Tag Archive: newsletter

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 21 novembre 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

Dollar Jumps, while Surge in Covid Cases Raise Questions about China’s Pivot

Overview: Surging Covid cases in China and Hong Kong

are undermining hopes of a Covid-pivot and the US dollar is broadly higher.

Equities are under pressure to start the week. Most of the large bourses in the

Asia Pacific but Japan, fell earlier today. Europe’s Stoxx 600 is paring last

week’s minor gain, which was the fifth consecutive weekly rise. US stock futures

are lower, while the 10-year US Treasury yield is flat near 3.83%. European

yields...

Read More »

Read More »

Hans-Werner Sinn: “Die Apokalypse ist die Realität” l The Pioneer Briefing l 21. November 2022

The Pioneer Briefing von Gabor Steingart. Am 21. November 2022 mit den folgenden Themen:

Im Interview: Der Ökonom und ehemalige Präsident des ifo-Instituts Prof. Hans-Werner Sinn spricht über seine Sorgen in Zeiten von Inflation und Rezession.

Die Börsenreporterinnen Anne Schwedt und Annette Weisbach über den größten Skandal der Silicon-Valley-Geschichte und geben einen Ausblick auf die kommende Börsenwoche.

Nach Elon Musk-Umfrage: Trump wieder...

Read More »

Read More »

Russell 2000 technical analysis in 30 seconds.

Looks like RTY is headed towards the area close to the 1800 round number, next. Watch the double technical support as mentioned within the chart.

Updates may be provided within the comment section on:

https://www.forexlive.com/technical-analysis/russell-2000-technical-analysis-in-30-seconds-20221121/

Read More »

Read More »

Total Funding to Portuguese Fintech Companies Surpasses EUR 1B Mark

In 2022, the Portuguese fintech ecosystem entered a new stage of development, marked by greater maturity of the sector, continued innovation through partnerships and a dynamic venture capital (VC) market, a new report by industry trade group Portugal Fintech, in collaboration with KPMG, Visa and law firm Morais Leitao, claims.

The Portugal Fintech Report 2022, released in October, shows a resilient fintech industry that has continued to grow,...

Read More »

Read More »

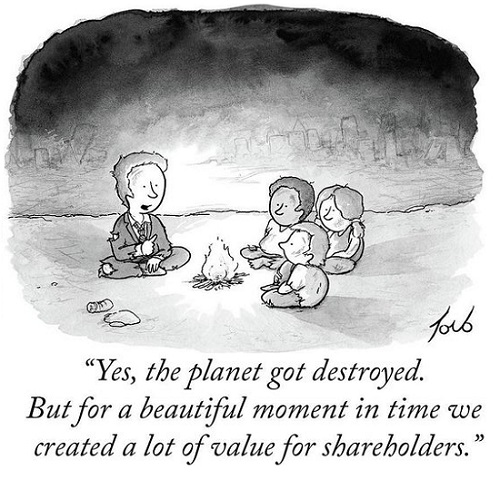

There’s No Bottom Until Frenzied Speculation Turns to Dust

Only when speculative sizzle attracts no buyers / marks will the bottom be in. There hasn't been a truly organic bottom in stocks in decades. Fifteen years of relentless central bank manipulation since the 2008-09 Global Financial Meltdown has persuaded punters that central banks will always save us should the market turn down because relentless central bank suppression of interest rates and expansion of liquidity (a.k.a. free money for financiers)...

Read More »

Read More »

Morning News mit Oliver Klemm

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Two out of three Swiss resorts raise ski-pass prices

Some ski lift companies are charging up to 15% more for passes this winter as high energy prices bite, a survey by CH Media shows.

Read More »

Read More »

China macht uns Sorgen! DAX = Short? – “DAX Long oder Short?” mit Marcus Klebe – 21.11.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

Relying on Experts: A Proven Path to Failure

The warning lights on the dashboard of your car suddenly light up. You naturally take it to a mechanic to diagnose and repair. Cars are complex. You don’t have the time or accumulated expertise to figure out what is happening or to fix it.

We rely on experts daily.

Read More »

Read More »

How Easy Money Fueled the FTX Crypto Collapse

The collapse of the crypto exchange FTX may prove to be a canary in the coal mine of the easy-money fueled crypto bubbles. FTX's collapse has exposed just how little due diligence is actually taking place among investors who are apparently willing to put large amounts of cash in whatever place looks like the hottest new thing and promises—without convincing evidence—big-time returns.

Read More »

Read More »

The weekend forex technical report for the week starting November 21, 2022

Greg Michalowski of Forexlive.com looks at the technicals that are driving the forex market heading into the new trading week starting November 21, 2022.

In the video, he looks at the EURUSD, USDJPY, GBPUSD, USDCHF, USDCAD, AUDUSD and the NZDUSD

Read More »

Read More »

COP27: does it go far enough?

COP27, the United Nations climate conference, has drawn to a close in Egypt. The Economist’s environment editor, Catherine Brahic, shares her assessment on the talks' breakthroughs, the frantic conclusion of the summit and the limitations of the agreement that emerged.

00:00 - COP27 has drawn to a close

00:17 - The final 24 hours

01:04 - Successes: loss and damage and finance

02:10 - Where COP27 fell short

03:22 - Challenges for COP28

A new UN...

Read More »

Read More »

WIR WOLLEN DOCH ALLE NUR FRIEDEN!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Thomas Andreas Beck @ Kongresspark (Kultursommer Wien, Open Air), So 7.8.2022 @Kultursommer Wien

Foto © https://www.medienmanufaktur.com/thomasandreasbeck

Kultursommer Wien, Open Air

Sonntag, 7. August 2022 20 : 00 (5:16)

https://kultursommer.wien

Kongresspark

1160 Wien

vienna, austria

https://linktr.ee/thomasandreasbeck

Thomas Andreas Beck

Thomas Pronai

Georg Allacher

Kultursommer Wien/// 7/8/2022

BECK | PRONAI | ALLACHER

██████████████████

███████████

███████

█████

████

███

██

█

0:00 soundcheck

3:33 moderation 1

███████████

5:16...

Read More »

Read More »

Übersterblichkeit steigt massiv an – was ist der Grund?

Die offizielle Übersterblichkeit im Oktober 2022 in Deutschland liegt bei sagenhaften 19% und das ist alles andere als normal! Doch woran kann es liegen? Einer Hitzewelle? Nachwirkungen der Corona-Maßnahmen? Dem Virus selbst geschuldet oder doch Nebenwirkungen der uns als sicher versprochenen Impfungen? Die Gerüchteküche brodelt und gemeinsam mit euch gehe ich jede mögliche Ursache auf den Grund und schaue, welche am wahrscheinlichsten ist.

Mein...

Read More »

Read More »

Ausgaben eines Millionärs in der Schweiz (niedriger als gedacht)

Zum Originalvideo: &t=313s

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

Trading Wochenanalyse für KW 47/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s zum kostenlosen EAthon Event:

https://www.digistore24.com/redir/464094/Trading360

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#BigPicture #Chartanalyse #MarcusKlebe

HIER geht es zur Webinarserie: TRADEN MIT KLEINEM KONTO IN 2022...

Read More »

Read More »