Tag Archive: Technically Speaking

Market Perspective Is Important To Avoid Mistakes

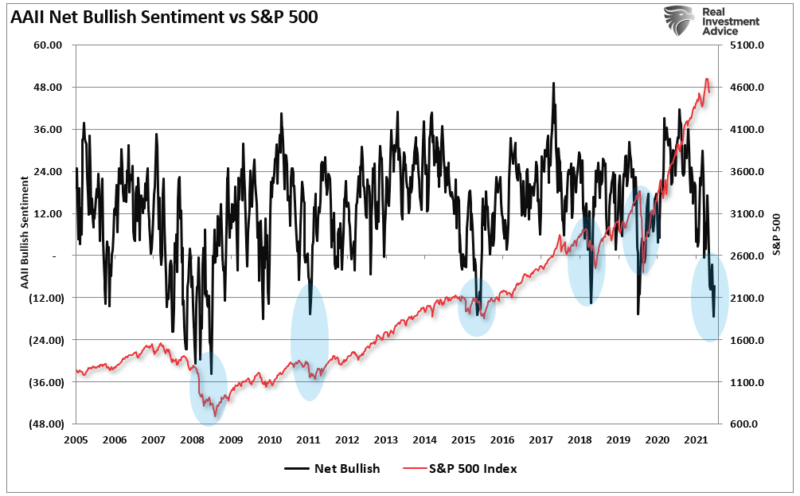

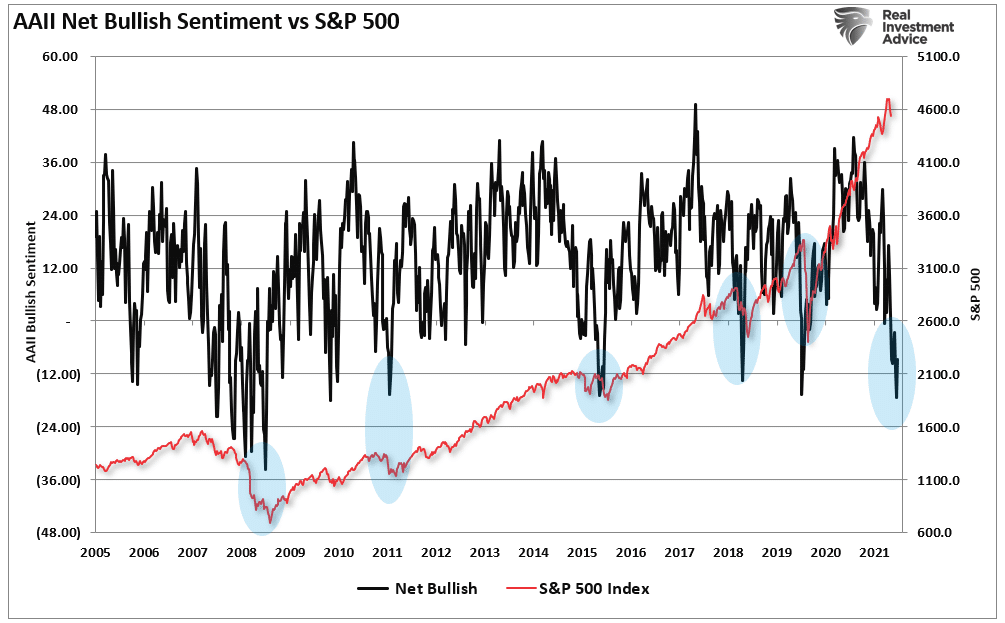

Market perspective is essential in avoiding investing mistakes. With CNBC airing “Markets In Turmoil” every time the market dips, it’s no wonder investor sentiment is now the lowest we have seen financial crisis lows.

Read More »

Read More »

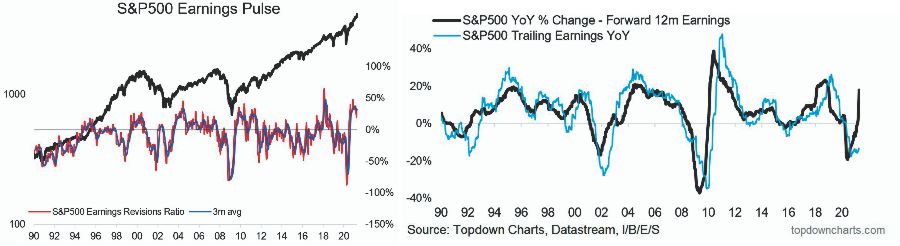

Hiking Rates Into Peak Valuations Is A Mistake

Hiking rates into a wildly overvalued market is potentially a mistake. So says Bank of America in a recent article.

