Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Tag Archive: monetary stimulus

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

Helicopter Money against Animal Spirits and our Critique

The newest paper by McCulley and Poszar "Helicopter Money: or how I stopped worrying and love fiscal-monetary cooperation" presents fiscal policy and monetary policy along these two criteria

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »

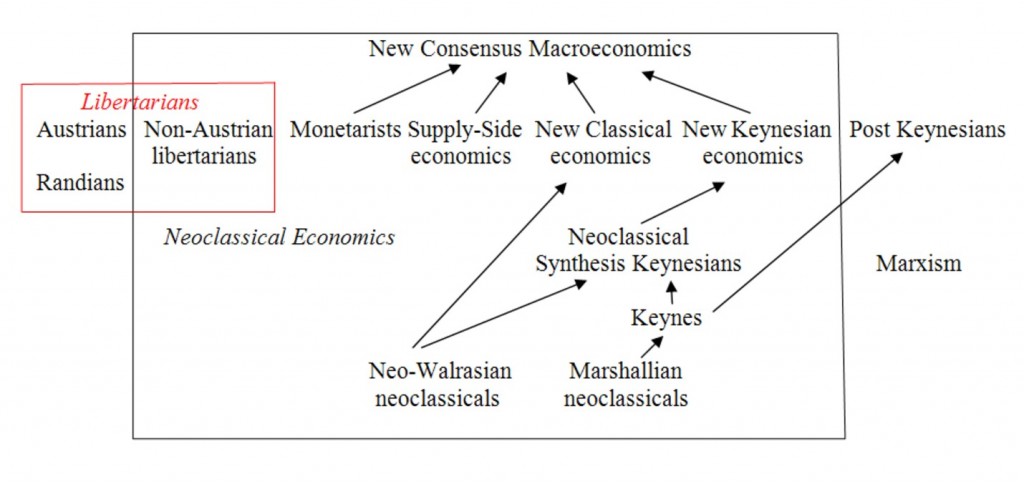

Traditional Monetarist vs. Market Monetarists

Along the double mandate of the federal reserve, monetarists can be divided into. - traditional monetarists that focus on a slow increase of money supply in order to avoid price inflation. - Market monetarists that want to target growth and income instead of inflation.

Read More »

Read More »

Brad DeLong on Jackson Hole and Quantitative Easing

Berkeley Professor Brad DeLong has delivered a nice allegorical entry in his type pad on a quick Quantitative Easing. Letting speak old greek mythological figures he hides his personal opinion. A half now completely written platonic dialogue on what the Federal Reserve is Doing — or not Doing — Right Now DeLong explains the …

Read More »

Read More »