Tag Archive: Thoughts

The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West.

Read More »

Read More »

“Gold is Money, Everything Else Is Credit” – J.P. Morgan

By now it is probably obvious, even to the most naive of mainstream narrative followers, that we are well past the point of no return on many fronts. Politics, on a national and global level, are never getting back to “normal”, the economy is already knee-deep in a severe recession, while social frictions and public discontent with governments, institutions and all kinds of rulers and central planners is on a sharp and dangerous trajectory.

Read More »

Read More »

Unless the US stops printing money, the dollar will collapse

Claudio Grass (CG): This crisis has shaken a lot of industries and core functions of the global economy and international trade. How do you assess its impact on the most important part of the machine, the banking system? Do you see risks there that investors should be worrying about?

Read More »

Read More »

“Unless the US stops printing money, the dollar will collapse.”

We’re less than two weeks away from the US election, and yet this sense of utter confusion, bitter political conflict, and economic uncertainty that has been ominously hovering over the nation, as well as the rest of the world, doesn’t seem to have subsided.

Read More »

Read More »

US election: Red flags for investors

Outlook and wider impact. As showcased during the debates and in the entire campaign rhetoric, politicians in the US but also in Europe, are solely focused on promoting solutions that only serve to paper over the problems and address the symptoms of the disease.

Read More »

Read More »

Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss.

Read More »

Read More »

We don’t have to kill the king, if we just can ignore the king

“The right of self-determination in regard to the question of membership in a state thus means: whenever the inhabitants of a particular territory, whether it be a single village, a whole district, or a series of adjacent districts, make it known, by a freely conducted plebiscite, that they no longer wish to remain united to the state to which they belong at the time, but wish either to form an independent state or to attach themselves to some...

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part II

In this surreal policy environment, how has the role and the investment process of the value investor evolved, especially over the last decade? How can one still identify value in a world of subsidized binge borrowing, extreme indebtedness, and stock buybacks?

Read More »

Read More »

“The U.S. economy felt like a balloon in search of a needle” – Part I

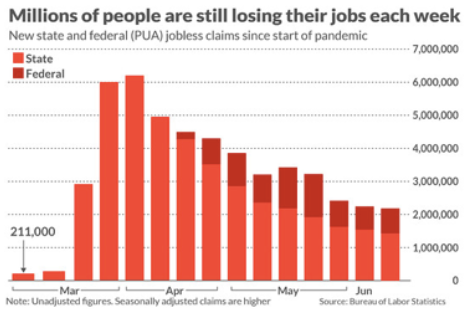

As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain.

Read More »

Read More »

You cannot print your way to prosperity – Part II

Looking at the damage inflicted upon supply chains, production facilities and global trade in particular, how quickly could these operations snap back even if all COVID-related restrictions were lifted tomorrow? Do you think we’ll eventually get back to business as usual, or have we now experienced a permanent shift to a “new normal”?

Read More »

Read More »

Gold doing what it does best – Part II

While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time.

Read More »

Read More »

A blueprint for a European superstate

After intense negotiations, long days and nights of clashes and a distinctly sour note underlying the entire summit, European Union leaders finally agreed on an unprecedented 1.82 trillion-euro ($2.1 trillion) budget and COVID recovery package.

Read More »

Read More »

Is the West repeating India’s mistakes?

Following the publication of our last conversation with Jayant Bhandari, I received a lot of interesting feedback and remarks. The common denominator of all those comments was the astonishment of many Western readers at the real conditions and dynamics on the ground in India.

Read More »

Read More »

War on poverty, or just war on the poor?

As the dust is now begging to settle, both from the heights of the COVID panic and from the riots that shook the western world, we are starting to get an idea about where we stand after this unprecedented and tumultuous time.

Read More »

Read More »

The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian...

Read More »

Read More »

Reject the “Next Generation EU Plan”

The Václav Klaus Institute urging the Czech Government to reject the dangerous Ursula von der Leyen´s plan. It is rather rare that I share articles on my channel that are not from my own pen. The following article is therefore an exception and for good reason. It is written by none other than the former President of the Czech Republic Václav Klaus, with whom I have a long-standing relationship, based on great respect and many shared values.

Read More »

Read More »

Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek

Read More »

Read More »

An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB.

Read More »

Read More »