Tag Archive: tic

Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

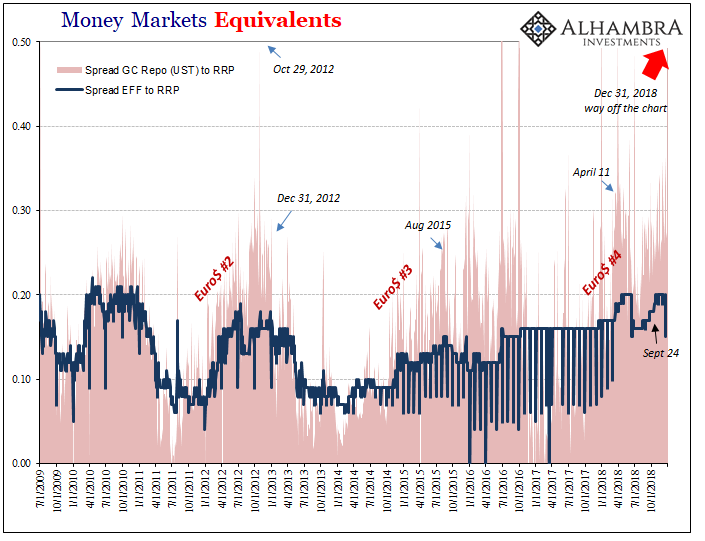

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system.

Read More »

Read More »

Looking Back At Chaotic March Through TIC

March ended up being a pretty wild ride. Lost amidst the furor over Russia’s invasion of Ukraine, the month began with a couple clear “collateral days. T-bill rates along with repo fails echoed that same shortfall before the yield curve then joined the eurodollar futures curve being inverted.

Read More »

Read More »

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

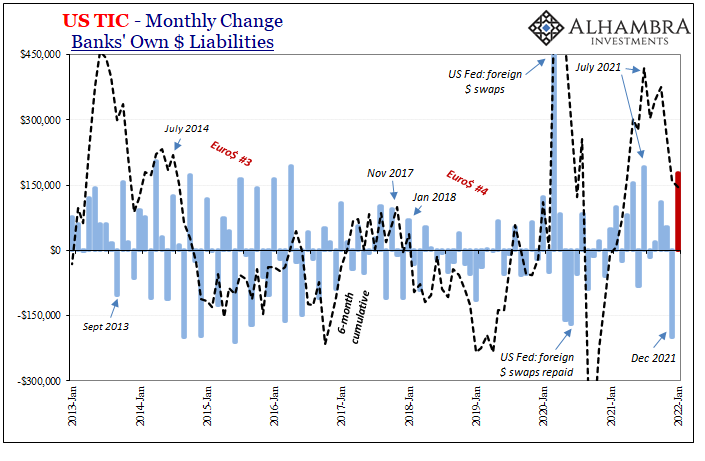

It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention.

Read More »

Read More »

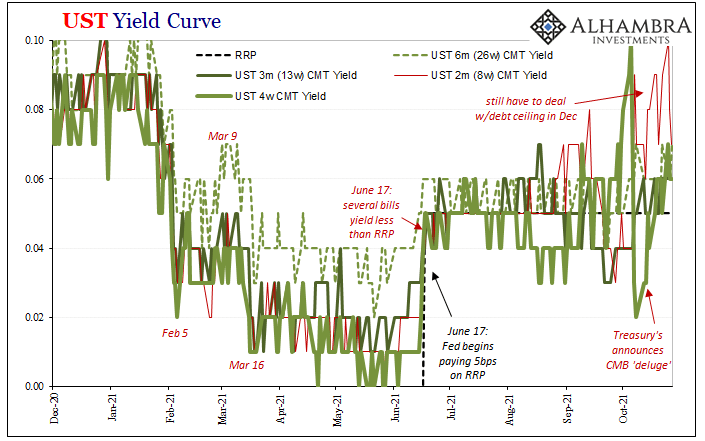

Short Run TIPS, LT Flat, Basically Awful Real(ity)