Optimists expecting the stock market to weather the rate-hike cycle as they’ve done in the past are missing one important detail, according to Bank of America Corp.’s strategists.While U.S. equities saw positive returns during previous periods of rate increases, the key risk this time round is that the Federal Reserve will be...

Read More »

Read More »

Sell Energy Stocks? The Time May Be Approaching

“Sell Energy Stocks” Was Originally Published At Marketwatch.com

Sell energy stocks? Such certainly seems counter-intuitive advice given high oil prices, geopolitical stress, and surging inflation. However, some issues suggest this could indeed be the time to “sell high.”

Before we go further, it is essential to state that I am not recommending selling energy stocks in total. As is always the case, portfolio management is...

Read More »

Read More »

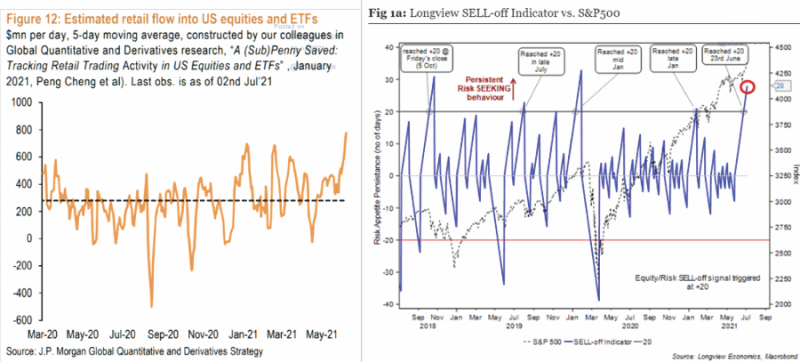

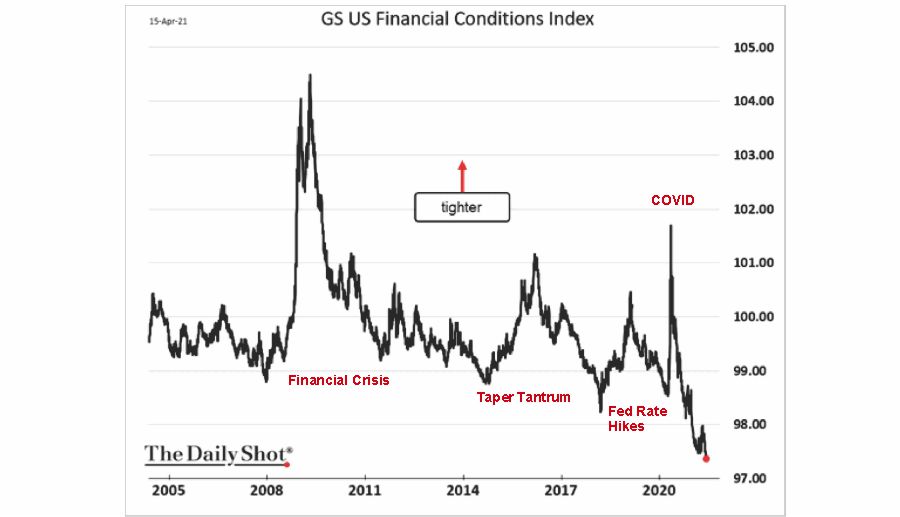

Market Selloff Into January

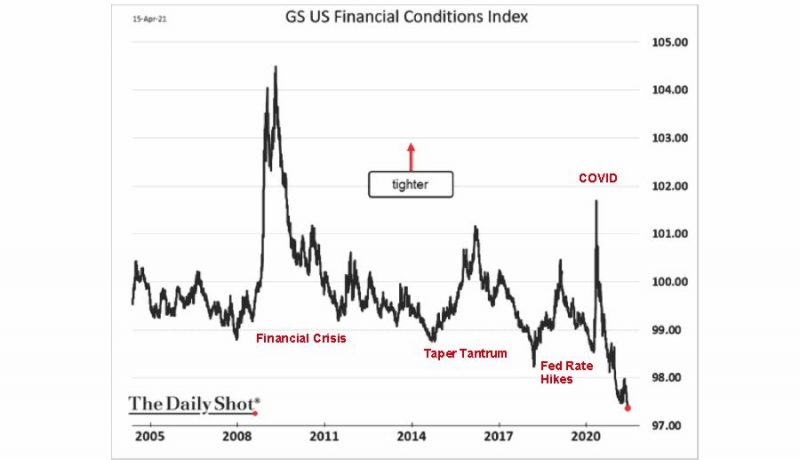

The market selloff into January rattled investors as concerns of “So Goes January, So Goes The Year” began to dampen expectations. Combined with a more aggressive stance from the Federal Reserve, rising inflation, and a reduction in liquidity, investor concerns seem to be well-founded.

