Tag Archive: newsletter

Swiss visit doctor less often than most of Europe

In 2017, an average Swiss resident visited a medical professional 4.32 times, according to data recently published by Eurostat. Only residents of Denmark (4.30), Sweden (2.77) and Cyprus (2.09) went to see a doctor less often. The average number of visits across those European countries with 2017 data was 6.84.

Read More »

Read More »

Parliament rubber stamps free trade deal with Indonesia

The Swiss parliament has given the go-ahead for a free trade deal with Indonesia, although not without debates about sustainability and the Asian country’s production of palm oil. Almost exactly a year after the deal was signed between the European Free Trade Association (EFTA) and Indonesia, the Swiss parliament gave its green light on Thursday.

Read More »

Read More »

Corporate Debt Time Bomb

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US.

Read More »

Read More »

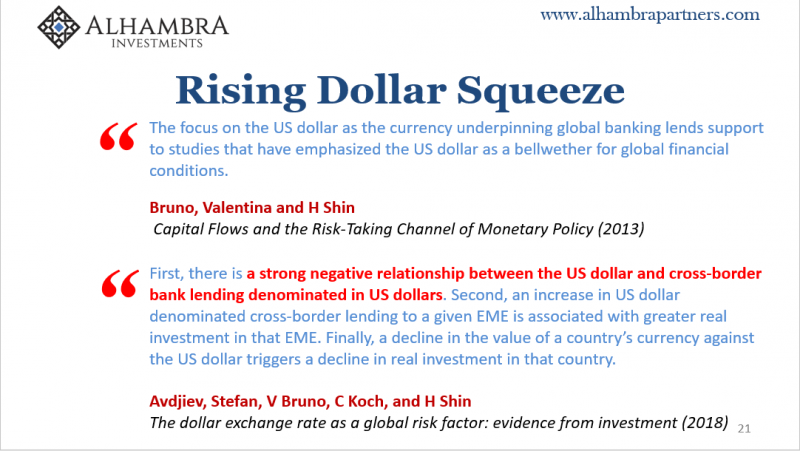

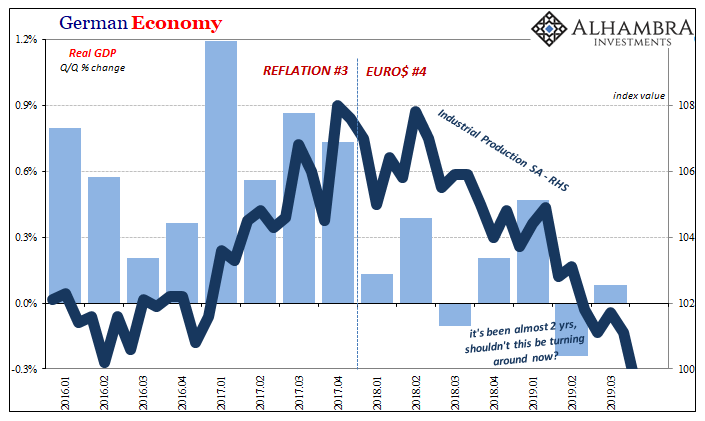

Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.”

Read More »

Read More »

Consumer Preferences Are Harder to Measure than the Behavioral Economists Think

A recent paper in the Journal of Consumer Psychology (JCP) has started a debate on the accuracy of "loss aversion," the idea that people are driven by fear of losses more than they are by the potential for gain. Core to behavioral economics, this idea has been rather universally accepted and been part of the awarding of two economics Nobel Prizes, in 2002 to Daniel Kahneman and in 2017 to Richard Thaler.

Read More »

Read More »

FX Daily, December 20: Sterling Trades Higher after Test on $1.30

Overview: The holiday mood has tightened its grip on the capital markets, and global investors have nearly completely ignored the impeachment of the US President as it has little economic or policy significance. US equities reached new record highs yesterday with the S&P 500 moving above 3200.

Read More »

Read More »

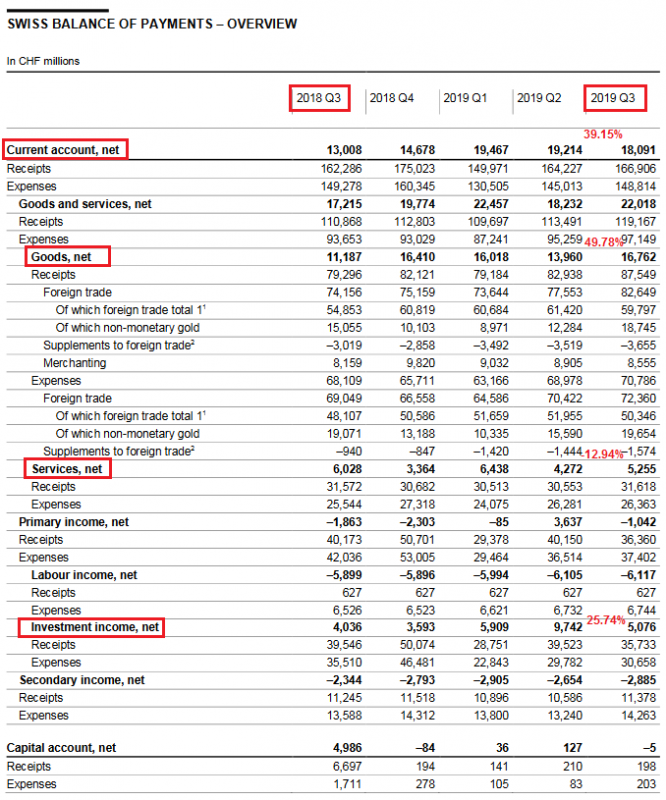

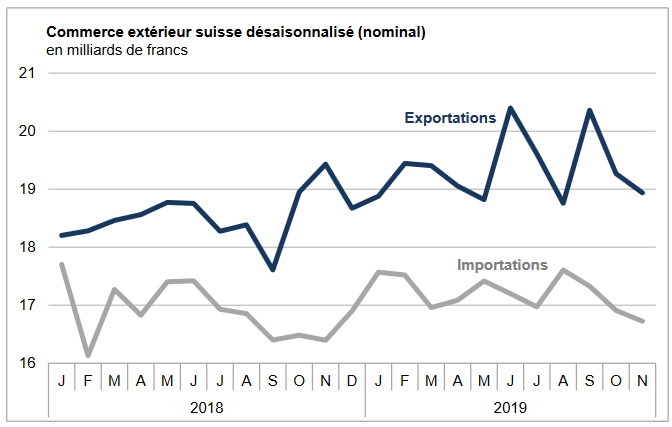

Swiss Balance of Payments and International Investment Position: Q3 2019

In summary: Nearly any change against the third quarter of 2018. About the same figures. But clearly and – as usual – a massive surplus. Key figures: Current Account: Up 39.15% against Q3/2018 to 18.09 bn. CHF. of which Goods Trade Balance: Plus 49.78% against Q3/2018 to 16.76 bn. of which the Services Balance: Minus 12.94% to 5.25 bn.

Read More »

Read More »

Rosenblatt Goes Full Bear On Apple With $150 Target As China iPhone Sales Slump

Rosenblatt Securities analyst Jun Zhang maintained a sell rating on Apple with a price target of $150 per share, citing a decline in iPhone sales in China is leading to a wave of production cuts by the company. "Based on our recent channel checks, we believe Apple's total iPhone sales in China were down ~-30% y/y in November," said Zhang in a note to clients on Tuesday.

Read More »

Read More »

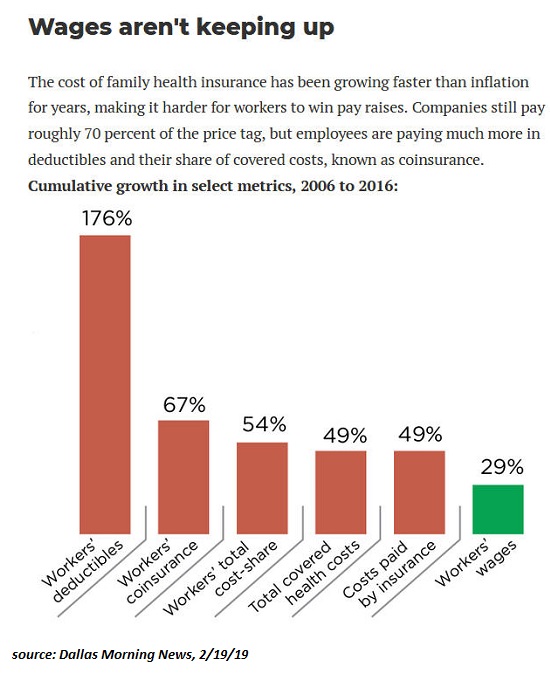

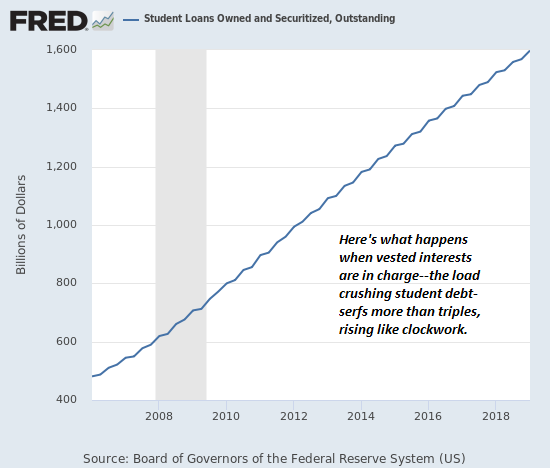

Skyrocketing Costs Will Pop All the Bubbles

The reckoning is coming, and everyone who counted on "eternal growth of borrowing" to stave off the reckoning is in for a big surprise. We've used a simple trick to keep the status quo from imploding for the past 11 years: borrow whatever it takes to keep paying the skyrocketing costs for housing, healthcare, college, childcare, government, permanent wars and so on.

Read More »

Read More »

OK Boomer, OK Fed

Eventually the younger generations will connect all the economic injustices implicit in 'OK Boomer' with the Fed. Much of the cluelessness and economic inequality behind the OK Boomer meme is the result of Federal Reserve policies that have favored those who already own the assets (Boomers) that the Fed has relentlessly pumped higher, to the extreme disadvantage of younger generations who were not given the opportunity to buy assets cheap and ride...

Read More »

Read More »

Outlook 2020 | Buy Gold and Silver To Hedge Massive Risks including U.S. ‘Insolvency’

Buy gold and silver to hedge risks in 2020. IG interview Mark O’Byrne of GoldCore

With late cycle risks and concerns about global growth, many Wall Street analysts are increasingly bullish on gold. Mark O’Byrne, founder at GoldCore spoke to IGTV’s Victoria Scholar about the outlook for gold in 2020.He explained why most analysts including GoldCore are optimistic on both gold and silver.

Read More »

Read More »

FX Daily, December 19: Whiff of Inflation in the Air

It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year.

Read More »

Read More »

Swiss Trade Balance November 2019: Foreign trade continues to contract

As in the previous month, cross-border flows of goods fell in both directions of traffic in November 2019. In seasonally adjusted terms, exports fell 1.7% on a month compared to 1.1% for imports. Swiss sales fell back to their level at the start of 2019, while admissions fell by almost a billion francs. The trade balance closed with a surplus of 2.2 billion francs.

Read More »

Read More »

Swiss railways are becoming safer, new figures show

There has been a fall in the number of accidents and fatalities on the Swiss railways, according to new national figures. On Tuesday, the Federal Statistical Office reported a total of 70 rail accidents and 14 deaths in 2018. This is the lowest number of annual fatalities since 2011. In the 2000s there were between 200 and 282 reported accidents each year and 20-40 deaths, excluding suicides on the Swiss rail network.

Read More »

Read More »

Poverty in Switzerland rises 10 percent in a year

Although Switzerland is rich, poverty within the country continues to rise, says a report released on Tuesday. Poverty affected 675,000 people including 100,000 children in 2017, a 10% increase on the previous year, according to the report (in French) by the non-governmental organisation Caritas.

Read More »

Read More »

Latest European Sentiment Echoes Draghi’s Last Take On Global Economic Risks

While sentiment has been at best mixed about the direction of the US economy the past few months, the European economy cannot even manage that much. Its most vocal proponent couldn’t come up with much good to say about it – while he was on his way out the door. At his final press conference as ECB President on October 24, Mario Draghi had to acknowledge (sort of) how he is leaving quite the mess for Christine Lagarde.

Read More »

Read More »

Where’s the Inflation? It’s in Stocks, Real Estate, and Higher Ed

In my days before I worked for the Mises Institute, I had a colleague who knew I associated with Austrian-School economists. In the wake of the bailouts and quantitative easing that followed the 2008 financial crisis, he'd sometimes crack "where's all that inflation you Austrians keep talking about?"

Read More »

Read More »

Hard Brexit Redux?

The risks of a hard Brexit are perhaps higher than markets appreciated. Here, we set forth some possible scenarios as to what may unfold after the January 31 deadline. Uncertainty is likely to be protracted and markets hate uncertainty. As such, we see UK assets continuing to underperform.

Read More »

Read More »

Fed Is Monetizing 90 percent of U.S. Deficit to Keep Interest Rates from Rising and Crashing Markets

By Daniel R. Amerman, CFAAs can be seen in the graph above, for the last 12 weeks there has been a stunning visual correlation between the yellow bars of the total weekly funding of deficits by the Federal Reserve, and the green bars of the weekly deficit spending by the United States government.

Read More »

Read More »