Tag Archive: Taiwan

Weekly Market Pulse: A Very Contrarian View

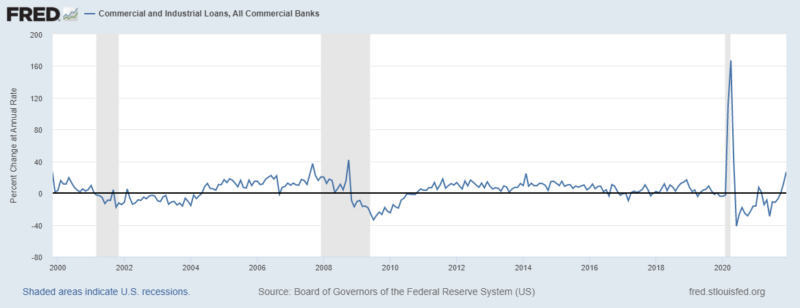

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace.

Read More »

Read More »

Today’s Big Events Still Lie Ahead

Overview: The day’s big events lie ahead: the UK’s budget, the Bank of Canada, and the central bank of Brazil meetings. The US data on tap, especially trade and inventories, will allow economists to fine-tune their forecasts for tomorrow’s first estimate of Q3 GDP. The mixed tech earnings helped spur a bout of profit-taking in Asia Pacific equities, where most of the large markets fell. Europe’s Stoxx 600 is posting a slight loss for the first...

Read More »

Read More »

The Euro and Sterling Remain within Tuesday’s Ranges

Overview: A new record high in the S&P 500 yesterday and news that Evergrande had made an interest rate payment failed to lift most Asia Pacific bourses, though Japan and Hong Kong, among the large markets, posted modest gains. The Dow Jones Stoxx 600 is pushing higher in the European morning to put its finishing touches on its third consecutive weekly gain. US tech is trading off, and this is weighing on the NASDAQ futures while the S&P...

Read More »

Read More »

Yesterday’s Dollar Recovery Stalls

Overview: US interest rates and the dollar turned higher following comments by the Fed's Vice Chairman Clarida, who appeared to throw his lot with the more hawkish members. The dollar recovered from weakness that had seen it fall to almost JPY108.70, its lowest level since late May, and lifted the euro to $1.19.

Read More »

Read More »

FX Daily, July 21: Did Japan Deliver a Fait Accompli to the US?

Overview: The biggest rally in US equities in four months has helped stabilize global shares today. In the Asia Pacific region, Japan, China, and Australian markets advanced. Led by information technology and consumer discretionary sectors, Europe's Dow Jones Stoxx 600 is up around 1.35% near the middle of the session.

Read More »

Read More »

FX Daily, June 10: ECB Meeting and US CPI: Transitory Impact

The ECB meeting and the US May CPI report is at hand. The US dollar is consolidating at a higher level against most of the major currencies. Softer than expected, inflation readings are weighing on the Scandis, which are bearing the brunt. The US 10-year yield closed below 1.50% for the first time in three months yesterday, and this may have helped underpin the Japanese yen.

Read More »

Read More »

FX Daily, May 12: The Dollar Stabilizes but Stocks, Not So Much

The markets remain on edge. Asia Pacific and US equities have yet to find stable footing, and inflation fears are elevated. The foreign exchange market has turned quiet as the dollar consolidates its recent losses.

Read More »

Read More »

FX Daily, April 8: Calm Capital Markets See the Dollar Drift

Overview: Global stocks are moving higher today. Fears of a new lockdown in Tokyo amid rising covid cases weighed on Japanese stocks, a notable exception as the MSCI Asia Pacific Index rose for its fifth session of the past six. Europe's Dow Jones Stoxx 600 is edging to new record highs today and is advancing for its fifth session of the past seven.

Read More »

Read More »

FX Daily, February 23: Dramatic Market Adjustment Continues

Overview: Rising rates continue to spur a rotation and retreat in stocks. Yesterday the NASDAQ sold-off by nearly 2.5% while the Dow Industrials eked out a minor gain. Equities are mostly higher in the Asia Pacific region while Japanese markets were on holiday.

