Tag Archive: Reserves

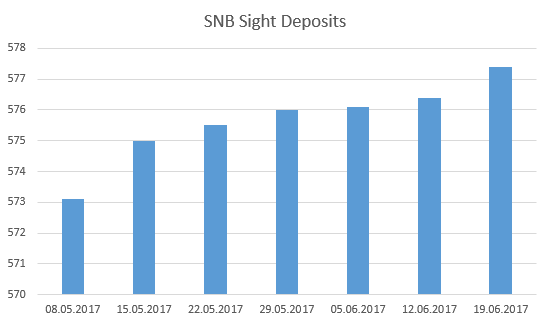

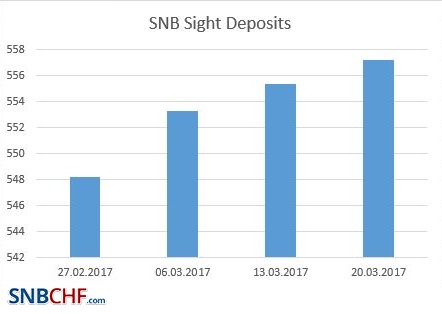

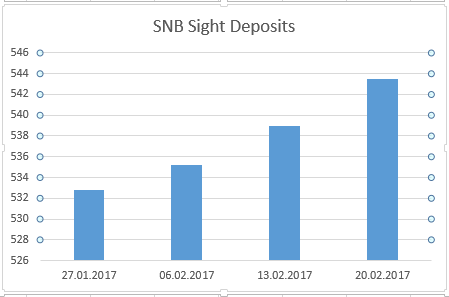

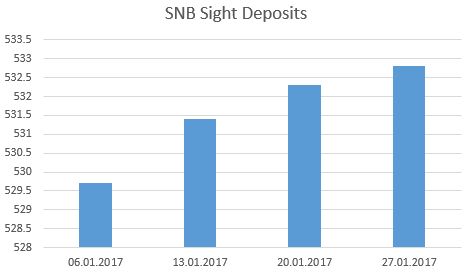

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

The sight deposits at the SNB increased by 5.2 billion francs compared to the previous week.

Read More »

Read More »

Greenback Returns Better Bid

Overview: After the making marginal new highs in

early North America yesterday, the dollar pulled back, arguable dragged lower

by the softness of US rates, helped by the sharp drop in oil prices and healthy

reception to the US three-year note auction. However, the greenback has

returned better bid today as the market continues to search for direction

post-FOMC and US jobs report. The euro and sterling are the weakest of the G10 currencies

through...

Read More »

Read More »

Dollar Jumps, while Surge in Covid Cases Raise Questions about China’s Pivot

Overview: Surging Covid cases in China and Hong Kong

are undermining hopes of a Covid-pivot and the US dollar is broadly higher.

Equities are under pressure to start the week. Most of the large bourses in the

Asia Pacific but Japan, fell earlier today. Europe’s Stoxx 600 is paring last

week’s minor gain, which was the fifth consecutive weekly rise. US stock futures

are lower, while the 10-year US Treasury yield is flat near 3.83%. European

yields...

Read More »

Read More »

Intraday Momentum Indicators Point to a Dollar Recovery After the Employment Report

Asia Pacific bourses followed yesterday’s US loss, but after opening lower Europe’s Stoxx 600 has steadied. US futures are narrowly mixed ahead of the US jobs report. Benchmark 10-year yields are higher across the board.

Read More »

Read More »

What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns.

Read More »

Read More »

A Word on Q3 COFER-It Might not be What You Think

The IMF offers the most authoritative report on central bank reserves on a quarterly basis with a quarter lag. The report, the Currency Composition of Official Foreign Exchange Reserves (COFER), covering Q318 has been released. It may be have been overlooked during the holidays, but if and when the pundits see it, the leading takeaway is that the dollar's share of global reserves fell below 62% for the first time five years.

Read More »

Read More »

The Dollar and Its Rivals

I was in graduate school, studying American foreign policy when I stumbled on Riccardo Parboni's "The Dollar and Its Rivals." This thin volume showed how the foreign exchange market was the arena in which capitalist rivalries were expressed. More than any single book, it set me on a more than 30-year path.

Read More »

Read More »

Weekly SNB Interventions Update: Slight Rise after Weeks of Near-Zero Interventions

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »

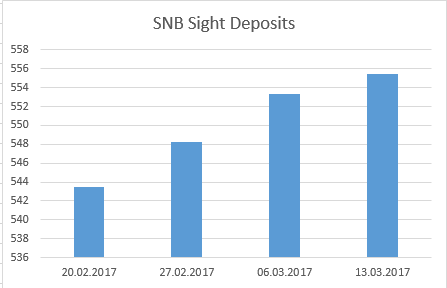

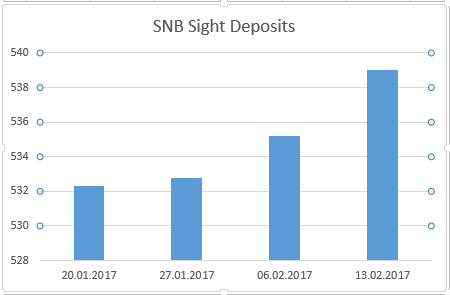

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 1.6 bn CHF at EUR/CHF 1.07 - 1.0750. This is less than previously.