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

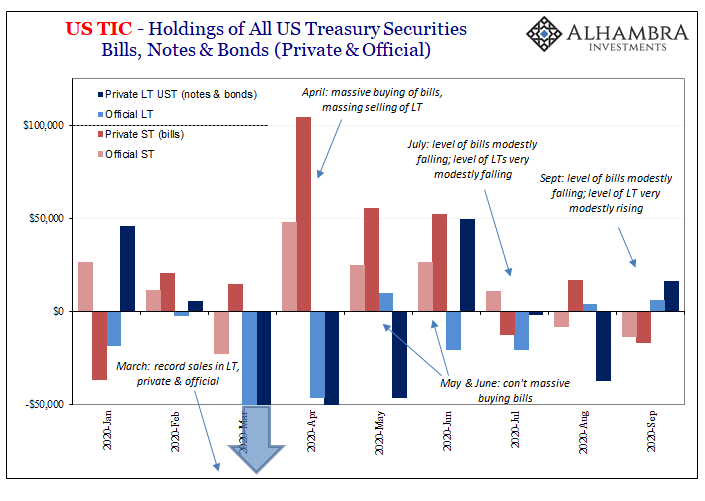

Just Who Is, And Who Is Not, Selling T-Bills

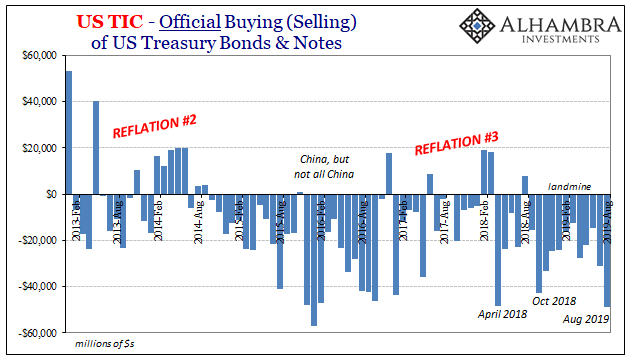

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

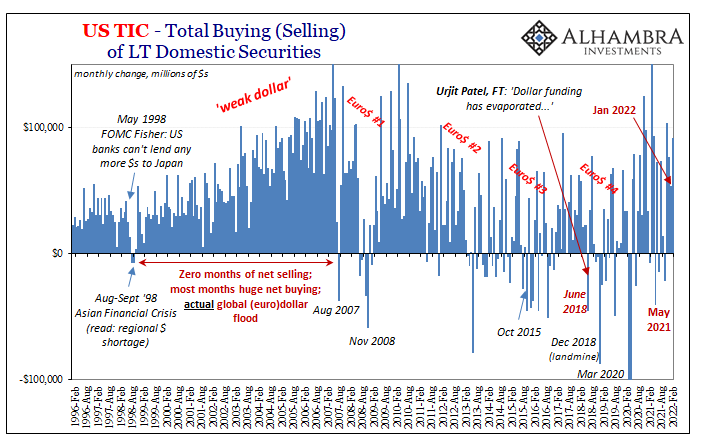

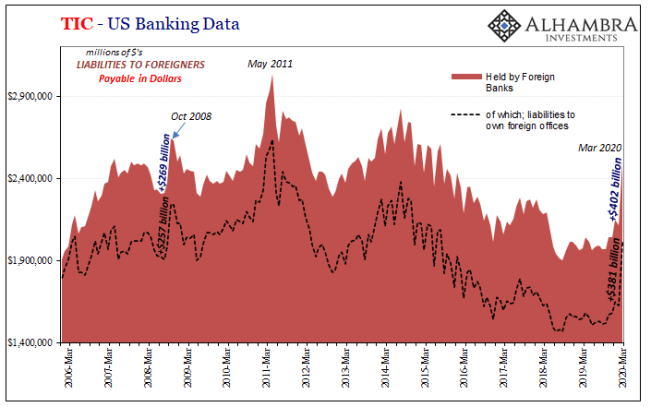

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets.

Read More »

Read More »

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

So Much Dollar Bull

According to the Federal Reserve’s calculations, the US dollar in Q1 pulled off its best quarter in more than twenty years – though it really didn’t need the full quarter to do it. The last time the Fed’s trade-weighed dollar index managed to appreciate farther than the 7.1% it had in the first three months of 2020, the year was 1997 during its final quarter when almost the whole of Asia was just about to get clobbered.In second place (now third)...

Read More »

Read More »

No Flight To Recognize Shortage

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it.

Read More »

Read More »

August TIC: Trying To Get Collateral Out of the Shadows

The second most frustrating aspect of trying to analyze global shadow money is how the term “shadow” really applies in this case. It’s not really because banks are being sneaky, desperately maintaining their cover for any number of illicit activities they are regularly accused of undertaking. The money stays in the shadows for the simple reason central bankers don’t know their jobs; even after a somehow Global Financial Crisis in 2008, they don’t...

Read More »

Read More »

FX Daily, June 18: Draghi Ends Calm Ahead of FOMC, Sending the Euro and Yields Down

Overview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a "wait and see" stance ahead of tomorrow's FOMC decision. Draghi's comments sent the euro through $1.12 for the first time in two weeks and drove European bonds yields to new lows.

Read More »

Read More »

FX Daily, May 16: US Struggles to Strike a Less Strident Tone

Overview: Retail sales and industrial production disappointed in both the US and China prior to the end of the tariff truce, declared by the US in a series of presidential tweets on May 5. The reaction function of the US to the drop in equities was to play down tensions on three fronts. First, a US team is expected to return to Beijing in the coming weeks.

Read More »

Read More »

FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances.

Read More »

Read More »

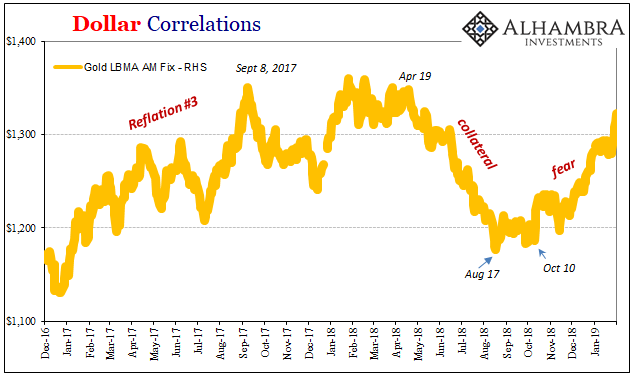

Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

Capital Flocks to the US

The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing.