Read More »

Read More »

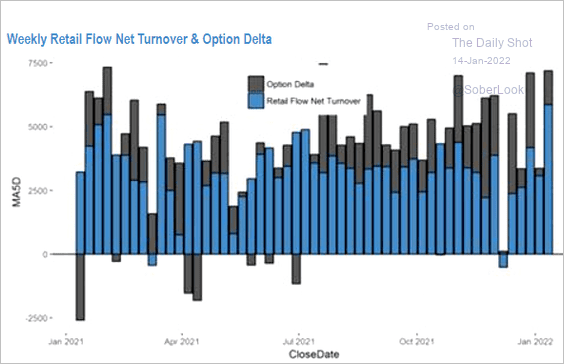

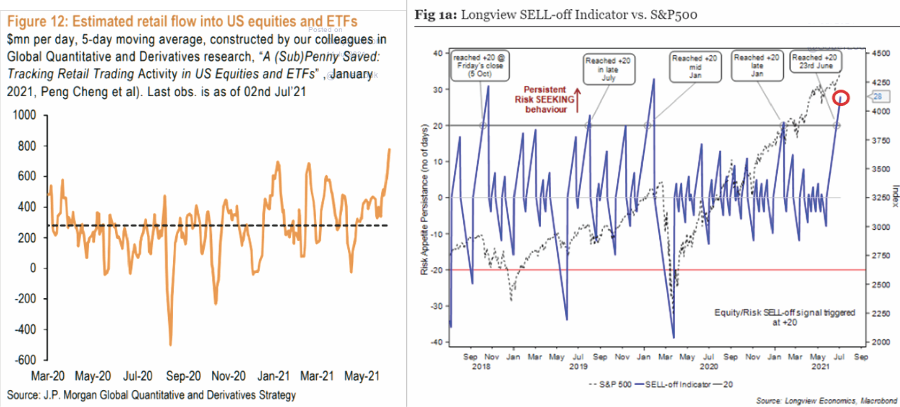

Technically Speaking: Hedge Funds Ramp Up Exposure

The “Fear Of Missing Out” has infected retail and hedge funds alike as they ramp up exposure to chase performance. We have previously discussed the near “mania” of retail investors taking on exceptional risk in various manners. From increasing leverage, engaging in speculative options trading, and taking out personal loans to invest, it’s all evidence of overconfident investors.

Read More »

Read More »

Technically Speaking: Yardeni – The Market Will Soon Reach 4500

“The strong economic recovery will not get interrupted by inflation or a credit crunch, and the market will soon reach 4,500.” – Ed Yardeni via Advisor Perspectives. After discussing BofA’s view of why the market could drop to 3800, I thought it fair to discuss a more optimistic view.

Read More »

Read More »

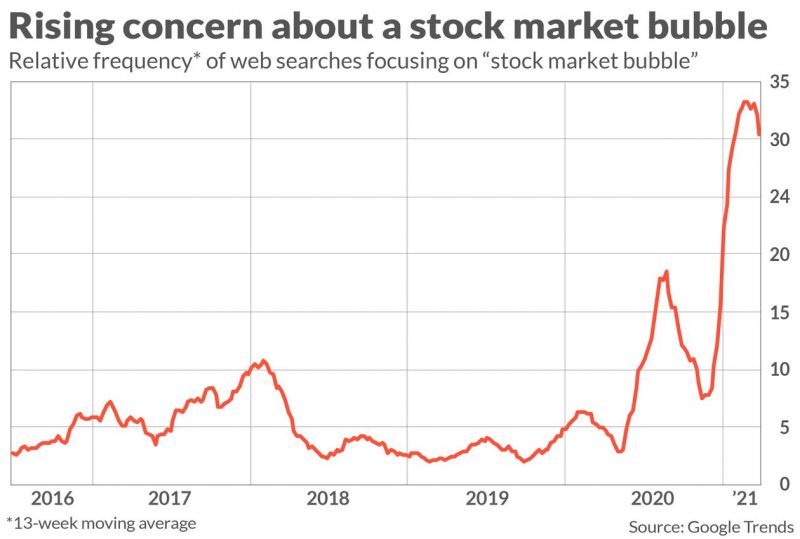

Technically Speaking: If Everyone Sees It, Is It Still A Bubble?

