Tag Archive: UBS

Swiss cantons forced to fish for multinationals with non-tax lures

Proposed changes to Switzerland’s tax rules could have a dramatic effect on which cantons remain attractive locations for multinational companies in future. As a result, factors such as the cost of premises or concentration of high tech facilities, will play a greater role, according to UBS bank.

Read More »

Read More »

Credit Suisse freezes $5 billion in US-Russia sanctions move

The Swiss Credit Suisse bank froze some CHF5 billion ($5 billion) of assets linked to Russia earlier this year in an effort to toe the line with US sanctions levied against Moscow. The bank froze the funds in the second quarter of 2018, according to Reuters, in response to sanctions introduced by Washington in April.

Read More »

Read More »

Swiss court blocks French request for UBS banking data

Switzerland’s Federal Administrative Court has ordered the Federal Tax Administration (FTA) not to provide France with details about 40,000 UBS bank clients with French addresses. In May 2016, the French tax authorities requested administrative assistance from the FTA. They wanted details about UBS clients who lived or had lived in France.

Read More »

Read More »

UBS Boss Bemoans Geopolitical Jitters

UBS may have seen quarterly profits rise year-on-year, but chief executive Sergio Ermotti says the threat of trade wars and political unrest has dampened investor enthusiasm and continues to hold back financial markets.

Read More »

Read More »

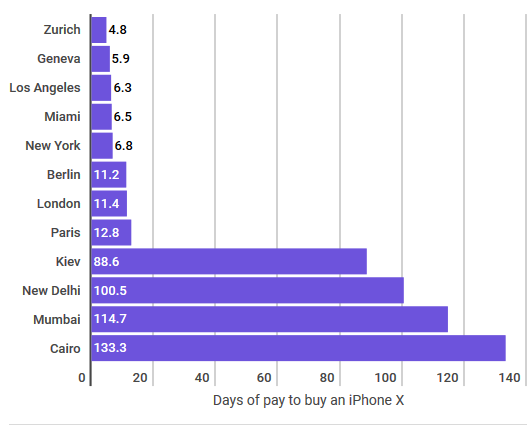

Pay in Zurich and Geneva highest in the world

A survey of the cost of living in 77 cities, by UBS, ranks Zurich (1st) and Geneva (2nd) as the most expensive. But while these cities are the most expensive, their workers are also the highest paid. In Zurich, less than five days pay affords an iPhone X. In Geneva, the same device requires less than six days of labour.

Read More »

Read More »

US Gold & Silver Futures Markets: “Easy” Targets

Following news coverage of the charging of five precious metals traders and three banks in January, Commodities Futures Trading Commission and Department of Justice documents reveal a global criminal cabal of 16 traders operating in at least four major financial institutions between 2008 and 2015 to defraud COMEX gold and silver futures markets.

Read More »

Read More »

UBS publishes Annual Report 2017

Zurich/Basel, 9 March 2018 – The Annual Report 2017 provides comprehensive and detailed information on the firm, its strategy, business, governance, financial performance and risk, treasury and capital management, as well as on the regulatory and operating environment for the financial year 2017.

Read More »

Read More »

UBS chief’s pay rises to over CHF14 million

The chief executive of Switzerland’s largest bank UBS received CHF14.2 million ($14.92 million) in compensation for 2017, up from CHF13.7 million in 2016, UBS said on Friday. The announcement comes at a time when executive pay and bonuses are under increased scrutiny in Switzerland.

Read More »

Read More »

UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems.

Read More »

Read More »