Read More »

Read More »

FX Daily, January 29: Please Stay Seated, the Ride is not Over

Powerful corrective forces continue to grip the market. After a large rally to start the New Year, the correction is punishing. Most Asia Pacific equities markets were off again today to bring the week's loss to 2.5% to 5.5% throughout the region. Europe's Dow Jones Stoxx 600 is a little more than 1% lower on the day.

Read More »

Read More »

FX Daily, January 25: A Subdued Start to a Big Week

What promises to be an eventful week has begun off on a mostly subdued note. Asia Pacific equities moved higher, again led by Hong Kong and ostensibly mainland buying. The Hang Seng rose 2.4% to bring this year's gain to 10.75%. South Korea's Kospi also increased by more than 2%, and, so far this month, it is up almost 11.7%.

Read More »

Read More »

FX Daily, January 20: The Dollar Slips to New Lows against Sterling and the Mexican Peso

Global equities are moving higher today. Led by continued strong buying of Hong Kong shares, the MSCI Asia Pacific Index rose to new highs. The Hang Seng is up 6% this year and is approaching the 2019 record high. Australia's shares set a new record today. Japan and Taiwan bucked the trend.

Read More »

Read More »

FX Daily, January 11: Greenback Extends Recovery

Julius Ceasar is said to have "crossed the Rubicon" on January 10, 49 BCE, taking the 13th Legion into Rome, defying orders from the Senate, and precipitating the Roman Civil Wat that marked the end of the republic and the birth of the empire.

Read More »

Read More »

FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week's gains. The Dow Jones Stoxx 600 is off around 2.7% near midday in Europe.

Read More »

Read More »

FX Daily, August 20: FOMC Minutes Spur Profit-Taking

Overview: The FOMC minutes depicted a Federal Reserve that appeared to be not quite ready to take fresh initiatives, whether it is yield curve control or changing the composition or quantities of its bond purchases. This unleashed profit-taking on some of the large moves in equities, the dollar, and gold.

Read More »

Read More »

FX Daily, August 10: Monday in August

Overview: The new week has begun slowly with Singapore and Tokyo markets closed for national holidays. The MSCI Asia Pacific Index rose 2% last week and edged higher today, led by 1.5%-1.7% rallies in South Korea and Australia. Hong Kong was a notable exception and eased around 0.6%.

Read More »

Read More »

FX Daily, August 5: Corrective Pressures in the FX Market Prove Short-Lived

The drop in US yields to new lows amid paralysis in Washington, except apparently over a lip-syncing app's threat to US national security, sent the dollar back to its lows after a modest recovery in early North American trading yesterday.

Read More »

Read More »

FX Daily, January 13: Dismal Data Undercuts Sterling and Boosts Chances of a Rate Cut

Overview: There are two big stories today. The first is the large scale protests in Iran after the government admits to accidentally shooting down the commercial airliner amid the fog of war. The market impact seems minimal but fueling speculation that this, coupled with the economic hardship related to the US embargo, could topple the regime. Second, the UK reported that the economy unexpectedly contracted in November.

Read More »

Read More »

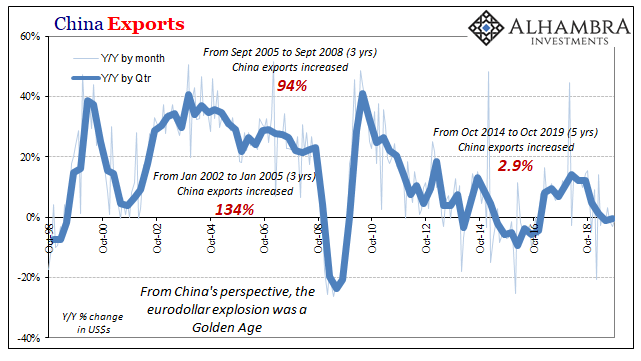

The Real Boom Potential

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving.

Read More »

Read More »

FX Daily, September 20: UK and India Provide Excitement Ahead of the Weekend

Overview: A word of optimism on a Brexit deal has sent sterling to its best level in two months. Corporate tax cuts sparked a more than 5% rally in Indian stocks as the week draws to a close. The MSCI Asia Pacific Index snapped a four-day losing streak to pare this week's decline. Europe's Dow Jones Stoxx 600 was flat for the week coming into today, and its four-week advance is at stake.

Read More »

Read More »