Read More »

Read More »

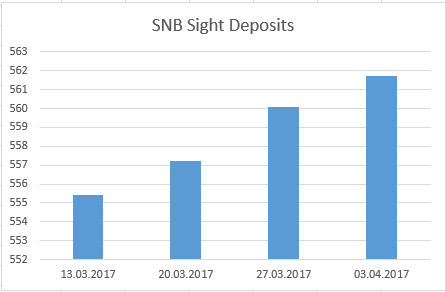

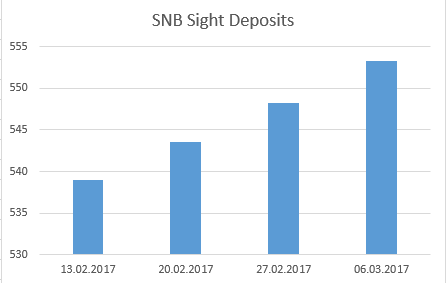

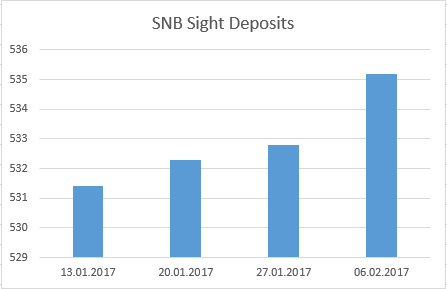

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 2.9 bn CHF at EUR/CHF 1.07. For us, clearly too much and too risky; she will not maintain this pace over a longer term. Hence the EUR/CHF is prone to fall again.

Read More »

Read More »

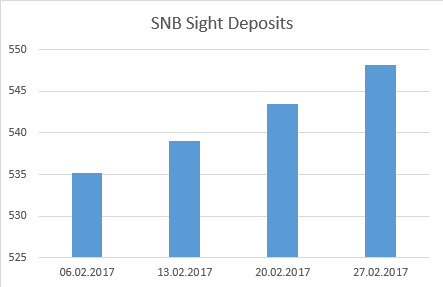

Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

The EUR/CHF suddenly appreciated with the ECB meeting, when Draghi seemed less dovish than before. The rate rose from the previous 1.0650 to over 1.0750. With the SNB meeting, the EUR/CHF receded again. SNB interventions, are currently at 2 bn. per week compared to 5 bn. before Draghi.

Read More »

Read More »

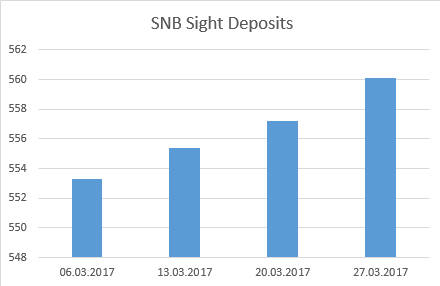

Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

The SNB intervened less than before. Investors might have changed their positions after a less dovish ECB.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Each week an intervention record.

Once again a massive SNB intervention and a post Trump election record: 5,1 billion, at far too expensive FX rates: EUR rate of 1.0648 and USD/CHF over parity.

Read More »

Read More »

Each Week the Same: Another SNB Intervention Record

Once again: another record in SNB intervention record for the period after Trump's election: an increase of 4.7 billion CHF in sight deposits. The trend for EUR/CHF versus parity getting confirmed.

Read More »

Read More »

Not Recession, Systemic Rupture – Again

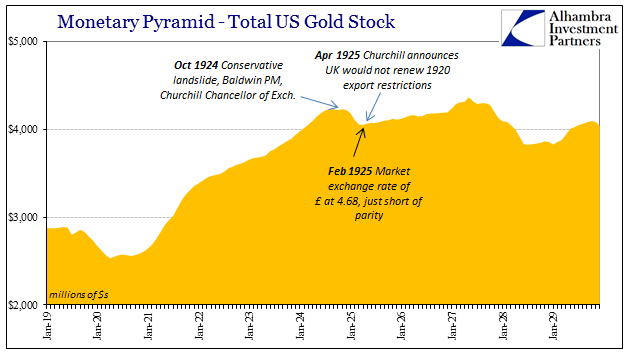

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Another Post-Trump SNB Intervention Record

A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But one should realize that private investors will need to buy the EUR at 1.10, but the SNB is not willing to do so any more. Hence we must see SNB interventions of zero, before EUR/CHF goes to 1.10.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Strong Swiss Trade Balance: SNB allows EUR/CHF to 1.0680

With the strong Swiss trade balance, the SNB let EUR/CHF fall to 1.0680. SNB intervenes for 0.5 bn CHF. Speculators are net short CHF with 13.6K contracts against USD, nearly unchanged.

Read More »

Read More »

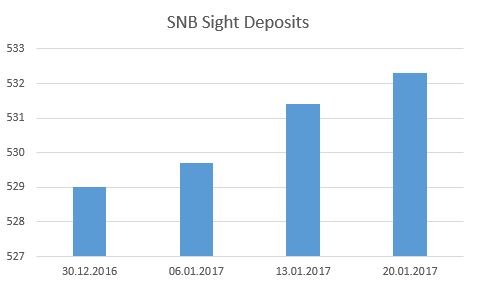

Weekly Sight Deposits and Speculative Positions: Weaker dollar let SNB accumulates losses

EUR/CHF is slightly above the “in-official minimum band”. The weaker dollar leads to bigger SNB losses in January. SNB intervenes for 0.9 bn at higher EUR/CHF rate. Speculators are net short CHF with 13.7K contracts against USD.

Read More »

Read More »