Tag Archive: Swiss National Bank

Der Nationalbank sind die Hände gebunden

EZB-Präsident Mario Draghi konstatierte letzte Woche zufrieden, dass die aktuellen Turbulenzen in einzelnen Staaten auch dort bleiben und nicht andere Länder anstecken. Seine Kollegen in der Nationalbank, die diese Woche ihren geldpolitischen Entscheid fällen, dürften das etwas anders sehen.

Read More »

Read More »

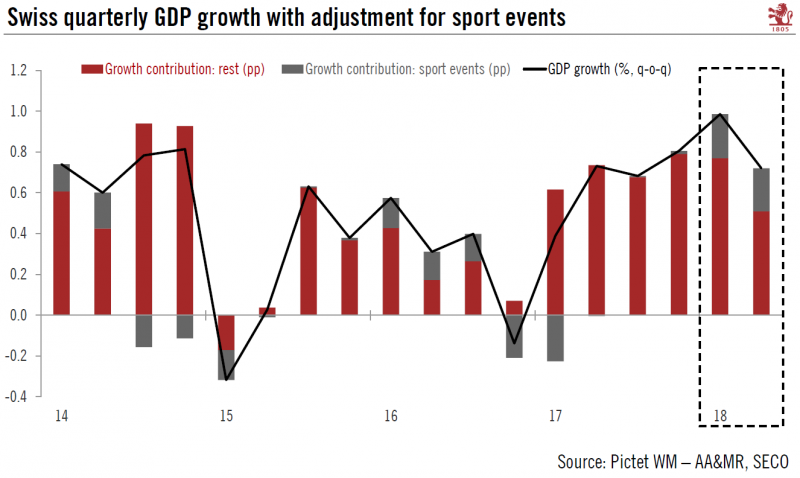

Switzerland Q2 growth numbers are impressive, but details are mixed

Manufacturing and sports events served as boosts to growth, while domestic consumption was a letdown.The latest Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2, slightly above our 0.6% projection and consensus. Average growth in the first half of 2018 was therefore the strongest since 2010.

Read More »

Read More »

Inflation ist nicht Inflation

Das südamerikanische Land Venezuela führt gerade vor, was geschehen kann, wenn die Inflation ausser Kontrolle gerät. Der Internationale Währungsfonds rechnet bis Ende Jahr mit einer Teuerung von 1 Million Prozent. Eine solche Inflation wird etwa erreicht, wenn sich das Preisniveau rund alle vier Wochen verdoppelt. Wenn sich Geld in einem solchen Ausmass entwertet, verliert es jeden Nutzen, denn dann kann es seine Funktionen als Mittel zur...

Read More »

Read More »

SNB banknote app updated for new 200-franc note

The Swiss National Bank’s ‘Swiss Banknotes’ app is designed to help the public familiarise themselves with the new banknotes. The popular app, which has been downloaded some 100,000 times, now also showcases the new 200-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

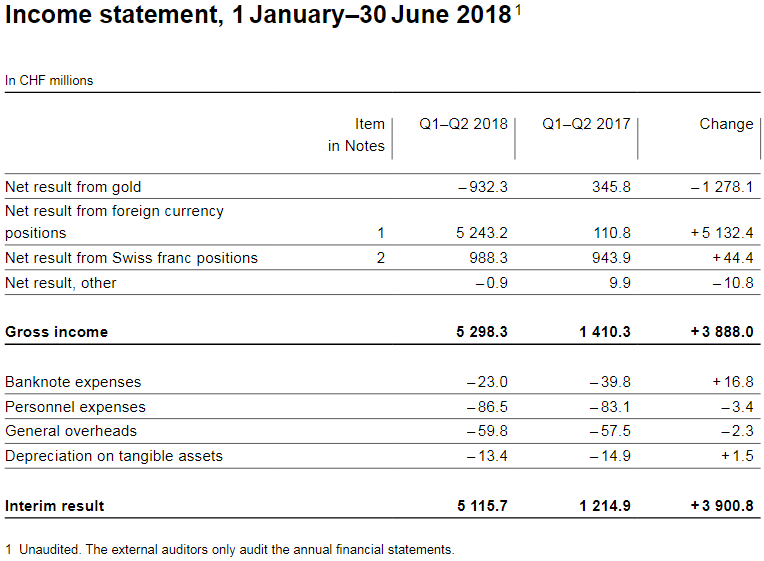

SNB reports a profit of CHF 5.1 billion for the first half of 2018

The Swiss National Bank (SNB) reports a profit of CHF 5.1 billion for the first half of 2018. A valuation loss of CHF 0.9 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.2 billion. The profit on Swiss franc positions was CHF 1.0 billion.

Read More »

Read More »

Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct.

Read More »

Read More »

Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘.

Read More »

Read More »

SNB Statement on the outcome of the popular vote of 10 June 2018

The Swiss National Bank (SNB) has acknowledged the outcome of the popular vote on the sovereign money initiative. The SNB has a constitutional and statutory mandate to pursue a monetary policy serving the interests of the country as a whole. It is charged with ensuring price stability while taking due account of economic developments.

Read More »

Read More »

Nach Vollgeld-Schlacht: Wir Schweizer dürfen nie mehr zum Spielball ausländischer Ideologen werden

Wer sich intensiv mit der fachlichen Materie „Vollgeld-Initiative“ auseinandergesetzt hat, kann aufatmen. Wäre diese Initiative angenommen worden, hätte deren Umsetzung unser Land in ein wirtschaftliches und politisches Chaos gestürzt.

Read More »

Read More »

Switzerland’s vote to change its monetary system – sensible or silly?