“If everyone sees it, is it still a bubble?” That was a great question I got over the weekend. As a “contrarian” investor, it is usually when “everyone” is talking about an event; it doesn’t happen.

As Mark Hulbert noted recently, “everyone” is worrying about a “bubble” in the stock market.

Read More »

Read More »

#MacroView: Are Stocks Cheap, Or Just Another Rationalization?

Are stocks “cheap,” or is this just another bullish “rationalization.” Such was the suggestion by the consistently bullish Brian Wesbury of First Trust in a research note entitled “Yes, Stocks Are Cheap.” To wit:

“The Fed remains highly accommodative, there are trillions of dollars of cash on the sidelines, vaccines have reached over 50% of Americans, and the economy is expanding rapidly. Some valuations have been stretched, but the market as a...

Read More »

Read More »

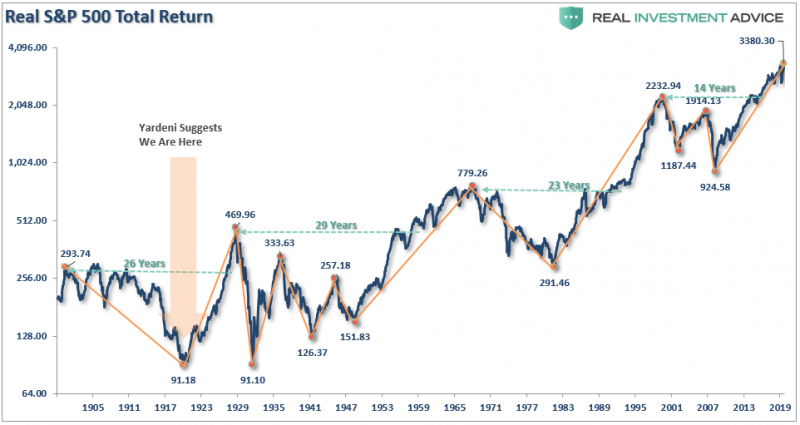

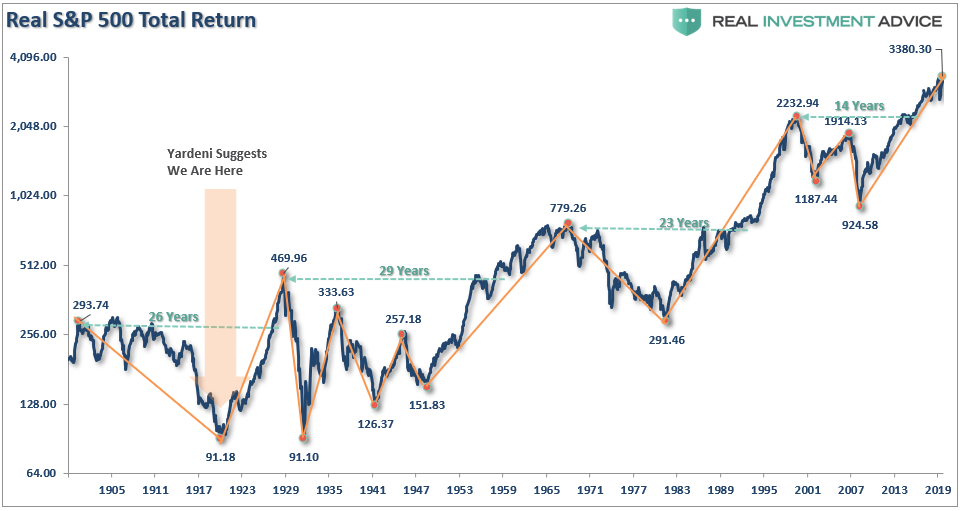

Technically Speaking: Why This Isn’t 1920. Valuations & Returns

Why this isn’t 1920 has everything to starting valuations and future returns. While, generally, I’m not too fond of comparisons between today’s markets and the past, Ed Yardeni made a comparison too bombastic to disregard in his blog.

Read More »

Read More »