Tag Archive: Market Crash

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

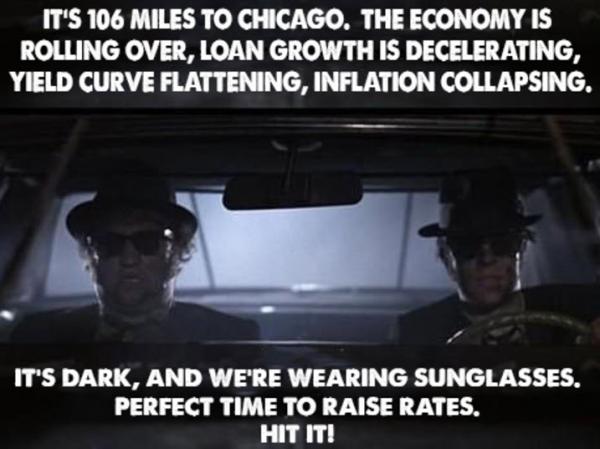

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

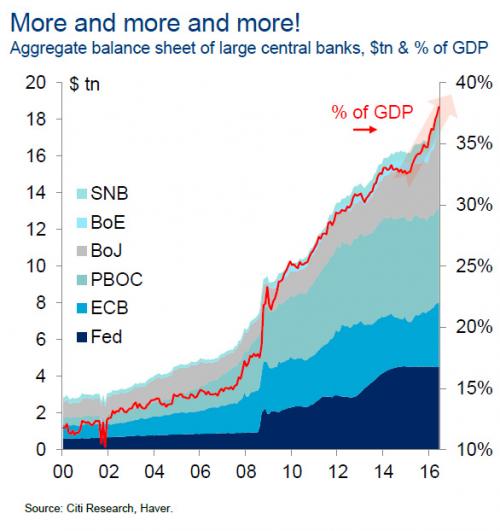

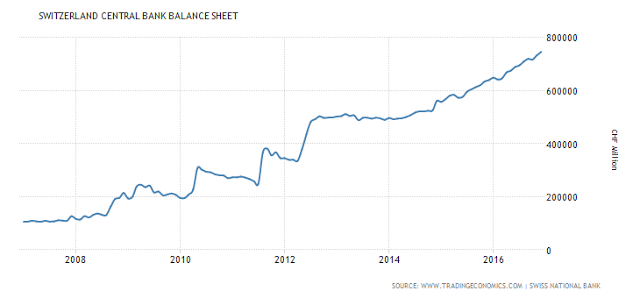

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »

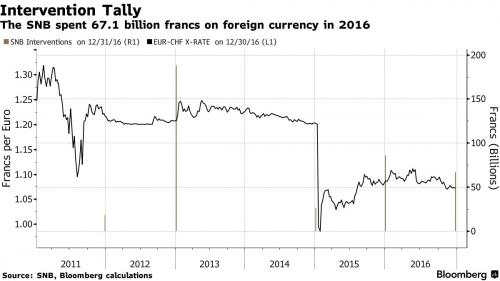

SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China.

Read More »

Read More »

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds.

Read More »

Read More »

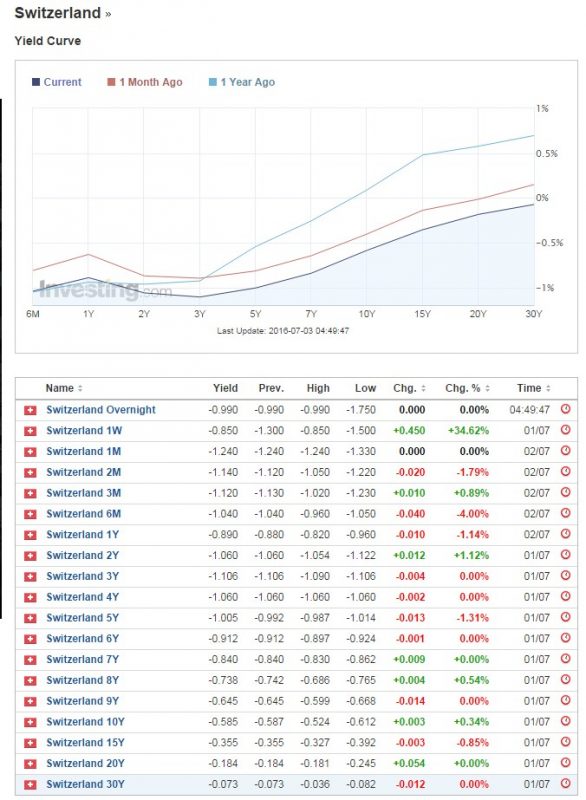

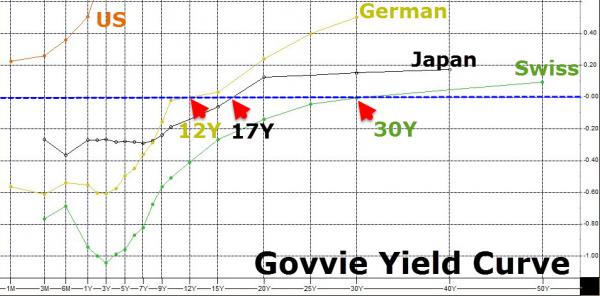

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

US Negative Interest Rate Bets Surge To Record Highs

As the "deflationary supernova" sweeps across the world, dragging bond yields to zero-and-beyond, even the almighty omniscent Federal Reserve has been forced to capitulate as the 'cheapness' of Treasury bonds lures the world's yield-hunters dragging ...

Read More »

Read More »

Expect the Unexpected from the Fed

2022-04-28

by Stephen Flood

2022-04-28

Read More »