World stocks eased back from record highs and fell for the first time in eight days, as jitters about Catalonia’s independence push returned while bets on higher U.S. interest rates sent the dollar to its highest since mid August; S&P 500 futures were modestly in the red - as they have been every day this week before levitating to record highs - ahead of hurricane-distorted nonfarm payrolls data (full preview here). U.S. jobs report will also be...

Read More »

Tag Archive: Trump Administration

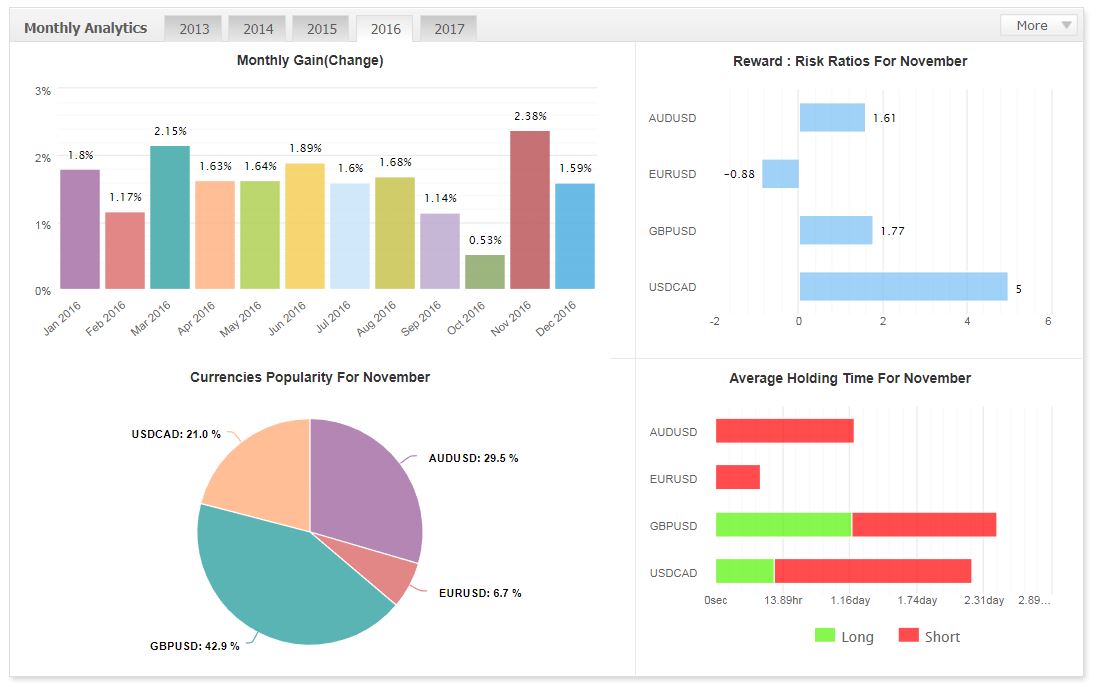

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

What Will Trump Do About The Central-Bank Cartel?

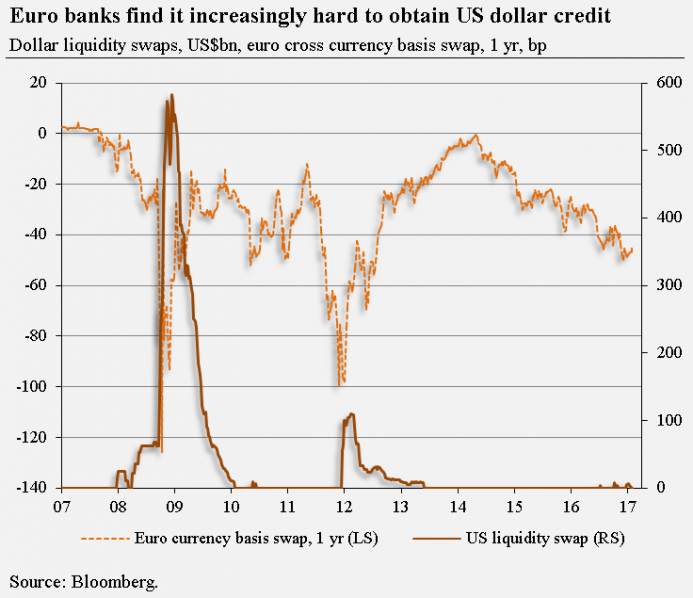

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

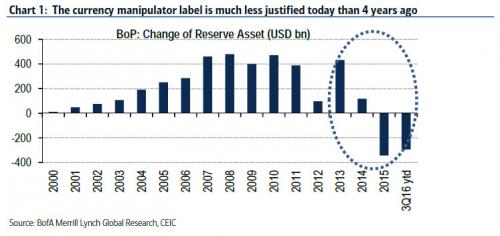

Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump's violating the "One China" policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

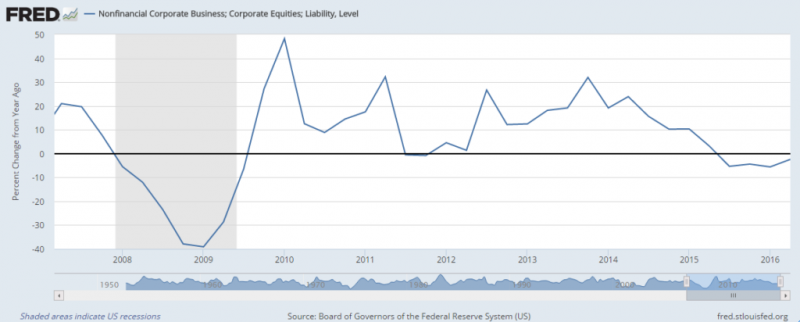

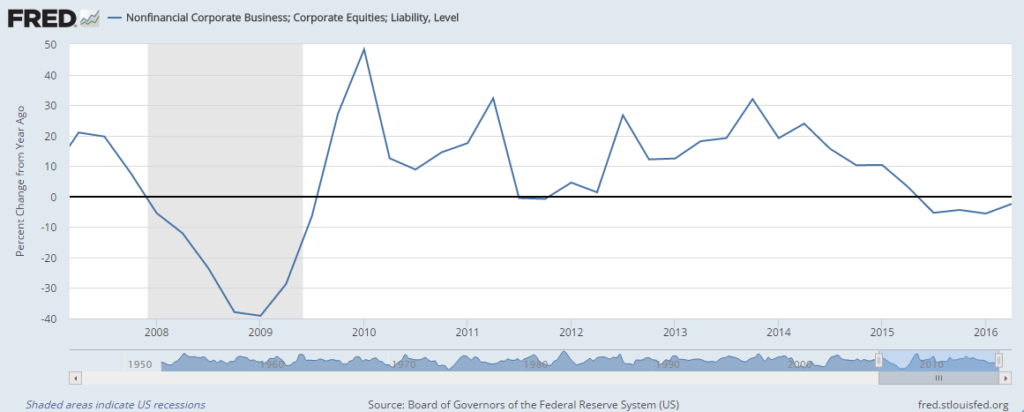

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »