Tag Archive: None

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

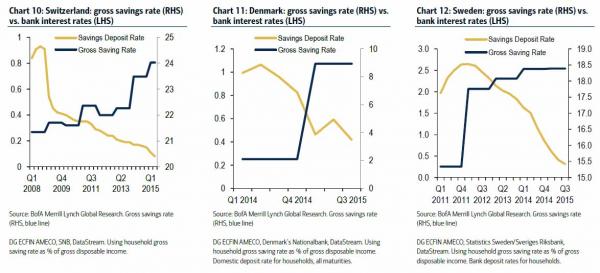

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

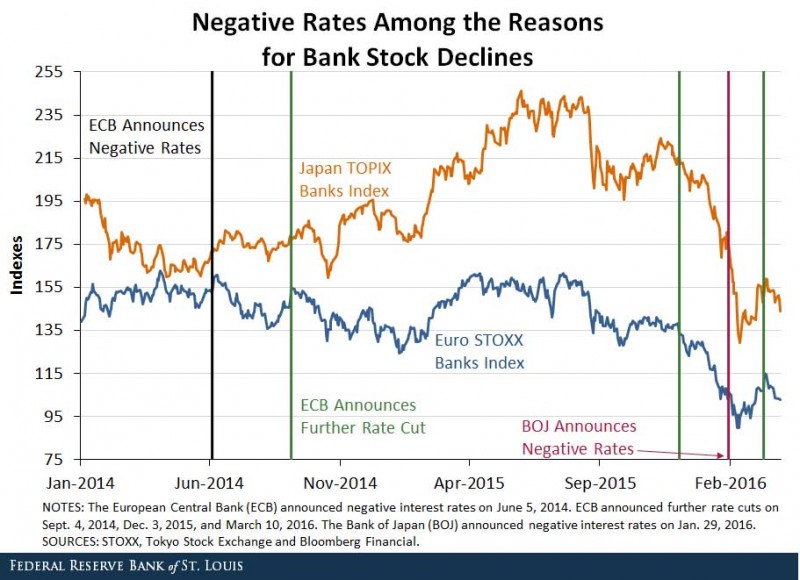

St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

"At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?" Those are the shocking wor...

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

Wall Street and SNB In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name.

Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to unde...

Read More »

Read More »

Malaysia CDS Spike After Abu Dhabi Puts Scandal-Ridden 1MDB In Default, Funds hidden in Switzerland

Over the better part of the past year, we’ve documented the curious case of 1MDB, Malaysia’s government investment fund founded in 2009.

It’s a long and exceptionally convoluted story that doesn’t exactly lend itself to a concise summary but suffice...

Read More »

Read More »

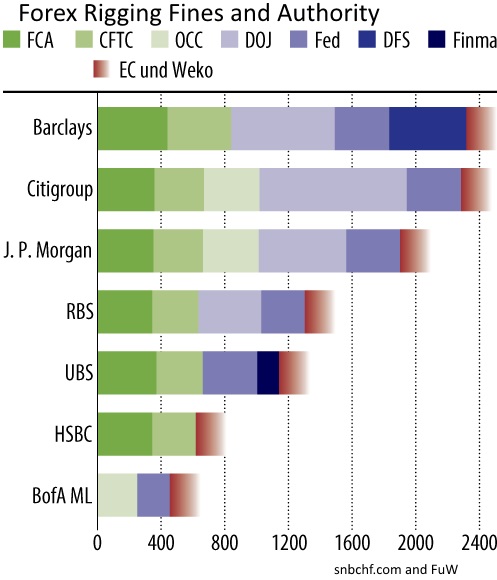

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

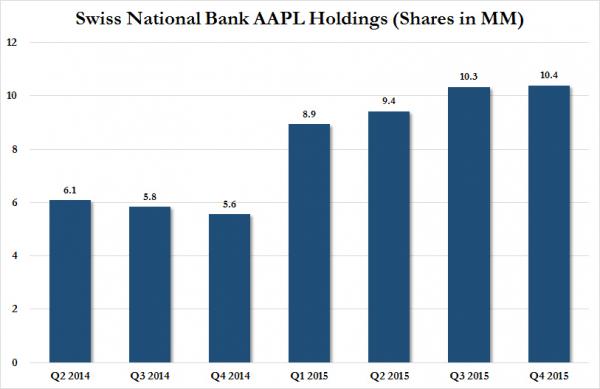

The Swiss National Bank Doubled Its Apple Holdings in 2015

In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled - in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions...

Read More »

Read More »