Tag Archive: reserve currency

China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

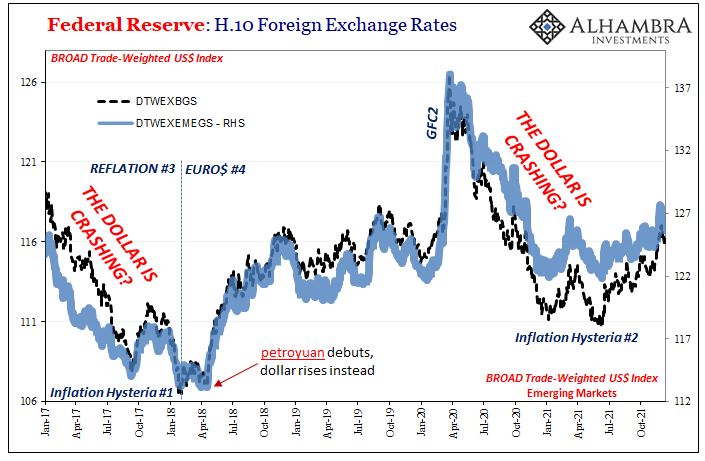

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike.

Read More »

Read More »

Seriously, Good Luck Dethroning the (euro)Dollar

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y.

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

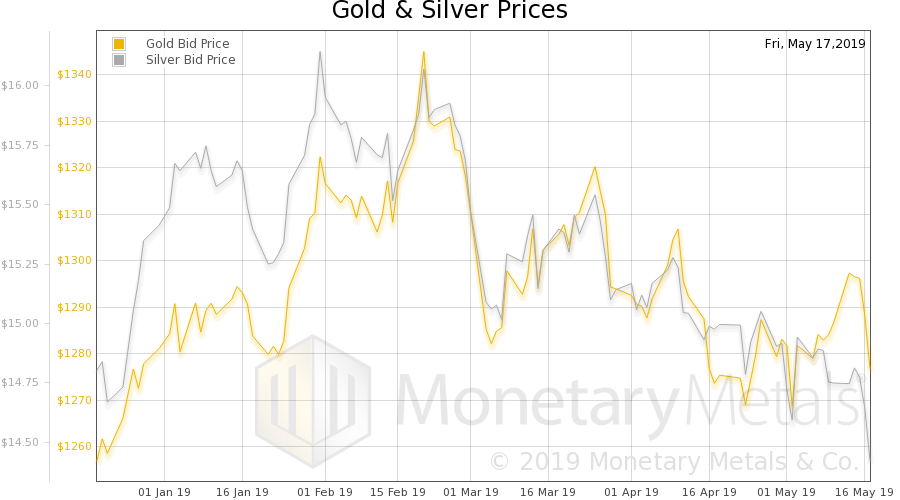

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

The Shocking Reason For FATCA… And What Comes Next

Submitted by Nick Giambruno via InterntionalMan.com,

If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone.

Few people have, and even fewer fully grasp the terrible things it foreshadows.

FATCA is a U.S. ...

Read More »

Read More »

Square Holes And Currency Pegs

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years....

Read More »

Read More »

When Will the Renminbi Become a Reserve Currency?

We recently explained that China will overtake the United States not only for GDP but also for wealth. In this post we explain what is still missing to become a world reserve currency and how quickly this could happen.

Read More »

Read More »

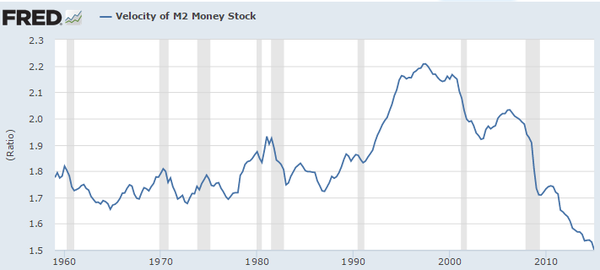

Central Banks’ Quasi-Fiscal Deficits and Potential Hyperinflation

There are different discussions ongoing if a central bank may monetize debt and act of a quasi-fiscal agent. One opinion was the Modern Monetary Theory that advocates monetizing debt.

Read More »

Read More »

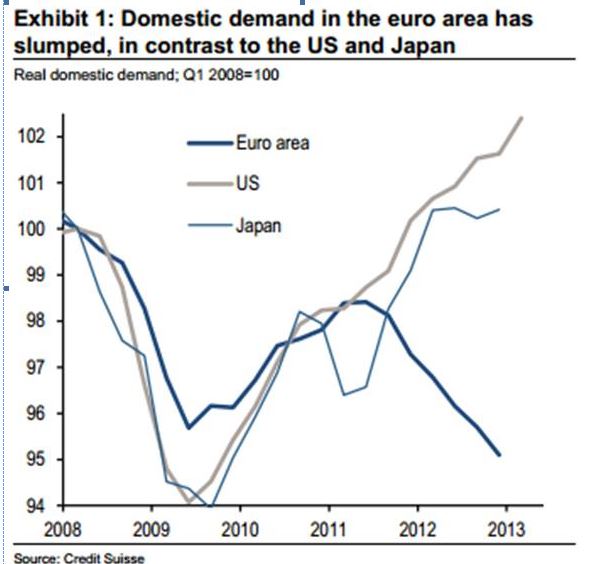

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »