Europe's Stoxx 600, led by energy and consumer discretionary sectors, is rising for the third consecutive sessions. US futures have a small upward bias.

Read More »

Read More »

Cautious Markets after China Disappoints

Overview: Ukraine's Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan's markets managed to post small gains. Tokyo was closed for the spring equinox.

Read More »

Read More »

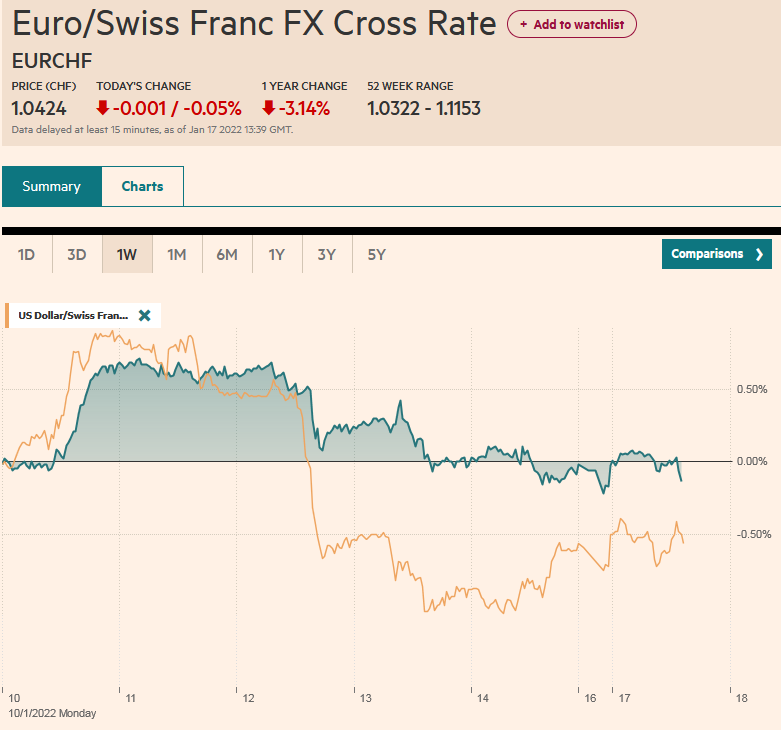

FX Daily, January 17: PBOC Eases, but the Yuan Firms

Overview: Russia is thought to be behind the cyber-attack on Ukraine at the end of last week, but a military attack over the weekend may be underpinning risk appetites today. The dollar's pre-weekend gains are being pared slightly. Led by the Canadian dollar and Norwegian krone, the greenback is lower against most major currencies, with the yen being the notable exception, which is off about 0.2%.

Read More »

Read More »

Has the Market Carried the Fed’s Water? Is the Dollar Vulnerable to Buy the Rumor and Sell the Fact?

Overview: The US dollar is trading with a bit of heavier bias against most of the major currencies as the focus turns to today's FOMC meeting, where a clear consensus has emerged in favor of faster tapering and a dot plot pointing to a steeper pace rate hikes. Emerging market currencies led by Turkey and South Africa are mostly lower. The JP Morgan Emerging Market Currency Index is lower for the third straight session. The US 10-year Treasury...

Read More »

Read More »

No Turnaround Tuesday for Equities?

Overview: Activity in the capital markets is subdued today, ahead of tomorrow's FOMC meeting conclusion and the ECB meeting on Thursday. The MSCI Asia Pacific equity index fell for the third consecutive session. European bourses are heavy after the Stoxx 600 posted an outside down day yesterday. Today would be the fifth consecutive decline. Selling pressure on the US futures indices continues after yesterday's losses. Australia and New Zealand...

Read More »

Read More »

Dollar Starts the Week Bid ahead of the FOMC

Overview: Equities, bonds, and the dollar begin the new week on a firm note. Japanese, Chinese, Australian, and New Zealand equities advanced in the Asia Pacific region. Europe's Stoxx 600 is snapping a three-day decline, and US futures are 0.25%-0.35% higher. The US 10-year yield is a little softer at 1.48%. European benchmark yields are mostly 1-2 bp lower, and near 0.71%, the UK Gilt's yield is at a three-month low. The dollar is rising...

Read More »

Read More »

Yuan Rises Despite China’s Move and the Fed’s Course is Set Regardless of Today’s CPI

Overview: After US equity indices posted their first loss of the week, Asia Pacific and European equities fell. While the MSCI Asia Pacific Index fell for the first time since Monday, Europe's Stoxx 600 is posting its third consecutive decline. US futures are trading slightly firmer. The US 10-year Treasury yield is up about 1.5 bp to 1.51%, which is about eight basis points higher than it settled last week when the sharp drop in equities saw...

Read More »

Read More »

Markets Turn Cautious Ahead of Tomorrow’s US CPI

Overview: The euro has come back offered after its seemingly inexplicable advance yesterday. The dollar is firmer against most major currencies today, with the yen an exception after JPY114.00 held on yesterday's advance. Most emerging market currencies are also softer, with a handful of smaller Asian currencies proving a bit resilient. Most large bourses advance in the Asia Pacific region, except Japan and Australia. Europe's Stoxx 600 is...

Read More »

Read More »

The Greenback Finds Traction ahead of the Jobs Report

Overview: The Omicron variant has been detected in more countries, but the capital markets are taking it in stride. Risk appetites appear to be stabilizing. The MSCI Asia Pacific Index rose for the third consecutive session, though Hong Kong and Taiwan markets did not participate in the advance today. Europe's Stoxx 600 is struggling to hold on to early gains, while US futures are narrowly mixed. The US 10-year yield is a little near 1.43%,...

Read More »

Read More »

FX Daily, December 02: Calm Surface Masks Lack of Conviction

The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated.

Read More »

Read More »

Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are...

Read More »

Read More »

Tech Sell-Off Continues

Overview: The markets are unsettled. Bond yields have jumped, tech stocks are leading an equity slump, and yesterday's crude oil bounce reversed. Gold, which peaked last week near $1877, has been dumped to around $1793. The tech sell-off in the US carried into the Asia Pacific session, and Hong Kong led most markets lower. The local holiday let Japanese markets off unscathed, though the Nikkei futures are off about 0.4%. Australia and India...

Read More »

Read More »

Covid Wave Knocks Euro Down and to new 6-year Lows Against the Swiss Franc

Overview: Concerns about the virus surge in Europe cut short the euro's bounce and sent it back below $1.1300 and are also weighing on central European currencies, including the Hungarian forint, despite yesterday's aggressive hike of the one-week deposit rate. Austria has reintroduced a hard 20-day lockdown. Germany's health minister warned that the situation deteriorated and vaccines were not enough to break the wave. He was explicit that a...

Read More »

Read More »

Euro Bounces Back, but the Turkish Lira Remains Unloved

Overview: The US dollar's sharp upside momentum stalled yesterday near JPY115 and after the euro met (and surpassed) a key retracement level slightly below $1.1300. Led by the Antipodean currencies today, the greenback is mostly trading with a heavier bias. Among the majors, helped by a steadying of US yields, the yen is soft. In the emerging market space, the Turkish lira continues its headlong plunge while the yuan softened and the Mexican...

Read More »

Read More »