Tag Archive: Swiss National Bank

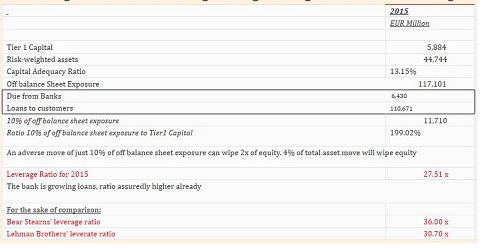

ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks...

Read More »

Read More »

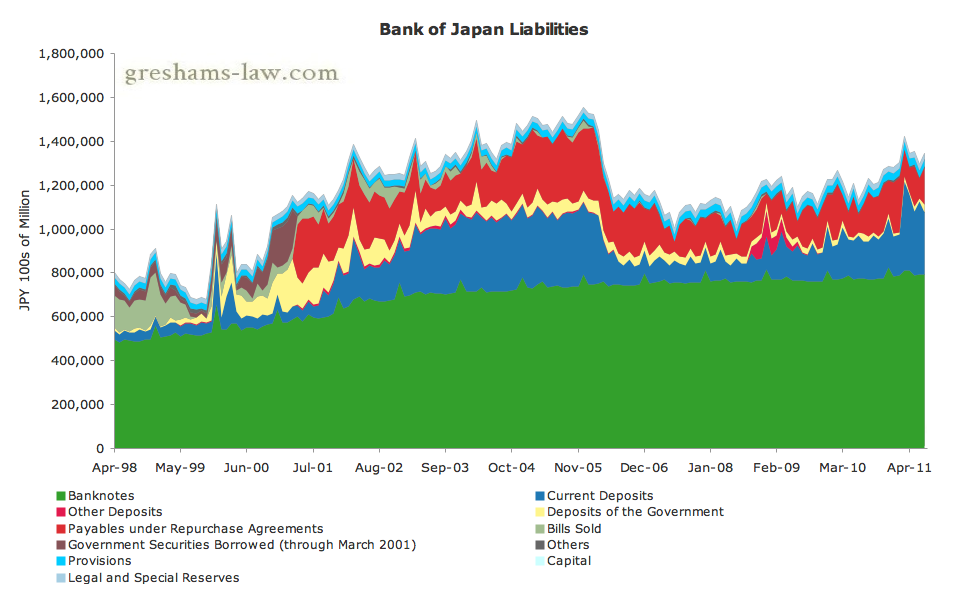

History of Bank of Japan Interventions

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.

As opposed to the Swiss National Bank, the Japanese only talk, they do not fight.