Sometimes Swiss voters are presented with questions that only specialists are equipped to answer. The vote on 10 June 2018 to change their monetary system appears to be one of these. On the surface it appears simple. Upon closer inspection it contains much complexity and uncertainty, compounded by a widespread misunderstanding of how the financial system works – banks do not act simply as intermediaries, lending out the deposits that savers place...

Read More »

Read More »

“Vollgeld – Was spricht dagegen? (Sovereign Money—What are the Problems?),” RABE, 2018

Die Vollgeld-Initiative will die Schweizer Geldpolitik komplett umkrempeln. Künftig soll nur noch die Nationalbank Geld herstellen dürfen, sowohl Banknoten und Münzen als auch das elektronische Geld. Die Schweizer Geschäftsbanken wie die UBS oder die CS, die heute 90% des elektronischen Geldes herstellen, soll das künftig verboten sein.

Read More »

Read More »

Konjunktur, Geldpolitik und eine riesige Bilanzsumme

Die Schweizer Konjunktur brummt wie schon lange nicht mehr. Vor allem zeigt der kürzlich publizierte Bericht der Seco-Expertengruppe, dass die Erholung auf breiter industrieller Basis stattfindet. Der Frankenschock von 2015 ist definitiv überwunden.

Read More »

Read More »

“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB.

Read More »

Read More »

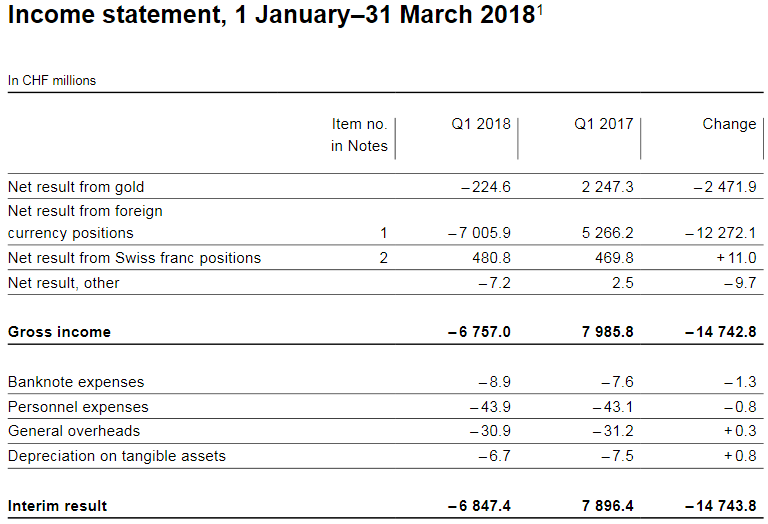

SNB loses 6.8 billion in Q1/2018

The Swiss National Bank (SNB) reports a loss of CHF 6.8 billion for the first quarter of 2018. A valuation loss of CHF 0.2 billion was recorded on gold holdings. The SNB’s financial result depends largely on developments in the gold, foreign exchange and capital markets. Strong fluctuations are therefore to be expected, and only provisional conclusions are possible as regards the annual result.

Read More »

Read More »

Weakening franc approaches symbolic mark

As the Swiss franc weakens towards the threshold CHF1.20 exchange rate, the likelihood remains slim that Switzerland’s central bank will alter monetary policy any time soon. On Thursday morning a euro cost CHF1.198 francs. In February, the price of a single euro fell to under CHF1.150. The greater the number of francs needed to buy another currency signals a weaker franc, and vice versa if the exchange rate declines.

Read More »

Read More »

Elektronisches Zentralbankengeld hat Vorteile

Die Schweizerische Nationalbank hat dem E-Franken eine Absage erteilt – zu Unrecht, sagt Dirk Niepelt im Interview mit finews.ch. Der Direktor des SNB-nahen Studienzentrums Gerzensee erklärt, warum digitales Geld Vorteile bringt. Vergangene Woche hat sich Andréa Mächler, Mitglied des dreiköpfigen Direktoriums der Schweizerischen Nationalbank (SNB), kritisch zur Einführung eines elektronischen Frankens durch die SNB geäussert, wie auch finews.ch...

Read More »

Read More »

US trade disputes indirectly threaten Swiss economy

Ongoing global trade disputes involving the United States are casting a potential shadow over Swiss economic growth, along with other international events, such as the Italian elections and Brexit. However, the Swiss economy is forecast to expand 2.4% this year and 2% in 2019.

Read More »

Read More »

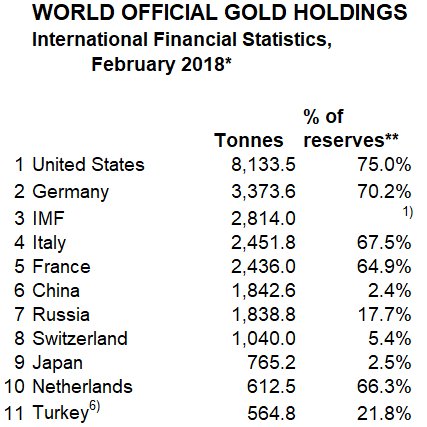

Swiss central bank records huge profits after franc slide

The Swiss National Bank (SNB) was less active on the foreign exchange markets last year, acquiring CHF48.2 billion ($50.8 billion) in foreign currency to weaken the franc. On Thursday, the central bank nonetheless confirmed massive profits on currency holdings in 2017. In 2017, the SNB purchased CHF48.2 billion in foreign currency to stop the Swiss franc appreciating – down from CHF67.1 billion in 2016.

Read More »

Read More »

New CHF200 banknote to be introduced in August

The Swiss National Bank (SNB) has announced that the latest addition to the new banknote series – the CHF200 note ($209) - will go into circulation on August 22. The brown note’s key motif will be physical matter. It will “showcase Switzerland’s scientific expertise”, the SNB said a press release on Monday.

Read More »

Read More »