Read More »

Read More »

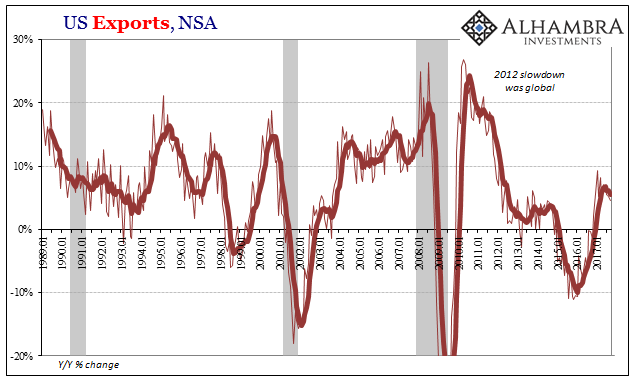

Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »

Swimming The ‘Dollar’ Current (And Getting Nowhere)

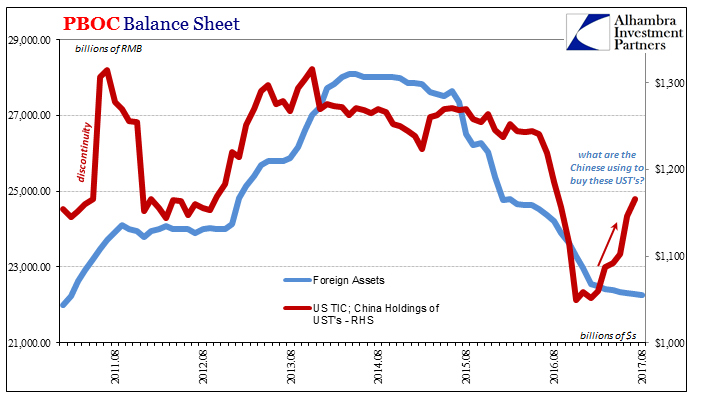

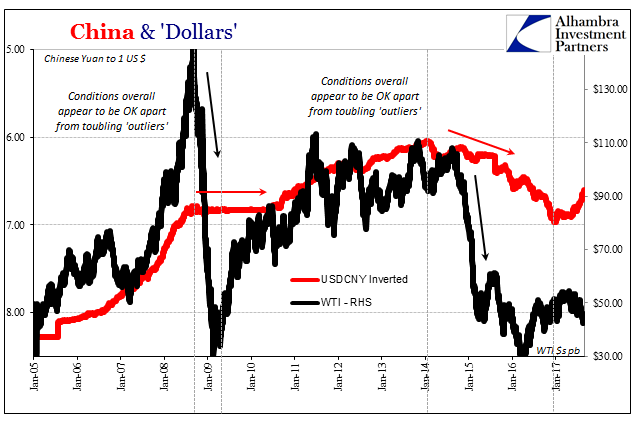

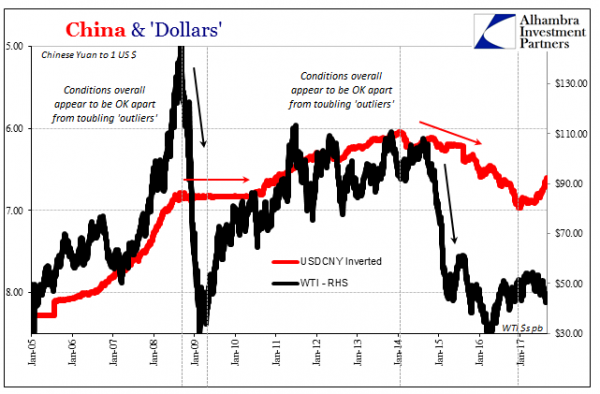

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August.

Read More »

Read More »

Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is coincidence. Three times is an enemy...

Read More »

Read More »

‘Dollar’ ‘Improvement’

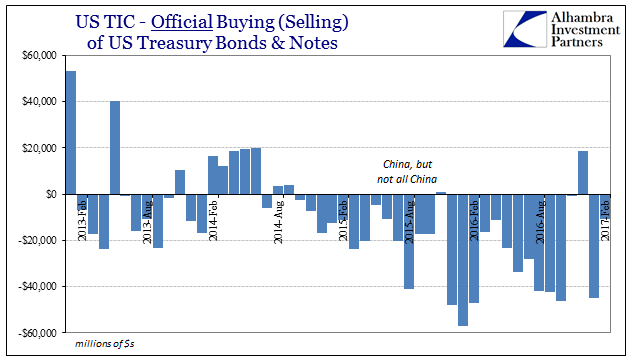

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment.

Read More »

Read More »