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

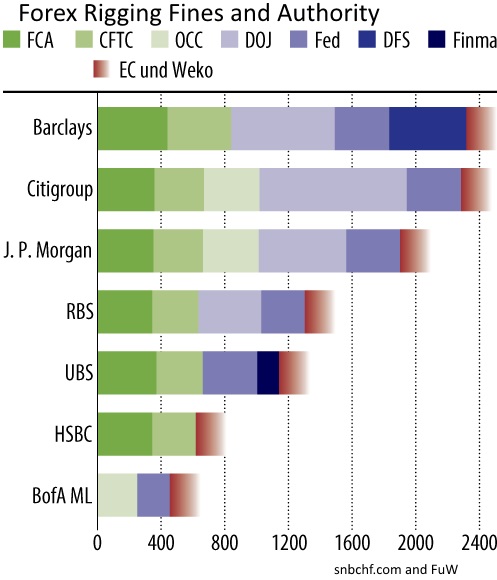

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

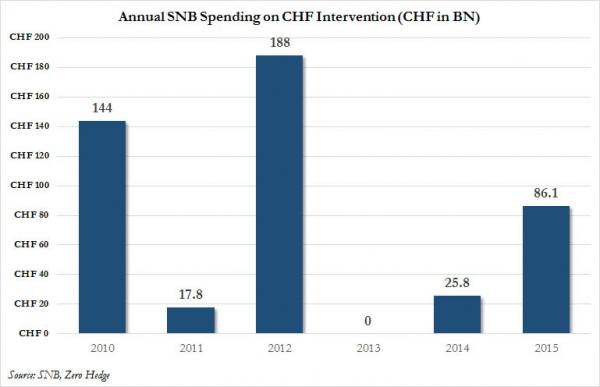

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

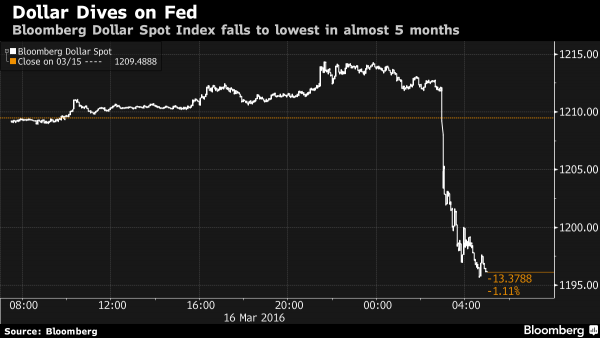

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

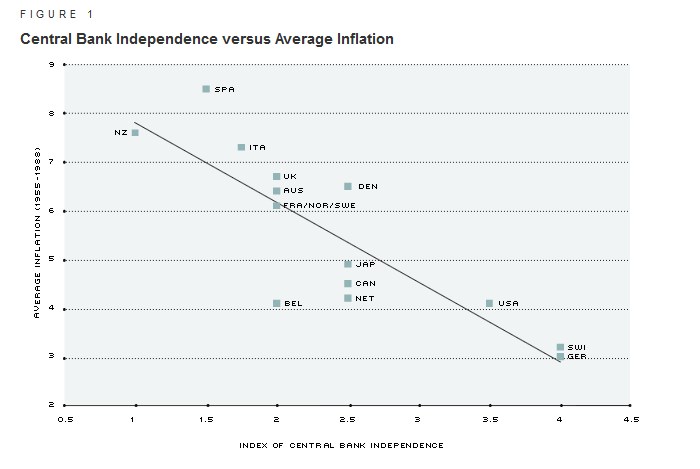

Central Bank Independence in Switzerland: A Farce

articles by Marc Meyer, one of the most critical voices against the SNB.

This post explains

--- That the SNB does not understand what assets and liabilities are - and therefore - it speculates with massive leverage.

--- The difference between good and bad deflation

--- Both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank independence in Switzerland has become a farce.

Read More »

Read More »

FX Daily 03/14: Five Central Banks Meet as Monetary Policy is Downgraded

Fixed exchange rates limit the degrees of freedom for policymakers. The breakdown of Bretton Woods in 1971 removed this constraint on official action, and the results were larger budget deficit and higher inflation. The zero bound on interest rates also posed a constraint on behavior. Until this year, despite the long struggle against deflation, the Bank …

Read More »

Read More »

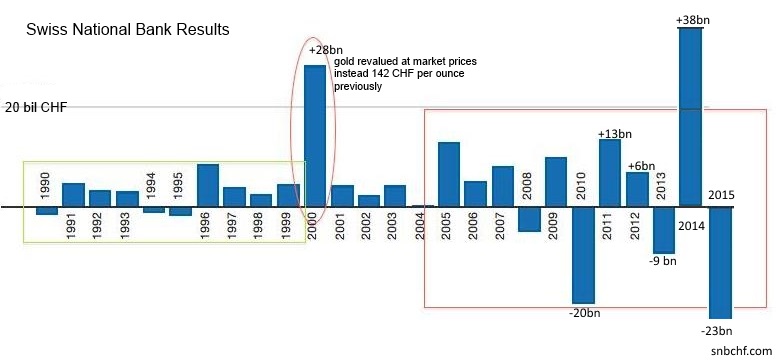

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »

SNB Reduced Loss from 50 Billion in June to 23 Billion

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July.

Read More »

Read More »

Central Banks Shiny New Tool: Cash-Escape-Inhibitors

Submitted by JP Koning via Moneyness blog,

Negative interests rates are the shiny new thing that everyone wants to talk about. I hate to ruin a good plot line, but they're actually kind of boring; just conventional monetary policy except in negative ...

Read More »

Read More »

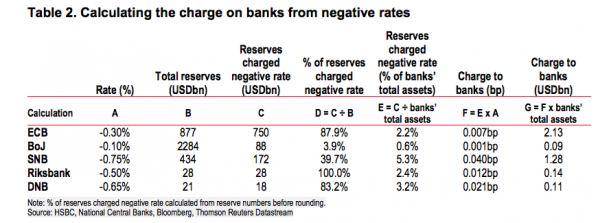

HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth.

For whatever reason, Haruhiko Kuroda’s move into NI...

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

Swiss Politicians Slam Attempts To Eliminate Cash, Compare Paper Money To A Gun Defending Freedom

As we predicted over a year ago, in a world in which QE has failed, and in which the ice-cold grip of NIRP has to be global in order to achieve its intended purpose of forcing savers around the world to spend the taxed product of their labor, one thi...

Read More »

Read More »

MXN Shorts Crushed After Mexican Central Bank Unexpectedly Hikes Rate By 50bps, Peso Soars

It was already a torrid day for commodity currencies, among which the MXN, or Mexican Peso, which were surging on today's latest crude short squeeze and then as if pulling a PBOC with just one intention - to crush the shorts - the Mexican Central Ban...

Read More »

Read More »

The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

Currency stability is a prerequisite for China's economic transition

Defending the yuan is prohibitively expensive – China cannot beat the market

Progressive devaluation managed by PBoC...

Read More »

Read More »

The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions...

Read More »

Read More »

How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Pan...

Read More »

Read More »

“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3...

Read More »

Read More »