Tag Archive: Thoughts

An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB.

Read More »

Read More »

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable.

Read More »

Read More »

Nothing Is What It Seems

My latest interview about Corona, Liberty, Private Property, Authoritarism, and a fear-mongering global media campaign, which I call borderline criminal

[embedded content]

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »

Modern Monetary Theory is an old Marxist Idea

Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970).

Read More »

Read More »

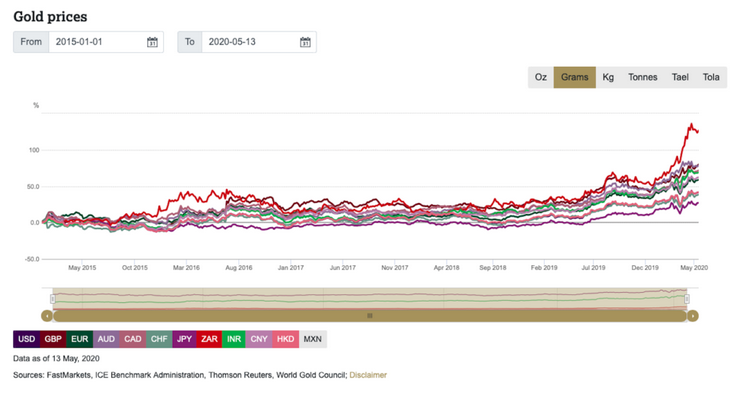

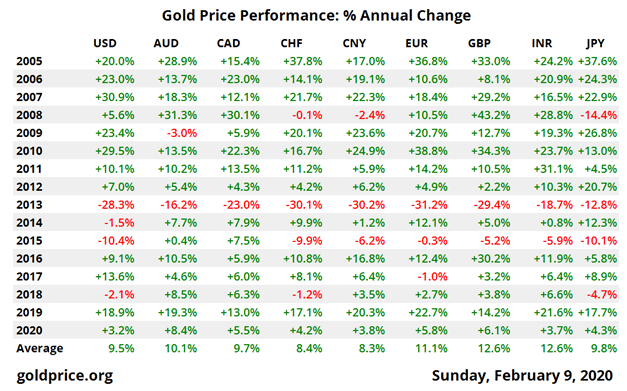

Gold is the 7th sense of financial markets

As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion.

Read More »

Read More »

Das Internet – die dezentrale (R)Evolution

Menschen werden durch unterschiedliche Motive angetrieben. Die einen sehen das höchste Glück in der Ansammlung von materiellen Werten, und andere sind von geistigen Werten angetrieben. Eine Idee kann genauso wie eine Rolex Glücksgefühle und Ansporn auslösen. Mich persönliche treiben Ideen an.

Read More »

Read More »

Investing in crypto the sound way!

I have long been fascinated by the far-reaching consequences and the great potential of the wave of new technologies and ideas that emerged with the crypto revolution. While most of us first came into contact with these concepts in 2017, this tectonic shift that is only just beginning has been in the making for nearly a decade. Now, we begin to see the basic ideas and tools take shape and give rise to endless exciting possibilities that can affect...

Read More »

Read More »

“We don’t have to behead the king if we can just ignore him” – Claudio Grass

“Negative interest rates are unsustainable and once investors decide to stop paying for the privilege of holding government debt, a banking crisis could result, says James Grant.” Returning SBTV guest, Claudio Grass, speaks with us about the unsustainable pensions, crumbling fiat currencies and a looming financial crisis in a world of insane central bank monetary policies.

Read More »

Read More »

Is it platinum’s time to shine?

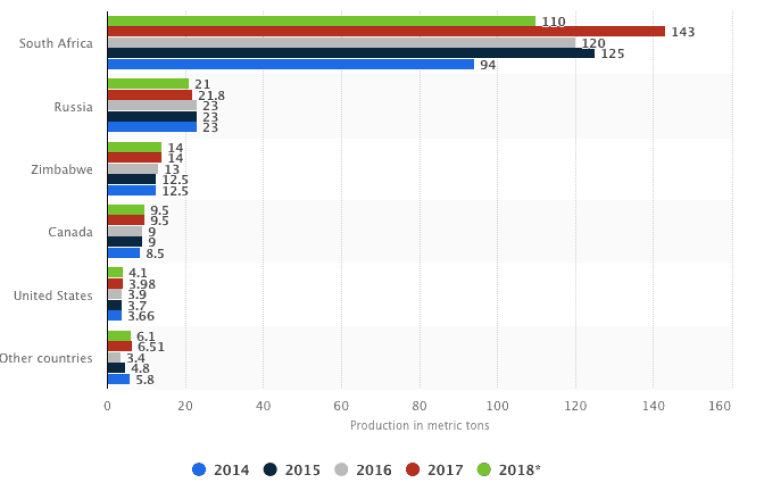

Even with seasoned precious metals investors, it is often the case that platinum gets overlooked, while gold and silver dominate the conversation over which metal affords the best long-term protection of one’s wealth. Nevertheless, platinum has proved to be an excellent store of value, while it also offers a number of interesting advantages as a long-term investment that could play an important part in a conservative and proactive strategy.

Read More »

Read More »

THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep stock markets afloat and the economic expansion alive.

Read More »

Read More »

The Swiss Legacy In Direct Democracy Is Exceptional

Our readers probably realize by now, what a proud Swiss fellow I am, and how I take every possible opportunity to argue how Switzerland presents itself as a role model to achieve radical decentralization and respect for civil liberties. It also assures the right of self-determination in an environment where municipalities, cities or smaller states are in competition with each other and, by doing so, limiting the power of politicians.

Read More »

Read More »

In defense of Switzerland

An interview with Prof. Angelo M. Codevilla. Following decades of the propagation of a false historical narrative regarding Switzerland’s role during WWII, an entire generation, especially in the West, has grown up with a distorted version of events, based on unfounded and unsubstantiated claims.

Read More »

Read More »

THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates.

Read More »

Read More »

Sound money: A Biblical perspective – Part I

In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of Enlightenment roughly 200 years ago. In the words of Immanuel Kant:

Read More »

Read More »

Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion.

Read More »

Read More »

ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change.

Read More »

Read More »

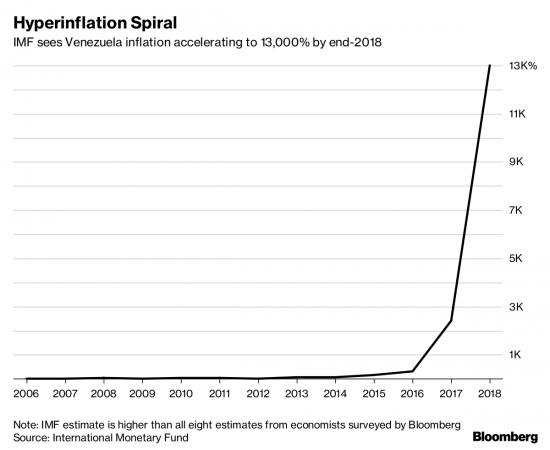

Venezuela: when fiat money reaches its intrinsic value

Over the last years, Venezuela has become a modern poster child for the failure of socialism and with good reason. It offers an abundance of lessons and stern warnings for many western nations, but it also provides a very insightful and relevant reminder for individual investors too.

Read More »

Read More »