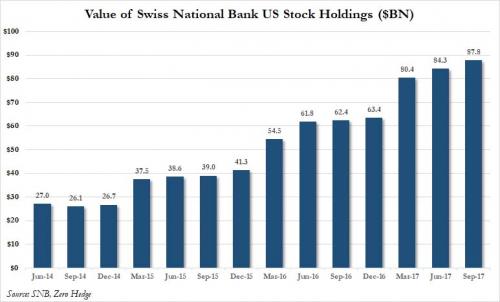

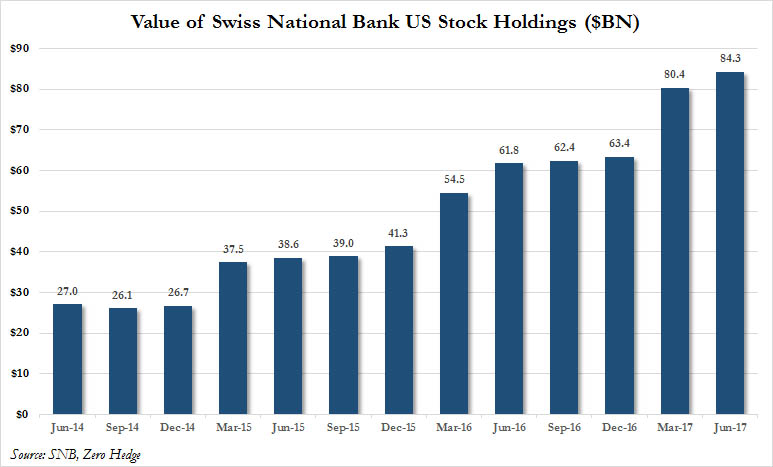

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

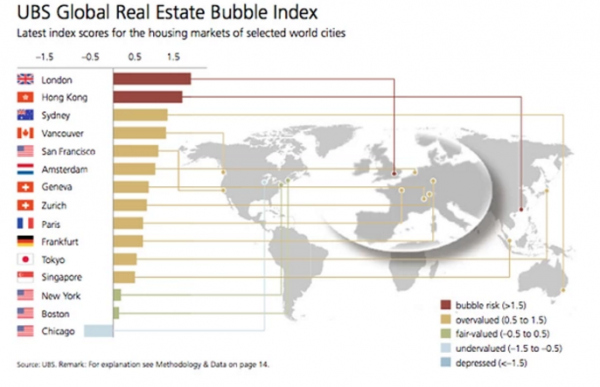

The Global Housing Bubble Is Biggest In These Cities

Two years ago, when UBS looked at the world's most expensive housing markets, it found that London and Hong Kong were the only two areas exposed to bubble risk.What a difference just a couple of years makes, because in the latest report by UBS wealth Management, which compiles the bank's Global Real Estate Bubble Index, it found that eight of the world's largest cities are now subject to a massive speculative housing bubble.

Read More »

Read More »

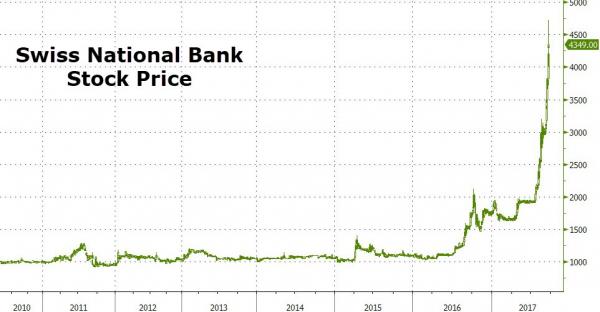

Is The Swiss National Bank A Fraud?

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. That sounds like a 'tulip' bubble-like 'fraud'... The SNB is up over 120% in Q3 so far - more than double 'bubble' Bitcoin...

Read More »

Read More »

Swiss Mystery: Someone Keeps Flushing €500 Bank Notes Down The Toilet

While there are several comments one can make here, “dirty money”, “flush with cash” and “flushing money down the toilet” certainly coming to mind, perhaps the ECB was on to something when it warned that €500 “Bin Laden” bills (which it has since discontinued to print) tend to be used by criminals. The reason for … Continue reading »

Read More »

Read More »

Hard times continue for Swiss private banks

Over half of private banks in Switzerland analysed by KPMG last year experienced net outflows of client cash. In a difficult period for finance, many could be forced to shut down or be bought out. “Implement truly radical change, or continue to see performance deteriorate.” This was the message of a study released Thursday by audit group KPMG with the University of St. Gallen, evaluating the performance of 85 Swiss private banks.

Read More »

Read More »

Swiss Asset Manager Settles US Tax Evasion Charges

The Geneva asset management firm Prime Partners has agreed to pay $5 million (CHF4.8 million) to the United States to settle charges for tax evasion and assisting US taxpayers in opening and maintaining undeclared foreign bank accounts from 2001 to 2010.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »

Would you take a pilotless plane?

Pilotless cargo and passenger planes could be in use within eight years and save airlines billions, according to a report by Swiss bank UBS. But customers remain wary of the new technology despite potential fare reductions. “In the not-too-distant future, we would expect to see a situation where flights are pilotless or the number of pilots shrinks to one, with a remote pilot based on the ground and highly-secure ground-to-air communications,” the...

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »