Donald Trump’s poll numbers were looking increasingly unhealthy at the time of writing, but at least the cocktail of drugs administered to the coronavirus-stricken President appears to have worked.

Read More »

Tag Archive: Pictet strategy

House View, September 2020

A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable.

Read More »

Read More »

Horizon 2020: long-term investing in a world marked by pandemic

The sudden, violent recession triggered by this year’s covid-19 outbreak provides further impetus to pre-existing economic and market dynamics.

Read More »

Read More »

House View, July 2018

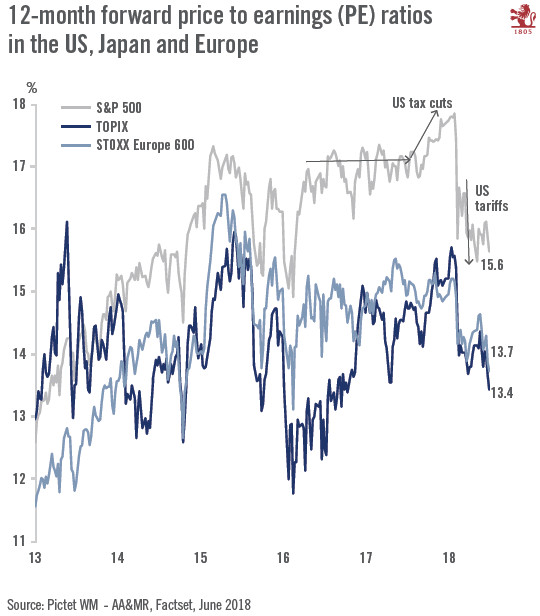

On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.

Read More »

Read More »

House View, May 2018

Pictet Wealth Management's latest positioning across asset classes and investment themes. In spite of a certain loss of momentum in positive surprises, a strong Q1 earnings season continues to justify our bullish stance on equities in most regions. We reiterate our negative view on core government bonds and remain short duration. Volatility is still higher than last year, and has increased noticeably in the bond market once again.

Read More »

Read More »

House View, April 2018

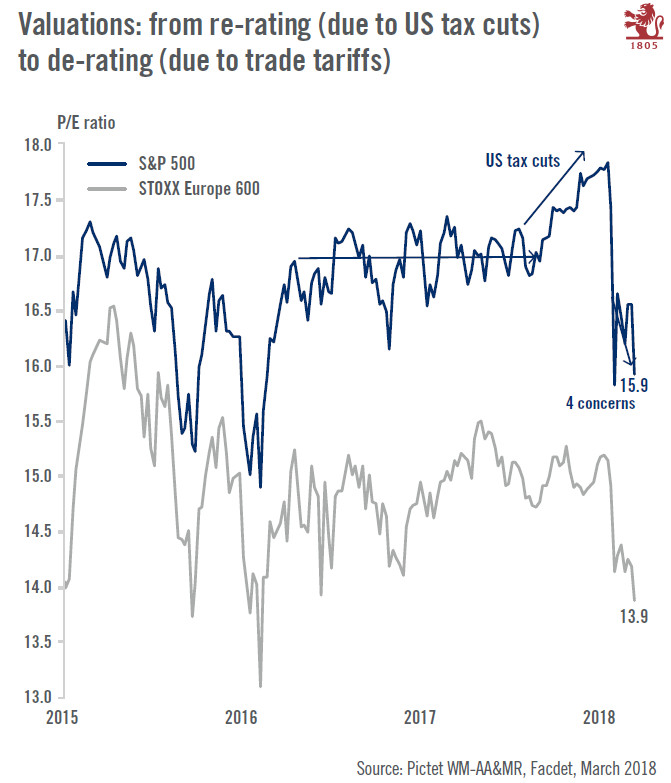

Pictet Wealth Management's latest positioning across asset classes and investment themes. While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally.

Read More »

Read More »